Question

Clarence works at College of Charlotte and is paid $30 per hour for a 40-hour workweek and time-and-a-half for hours above 40. a (Click the

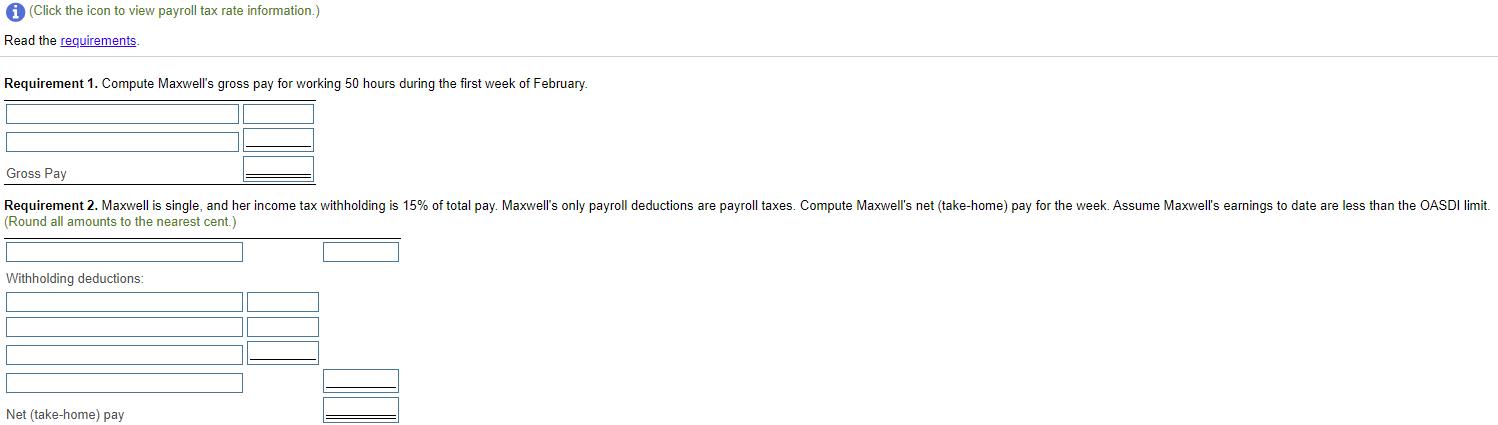

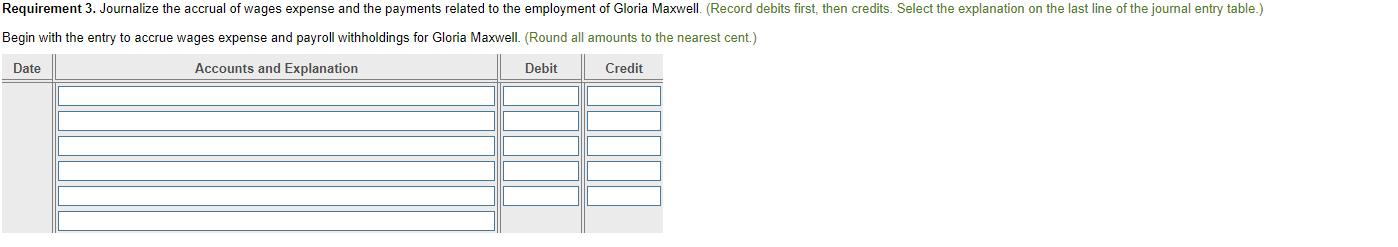

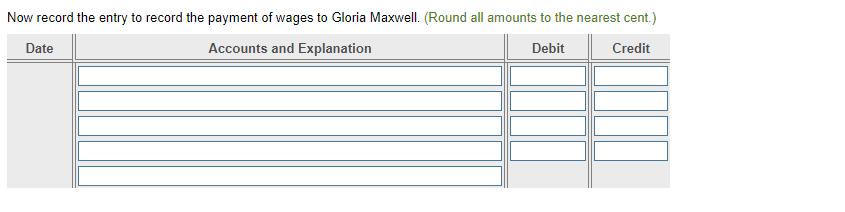

a (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 1. Compute Maxwell's gross pay for working 50 hours during the first week of February. Gross Pay Requirement 2. Maxwell is single, and her income tax withholding is 15% of total pay. Maxwell's only payroll deductions are payroll taxes. Compute Maxwell's net (take-home) pay for the week. Assume Maxwell's earnings to date are less than the OASDI limit. (Round all amounts to the nearest cent.) Withholding deductions: Net (take-home) pay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Basic pay 4030 per hour 1200 Overtime pay 50403015 450 Gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

5th edition

9780133851281, 013385129x, 9780134077321, 133866297, 133851281, 9780133851298, 134077326, 978-0133866292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App