Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clark Co.'s advertising expense account had a balance of P146,000 at December 31, 20x3, before any necessary year-end adjustment relating to the following: .

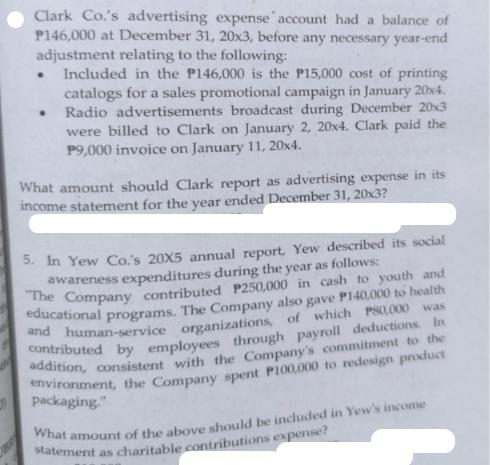

Clark Co.'s advertising expense account had a balance of P146,000 at December 31, 20x3, before any necessary year-end adjustment relating to the following: . Included in the P146,000 is the P15,000 cost of printing catalogs for a sales promotional campaign in January 20x4. Radio advertisements broadcast during December 20x3 were billed to Clark on January 2, 20x4. Clark paid the P9,000 invoice on January 11, 20x4. . What amount should Clark report as advertising expense in its income statement for the year ended December 31, 20x3? 5. In Yew Co.'s 20X5 annual report, Yew described its social awareness expenditures during the year as follows: The Company contributed P250,000 in cash to youth and educational programs. The Company also gave P140,000 to health and human-service organizations, of which P80,000 was contributed by employees through payroll deductions. In addition, consistent with the Company's commitment to the environment, the Company spent P100,000 to redesign product packaging." What amount of the above should be included in Yew's income statement as charitable contributions expense?

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

For Clark Cos advertising expense The cost of printing catalogs for the sales promotional campaign i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started