Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clark Inc. purchased 10% of the 10,000 shares of common stock in Nashville Inc. for $56,000 in January. Also, Shay Inc. purchased 35% of

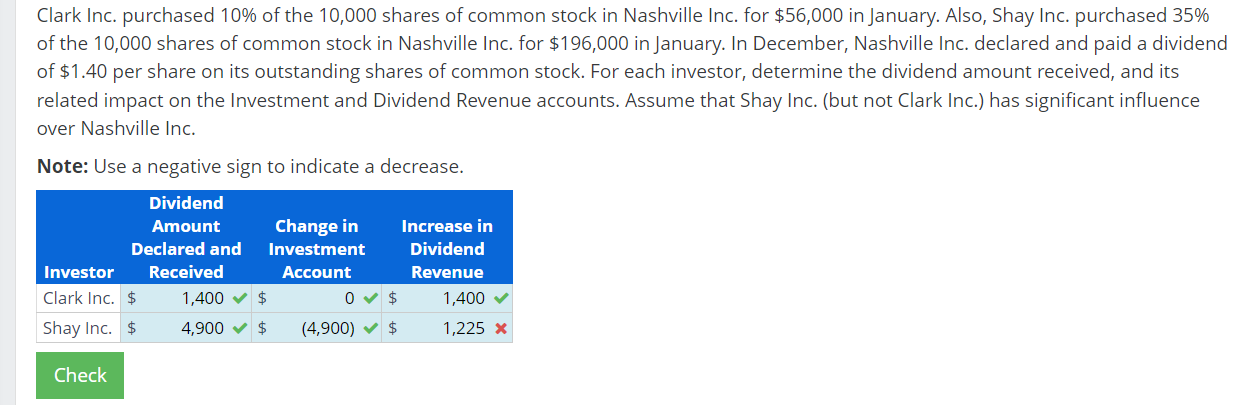

Clark Inc. purchased 10% of the 10,000 shares of common stock in Nashville Inc. for $56,000 in January. Also, Shay Inc. purchased 35% of the 10,000 shares of common stock in Nashville Inc. for $196,000 in January. In December, Nashville Inc. declared and paid a dividend of $1.40 per share on its outstanding shares of common stock. For each investor, determine the dividend amount received, and its related impact on the Investment and Dividend Revenue accounts. Assume that Shay Inc. (but not Clark Inc.) has significant influence over Nashville Inc. Note: Use a negative sign to indicate a decrease. Dividend Amount Declared and Change in Investment Increase in Dividend Investor Received Account Revenue Clark Inc. $ 1,400 $ 0 $ 1,400 Shay Inc. $ 4,900 $ (4,900) 1,225 x Check

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine the dividend amount received by each investor and its related impact on the Inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started