Question

Claire wants to buy a car when she graduates from North State University 5 years from now. She believes that she will need $29,500 to

Claire wants to buy a car when she graduates from North State University 5 years from now. She believes that she will need $29,500 to buy the car.

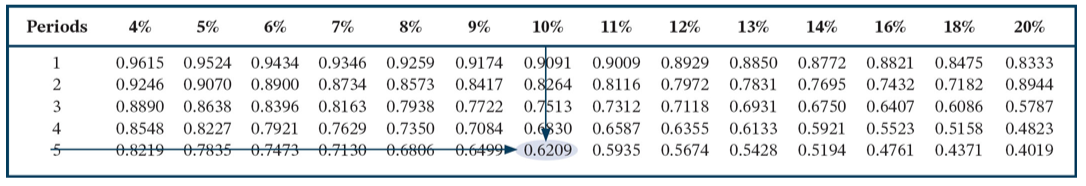

Calculate how much money Claire must put into her savings account today to have $29,500 in 5 years, assuming she can earn 14% compound semiannually. (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58, 975.) ***Please show how to find the compounding rate. I can't figure how dividing it by 2 gets the right decimal number. Below is the table for reference

Periods 4% 5% 6% 7% 8% 9% 1 2 0.9615 0.9524 0.9434 0.9346 0.9246 0.9070 0.8900 0.8734 3 0.8890 0.8638 0.8396 4 0.8163 0.8548 0.8227 0.7921 0.7629 5 10% 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8821 0.8475 0.8333 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.7432 0.7182 0.8944 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.6407 0.6086 0.5787 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 0.5523 0.5158 0.4823 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 11% 12% 13% 14% 16% 18% 20% 0.5194 0.4761 0.4371 0.4019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Finding the SemiAnnual Interest Rate The interest rate is compounded semiannually meaning interest is earned twice a year The table shows annual inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started