Question

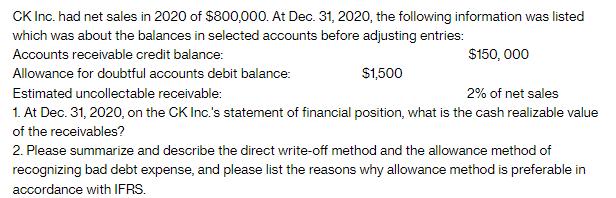

CK Inc. had net sales in 2020 of $800,000. At Dec. 31, 2020, the following information was listed which was about the balances in

CK Inc. had net sales in 2020 of $800,000. At Dec. 31, 2020, the following information was listed which was about the balances in selected accounts before adjusting entries: Accounts receivable credit balance: Allowance for doubtful accounts debit balance: $1,500 Estimated uncollectable receivable: 2% of net sales 1. At Dec. 31, 2020, on the CK Inc.'s statement of financial position, what is the cash realizable value of the receivables? 2. Please summarize and describe the direct write-off method and the allowance method of recognizing bad debt expense, and please list the reasons why allowance method is preferable in accordance with IFRS. $150,000

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 At Dec 31 2020 on the CK Incs statement of financial position the cash realizable value of the rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume I

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

16th Canadian edition

978-1260305821

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App