Answered step by step

Verified Expert Solution

Question

1 Approved Answer

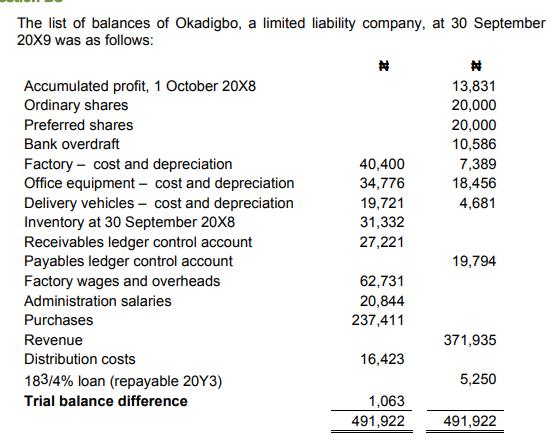

The list of balances of Okadigbo, a limited liability company, at 30 September 20X9 was as follows: Accumulated profit, 1 October 20X8 Ordinary shares

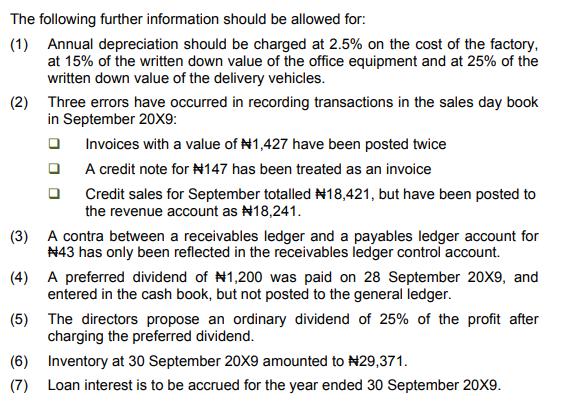

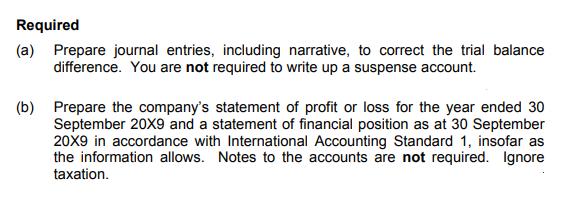

The list of balances of Okadigbo, a limited liability company, at 30 September 20X9 was as follows: Accumulated profit, 1 October 20X8 Ordinary shares Preferred shares Bank overdraft Factory - cost and depreciation Office equipment - cost and depreciation Delivery vehicles - cost and depreciation Inventory at 30 September 20X8 Receivables ledger control account Payables ledger control account Factory wages and overheads Administration salaries Purchases Revenue Distribution costs 183/4% loan (repayable 20Y3) Trial balance difference # 40,400 34,776 19,721 31,332 27,221 62,731 20,844 237,411 16,423 1,063 491,922 # 13,831 20,000 20,000 10,586 7,389 18,456 4,681 19,794 371,935 5,250 491,922 The following further information should be allowed for: (1) Annual depreciation should be charged at 2.5% on the cost of the factory, at 15% of the written down value of the office equipment and at 25% of the written down value of the delivery vehicles. (2) Three errors have occurred in recording transactions in the sales day book in September 20X9: Invoices with a value of #1,427 have been posted twice A credit note for #147 has been treated as an invoice Credit sales for September totalled #18,421, but have been posted to the revenue account as #18,241. (3) A contra between a receivables ledger and a payables ledger account for #43 has only been reflected in the receivables ledger control account. (4) A preferred dividend of #1,200 was paid on 28 September 20X9, and entered in the cash book, but not posted to the general ledger. (5) The directors propose an ordinary dividend of 25% of the profit after charging the preferred dividend. Inventory at 30 September 20X9 amounted to N29,371. (6) (7) Loan interest is to be accrued for the year ended 30 September 20X9. Required (a) Prepare journal entries, including narrative, to correct the trial balance difference. You are not required to write up a suspense account. (b) Prepare the company's statement of profit or loss for the year ended 30 September 20X9 and a statement of financial position as at 30 September 20X9 in accordance with International Accounting Standard 1, insofar as the information allows. Notes to the accounts are not required. Ignore taxation.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entries 1 Dr TB d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started