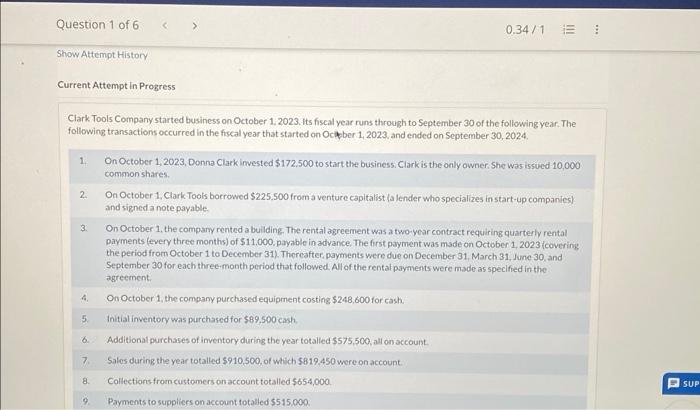

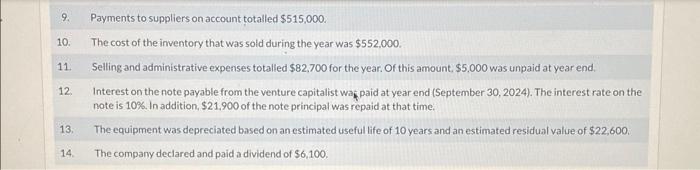

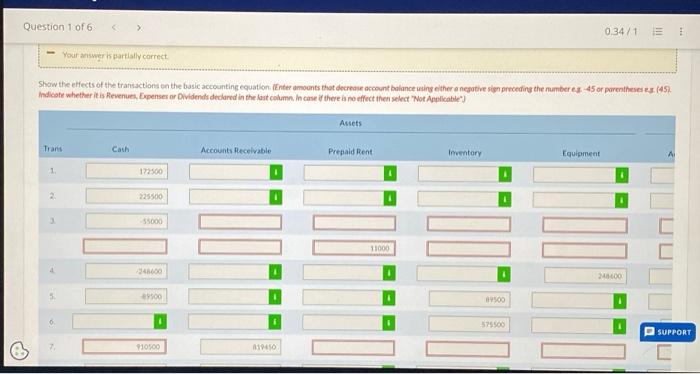

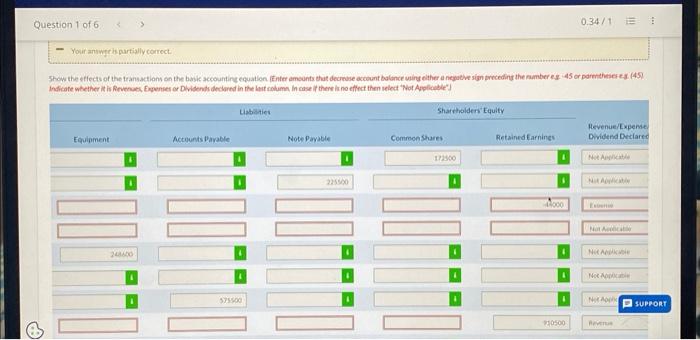

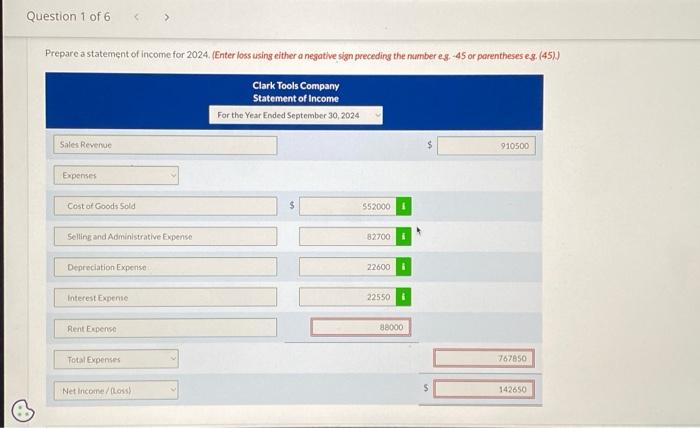

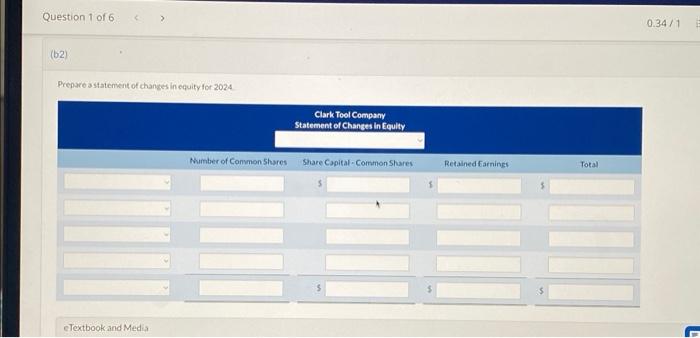

Clark Tools Company started business on October 1,2023. Its fiscal year runs through to September 30 of the following year. The following transactions occurred in the fiscal year that started on Ocatber 1, 2023, and ended on September 30, 2024. 1. On October 1,2023, Donna Clark invested $172,500 to start the business. Clark is the only owner. She was issued 10,000 commonshares. 2. On October 1, Clark Tools borrowed $225.500 from a venture capitalist (a lender who specializes in start-up companies) and signed a note payable. 3. On October 1, the compamy rented a buliding. The rental agreement was a two vear contract requiring quarterly rental payments (every three months) of $11,000, payable in advance. The first payment was made on October 1, 2023 (covering the period from October 1 to December 31). Thereafter, payments were due on December 31, March 31, June 30, and September 30 for each three-month period that followed. All of the rental payments were made as specified in the agreement. 4. On October 1, the company purchased equipment costing $248,600 for cash. 5. Initial inventory was purchased for $89,500 cash. 6. Additional purchases of inventory during the year totalled $575,500, all on account. 7. Salos during the year totalled $910,500, of which $819.450 were on account. 8. Collections from customers on account totalled $654,000 9. Payments to suppliers on account totalied $515,000. 9. Payments to suppliers on account totalled $515,000. 10. The cost of the inventory that was sold during the year was $552,000. 11. Selling and administrative expenses totalled $82,700 for the year. Of this amount, $5,000 was unpaid at year end. 12. Interest on the note payable from the venture capitalist waj paid at year end (September 30, 2024). The interest rate on the note is 10%. In addition, $21,900 of the note principal was repaid at that time. 13. The equipment was depreciated based on an estimated useful life of 10 years and an estimated residual value of $22,600. 14. The company declared and paid a dividend of $6,100. Indicole whether it is Revenues, Expenses or Dividends declared in the last column. In case if there is no effect then select "Not Applicable'] Question 1 of 6 0.34/1 - Yoir answgebsartislly correct. \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Equipment } & \multicolumn{2}{|c|}{ Lussitie } & \multicolumn{2}{|c|}{ Stareholden Equity } & \multirow{2}{*}{\begin{tabular}{l} Hevenue/Expense \\ Dividend Declares \end{tabular}} \\ \hline & Actounts Darable & Note Pansiele & Commonstures & Retained Earnines: & \\ \hline 1 & 1 & 1 & 12360 & 1 & Not Nephestis \\ \hline 1 & 1 & 23850 & 1 & 1 & \\ \hline & & & & 4500 & \\ \hline & & & & & \\ \hline 20000 & i. & 1 & 1 & 1 & \\ \hline 1 & 1 & 1 & 1 & 1 & Noc Aopolicitir: \\ \hline 1 & s7rsos & 1 & 1 & 1 & \\ \hline & & & & n0500 & Aners ? \\ \hline \end{tabular} Question 1 of 6 0.34/1= Question 1 of 6 Prepare a statement of income for 2024. (Enter loss using either a negative sign preceding the number es. 45 or porentheses es. (45) Prepare a statement of changes in equity for 2024