Answered step by step

Verified Expert Solution

Question

1 Approved Answer

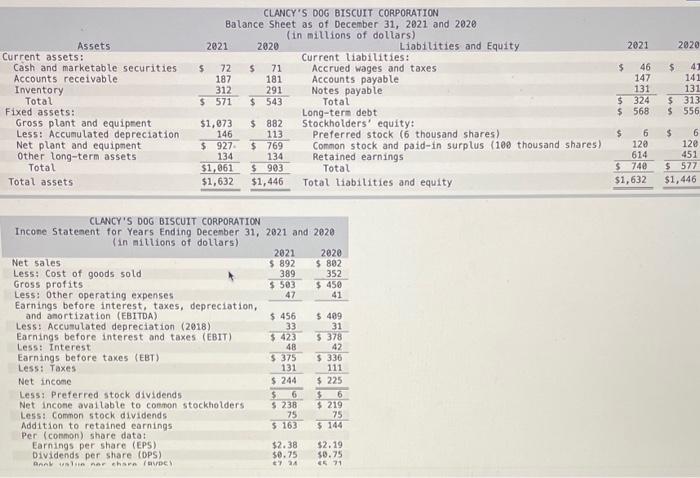

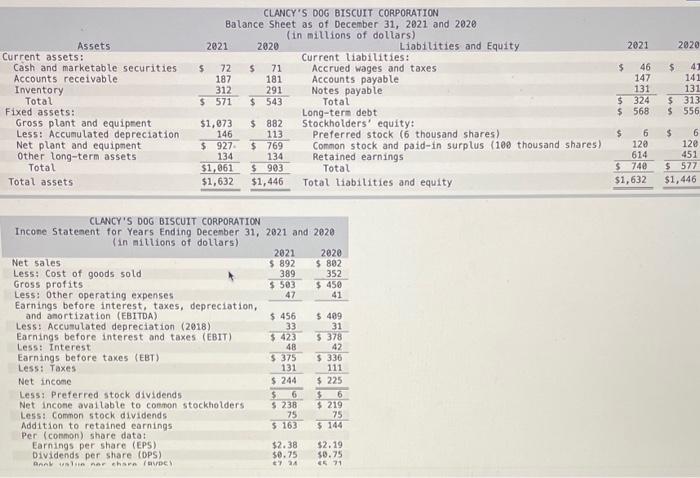

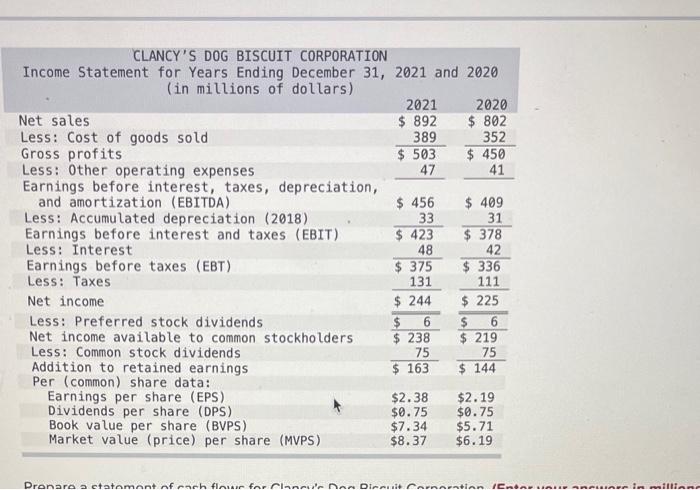

CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31,2021 and 2020 CLANCY'S DOG BISCUIT CORPORATION Incone Statenent for Years Ending Decenber 31, 2021 and

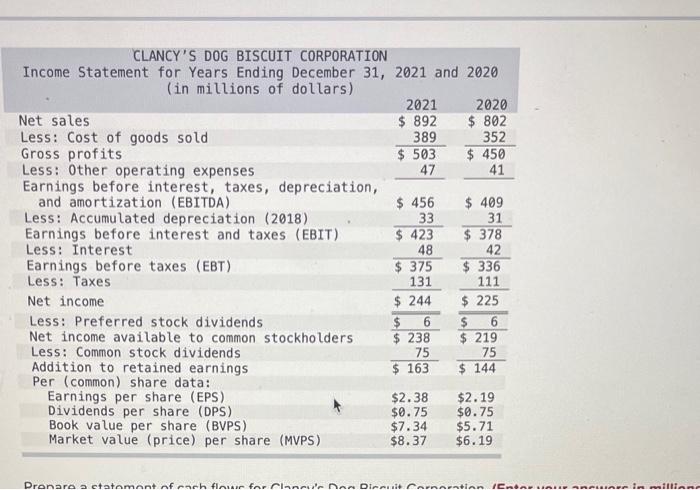

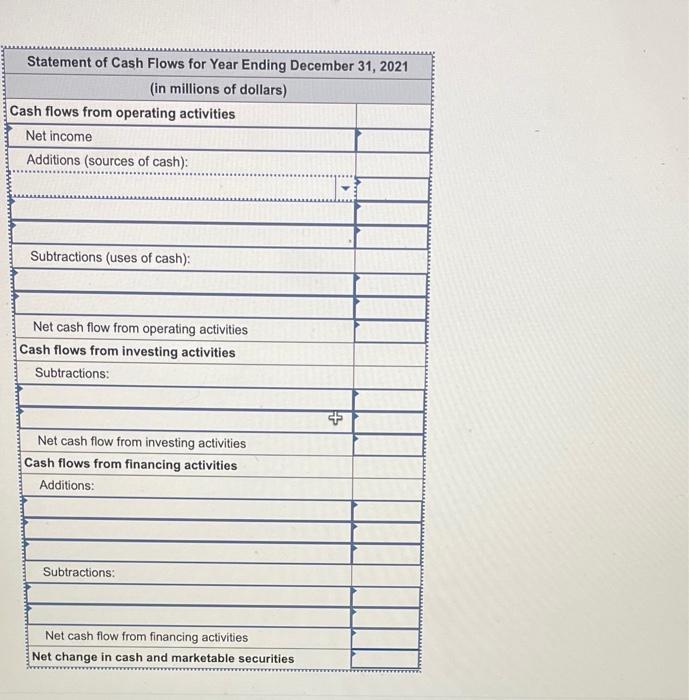

CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31,2021 and 2020 CLANCY'S DOG BISCUIT CORPORATION Incone Statenent for Years Ending Decenber 31, 2021 and 2020 (in alllions of dollars) Net sales Less: Cost of goods sold Gross profits Less: 0ther operating expenses Earnings before interest, taxes, depreciation, 47 \$4. 41 and anortization (EBITDA) Less:Accunulateddepreciation(2018)Earningsbeforeinterestandtaxes(EB1T)33$42331$378 Less: Interest Earnings before taxes (EBT) Less: Taxes Net income Less:PreferredstockdividendsNetinconeavailabletoconnonstockholders56524452195238521551555256 Less: Common stock dividends Addition to retained earnings Per (conmon) share data: Earnings per share (EPS) Oividends per stare (OPS) anat theline nar charn (avere) CLANCY'S DOG BISCUIT CORPORATION Income Statement for Years Ending December 31,2021 and 2020 (in millions of dollars) \begin{tabular}{lrrrr} Net sales & 2021 & & 2020 \\ Less: Cost of goods sold & $892 & & $802 \\ Gross profits & & 389 & & 352 \\ Less: Other operating expenses & $503 & & $450 \\ Earnings before interest, taxes, depreciation, & & & & 41 \\ and amortization (EBITDA) & & & \\ Less: Accumulated depreciation (2018) & $456 & & $409 \\ Earnings before interest and taxes (EBIT) & & 33 & & 31 \\ \hline Less: Interest & $423 & & $378 \\ Earnings before taxes (EBT) & & 48 & & 42 \\ \hline Less: Taxes & $375 & & $336 \\ Net income & & 131 & & 111 \\ \hline \end{tabular} Statement of Cash Flows for Year Ending December 31, 2021

CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31,2021 and 2020 CLANCY'S DOG BISCUIT CORPORATION Incone Statenent for Years Ending Decenber 31, 2021 and 2020 (in alllions of dollars) Net sales Less: Cost of goods sold Gross profits Less: 0ther operating expenses Earnings before interest, taxes, depreciation, 47 \$4. 41 and anortization (EBITDA) Less:Accunulateddepreciation(2018)Earningsbeforeinterestandtaxes(EB1T)33$42331$378 Less: Interest Earnings before taxes (EBT) Less: Taxes Net income Less:PreferredstockdividendsNetinconeavailabletoconnonstockholders56524452195238521551555256 Less: Common stock dividends Addition to retained earnings Per (conmon) share data: Earnings per share (EPS) Oividends per stare (OPS) anat theline nar charn (avere) CLANCY'S DOG BISCUIT CORPORATION Income Statement for Years Ending December 31,2021 and 2020 (in millions of dollars) \begin{tabular}{lrrrr} Net sales & 2021 & & 2020 \\ Less: Cost of goods sold & $892 & & $802 \\ Gross profits & & 389 & & 352 \\ Less: Other operating expenses & $503 & & $450 \\ Earnings before interest, taxes, depreciation, & & & & 41 \\ and amortization (EBITDA) & & & \\ Less: Accumulated depreciation (2018) & $456 & & $409 \\ Earnings before interest and taxes (EBIT) & & 33 & & 31 \\ \hline Less: Interest & $423 & & $378 \\ Earnings before taxes (EBT) & & 48 & & 42 \\ \hline Less: Taxes & $375 & & $336 \\ Net income & & 131 & & 111 \\ \hline \end{tabular} Statement of Cash Flows for Year Ending December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started