Answered step by step

Verified Expert Solution

Question

1 Approved Answer

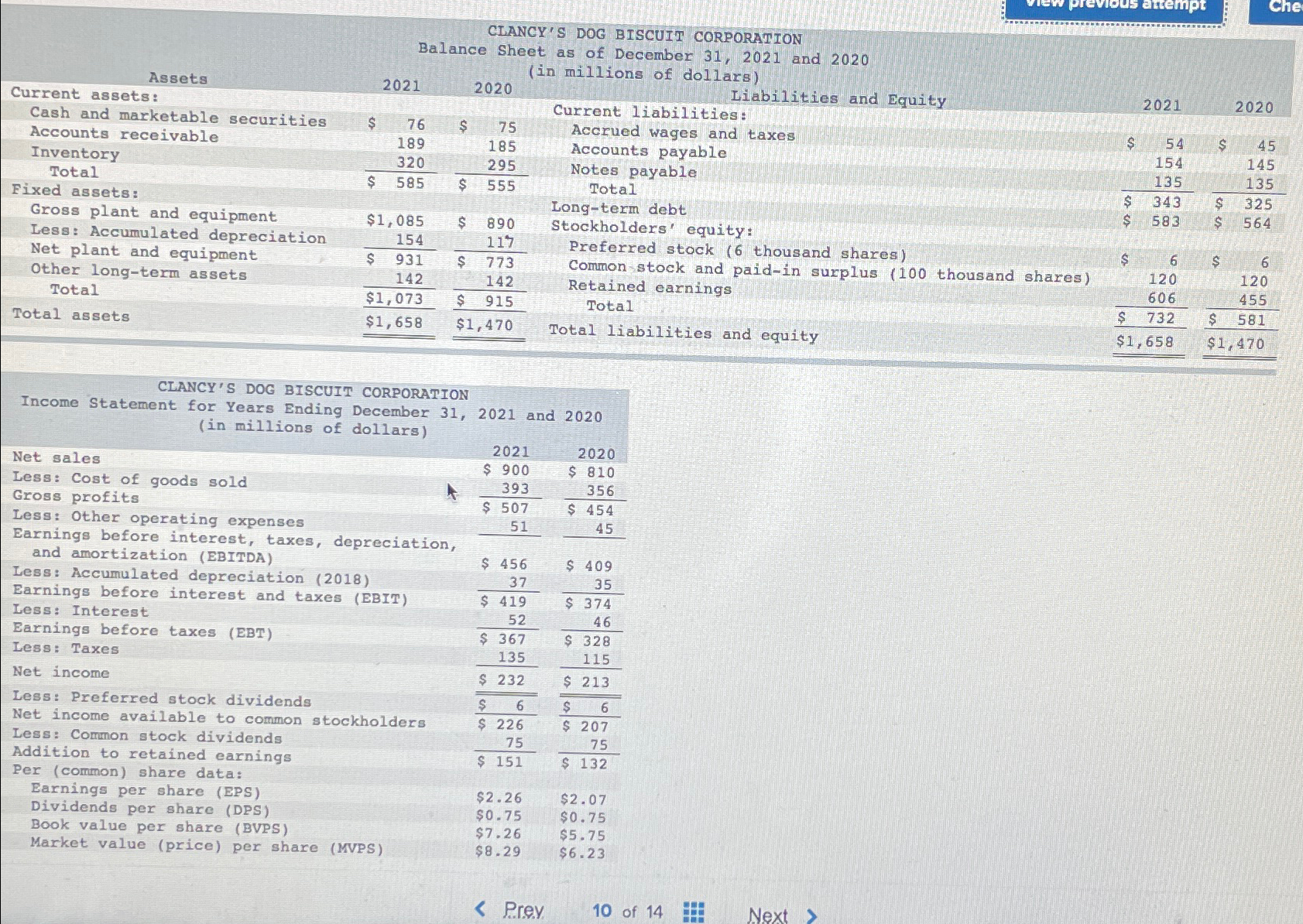

CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) previous attempt Che Assets 2021 2020 Current

CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) previous attempt Che Assets 2021 2020 Current assets: Liabilities and Equity 2021 2020 Current liabilities: Cash and marketable securities $ 76 $ 75 Accrued wages and taxes $ 54 $ 45 Accounts receivable 189 185 Accounts payable 154 145 Inventory 320 295 Notes payable 135 135 Fixed assets: Total Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term assets $ 585 $ 555 Total $ 343 $ 325 Long-term debt $ 583 $ 564 $1,085 154 $ 890 Stockholders' equity: 117 Preferred stock (6 thousand shares) $ 6 $ 6 Total Total assets $ 931 142 $1,073 $1,658 $ 773 142 Common stock and paid-in surplus (100 thousand shares) Retained earnings 120 120 606 455 $ 915 Total $ 732 $ 581 $1,470 Total liabilities and equity $1,658 $1,470 CLANCY'S DOG BISCUIT CORPORATION Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars) Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Accumulated depreciation (2018) Earnings before interest and taxes (EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes Net income Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends Addition to retained earnings Per (common) share data: Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) 2021 $ 900 393 $ 507 51 2020 $ 810 356 $ 454 45 $ 456 37 $ 409 35 $ 419 52 $ 374 46 $ 367 135 $ 328 115 $ 232 $ 213 $ 6 $ 6 $ 226 $ 207 75 75 $ 151 $ 132 $2.26 $2.07 $0.75 $0.75 $7.26 $5.75 $8.29 $6.23 < Prev www 10 of 14 www Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started