Question

Clark, a stockbroker, recently retired at age 65. He is married and has three grandchildren aged below 5. Clark and his wife have $2 million

Clark, a stockbroker, recently retired at age 65. He is married and has three grandchildren aged below 5. Clark and his wife have $2 million of personal savings (free of taxes) that are invested in a portfolio consisting of 50% in Spider (SPY) and 30% in Vanguard bond fund and 20% in 3-month Treasury bills. They further have $500,000 in 401K plan, which is taxable upon withdrawal, and invested in a portfolio consisting of 50% in Diamonds (DIA), 30% in Vanguard bond fund, and 20% in 3-month Treasury bills. Their average tax rate is 25%.

Clark and his wife feel that they need $75,000 per year for their living expenses. These will have to be adjusted for inflation.

Clark and his wife want to be able to provide $15,000 per year indexed for inflation for each of their grandchildren over the next 15 years for their college education.

They have approached you for guidance on how best to achieve their financial goals. Inflation is expected to increase at an average annual rate of 2.5 percent into the foreseeable future. Given that their personal portfolio is non-taxable, do not include their tax rate in your calculations. However, advise your client your projected return adjusted for taxes, given that withdrawals from 401K are taxable.

The Clark family’s tolerance for risk is below average. Their willingness and ability to assume risk is also below average and average.

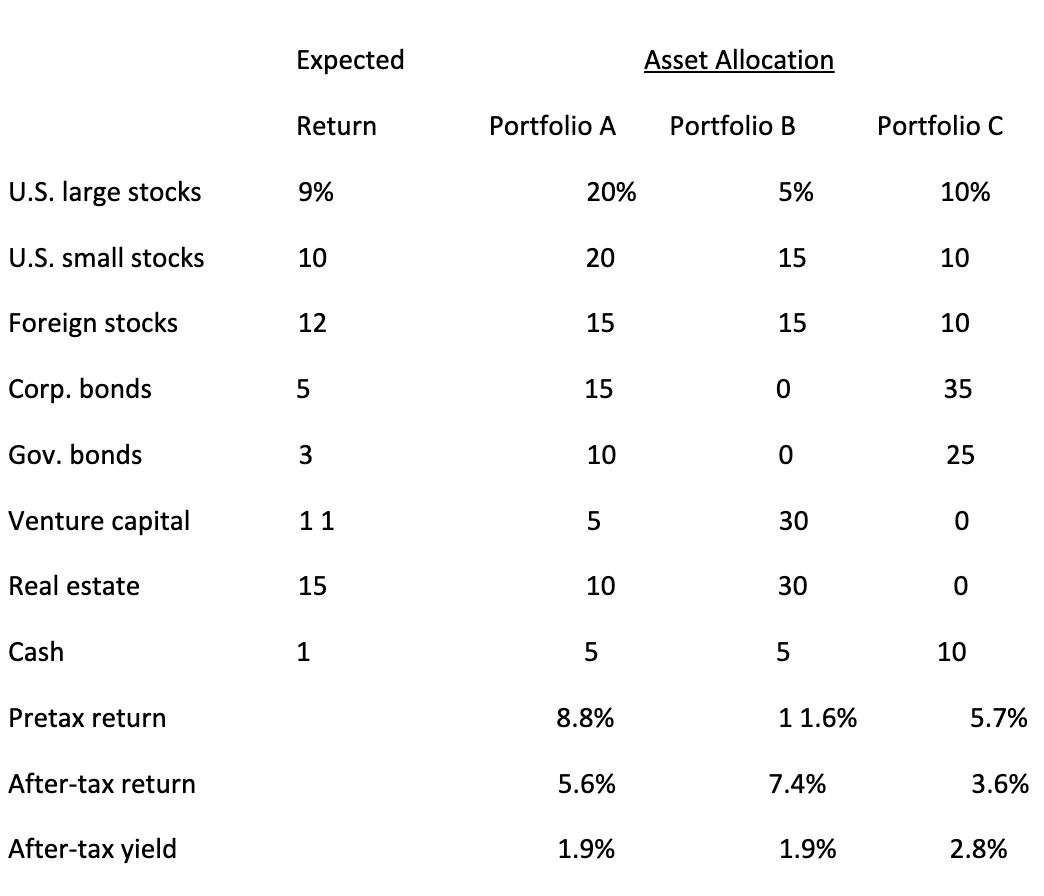

Using this chart above and the information in the worded case above, which one of the above portfolios should the Clarks choose and why?

U.S. large stocks U.S. small stocks Foreign stocks Corp. bonds Gov. bonds Venture capital Real estate Cash Pretax return After-tax return After-tax yield Expected Return 9% 10 12 5 3 11 15 1 Portfolio A 20% 20 15 15 10 5 10 5 8.8% 5.6% 1.9% Asset Allocation Portfolio B 5% 15 15 0 0 30 30 5 1 1.6% 7.4% 1.9% Portfolio C 10% 10 10 35 25 0 0 10 5.7% 3.6% 2.8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which portfolio the Clark family should choose we need to consider their financial goal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started