Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clarisse's loss on her rental property was $35,000. How should she report this loss on her tax return? a) It can be deducted from

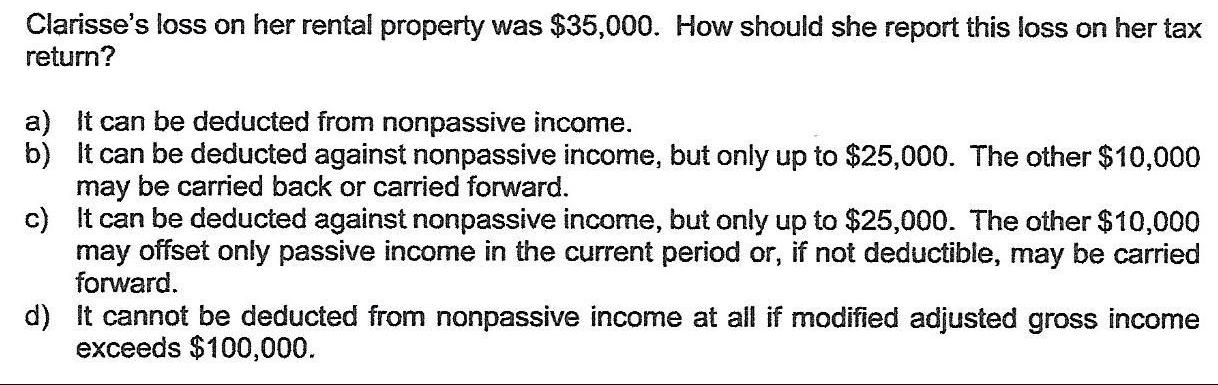

Clarisse's loss on her rental property was $35,000. How should she report this loss on her tax return? a) It can be deducted from nonpassive income. b) It can be deducted against nonpassive income, but only up to $25,000. The other $10,000 may be carried back or carried forward. c) It can be deducted against nonpassive income, but only up to $25,000. The other $10,000 may offset only passive income in the current period or, if not deductible, may be carried forward. d) It cannot be deducted from nonpassive income at all if modified adjusted gross income exceeds $100,000. Clarisse's loss on her rental property was $35,000. How should she report this loss on her tax return? a) It can be deducted from nonpassive income. b) It can be deducted against nonpassive income, but only up to $25,000. The other $10,000 may be carried back or carried forward. c) It can be deducted against nonpassive income, but only up to $25,000. The other $10,000 may offset only passive income in the current period or, if not deductible, may be carried forward. d) It cannot be deducted from nonpassive income at all if modified adjusted gross income exceeds $100,000.

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started