Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clark had brain surgery. Insurance will not pay for the surgery until the deductible of $1,000 is hit. Then Clark's coinsurance of 80% /

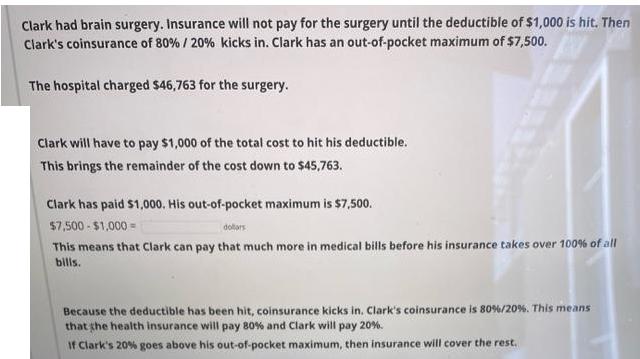

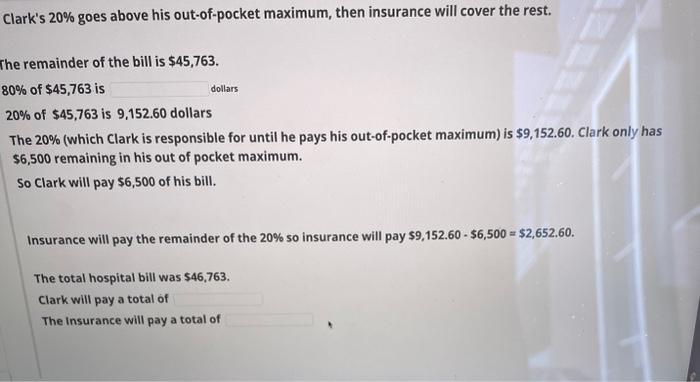

Clark had brain surgery. Insurance will not pay for the surgery until the deductible of $1,000 is hit. Then Clark's coinsurance of 80% / 20% kicks in. Clark has an out-of-pocket maximum of $7,500. The hospital charged $46,763 for the surgery. Clark will have to pay $1,000 of the total cost to hit his deductible. This brings the remainder of the cost down to $45,763. Clark has paid $1,000. His out-of-pocket maximum is $7,500. $7,500-$1,000- doltors This means that Clark can pay that much more in medical bills before his insurance takes over 100% of all bills. Because the deductible has been hit, coinsurance kicks in. Clark's coinsurance is 80 % / 20%. This means that the health insurance will pay 80% and Clark will pay 20%. If Clark's 20% goes above his out-of-pocket maximum, then insurance will cover the rest. Clark's 20% goes above his out-of-pocket maximum, then insurance will cover the rest. The remainder of the bill is $45,763. 80% of $45,763 is 20% of $45,763 is 9,152.60 dollars The 20% (which Clark is responsible for until he pays his out-of-pocket maximum) is $9,152.60. Clark only has $6,500 remaining in his out of pocket maximum. So Clark will pay $6,500 of his bill. dollars Insurance will pay the remainder of the 20% so insurance will pay $9,152.60 - $6,500 = $2,652.60. The total hospital bill was $46,763. Clark will pay a total of The Insurance will pay a total of

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Clarks coinsurance is 8020 which means he is responsible for 20 of the bill ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started