Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Classic Home Furniture is anticipating a 20% growth in sales in each of 2018 and 2019. Below is their 2017` profit and loss statement, the

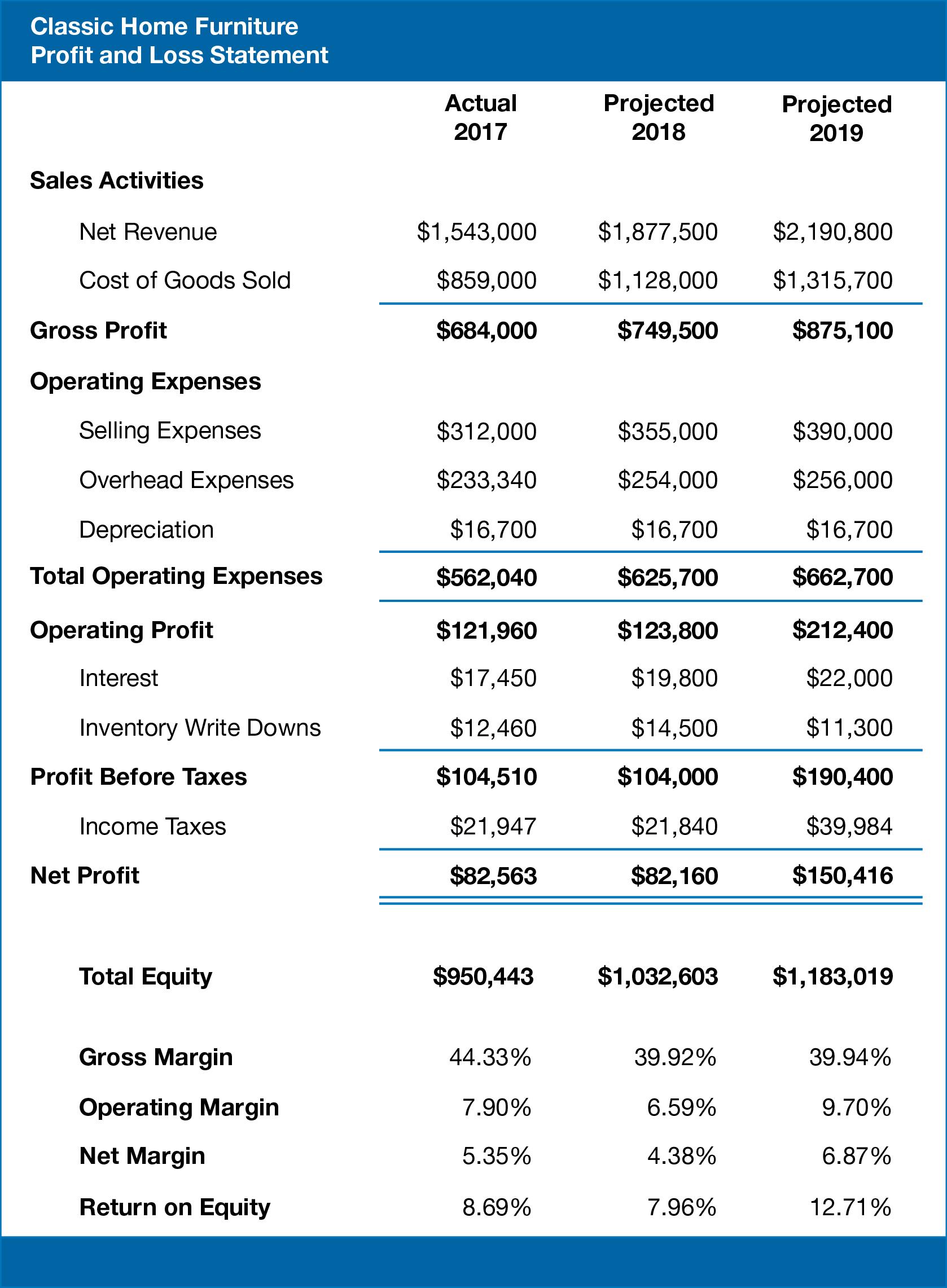

Classic Home Furniture is anticipating a 20% growth in sales in each of 2018 and 2019. Below is their 2017` profit and loss statement, the projected profit and loss statements for 2018 and 2019, and the select profitability ratios for each of the years. Should Classic Home Furniture grow as planned?

Classic Home Furniture Profit and Loss Statement Sales Activities Net Revenue Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses Overhead Expenses Depreciation Total Operating Expenses Operating Profit Interest Inventory Write Downs Profit Before Taxes Income Taxes Net Profit Total Equity Gross Margin Operating Margin Net Margin Return on Equity Actual 2017 $1,543,000 $859,000 $684,000 $312,000 $233,340 $16,700 $562,040 $121,960 $17,450 $12,460 $104,510 $21,947 $82,563 $950,443 44.33% 7.90% 5.35% 8.69% Projected 2018 $1,877,500 $1,128,000 $749,500 $355,000 $254,000 $16,700 $625,700 $123,800 $19,800 $14,500 $104,000 $21,840 $82,160 $1,032,603 39.92% 6.59% 4.38% 7.96% Projected 2019 $2,190,800 $1,315,700 $875,100 $390,000 $256,000 $16,700 $662,700 $212,400 $22,000 $11,300 $190,400 $39,984 $150,416 $1,183,019 39.94% 9.70% 6.87% 12.71%

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To assess whether Classic Home Furniture should grow as planned we need to analyze the projected financial statements and profitability ratios for 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started