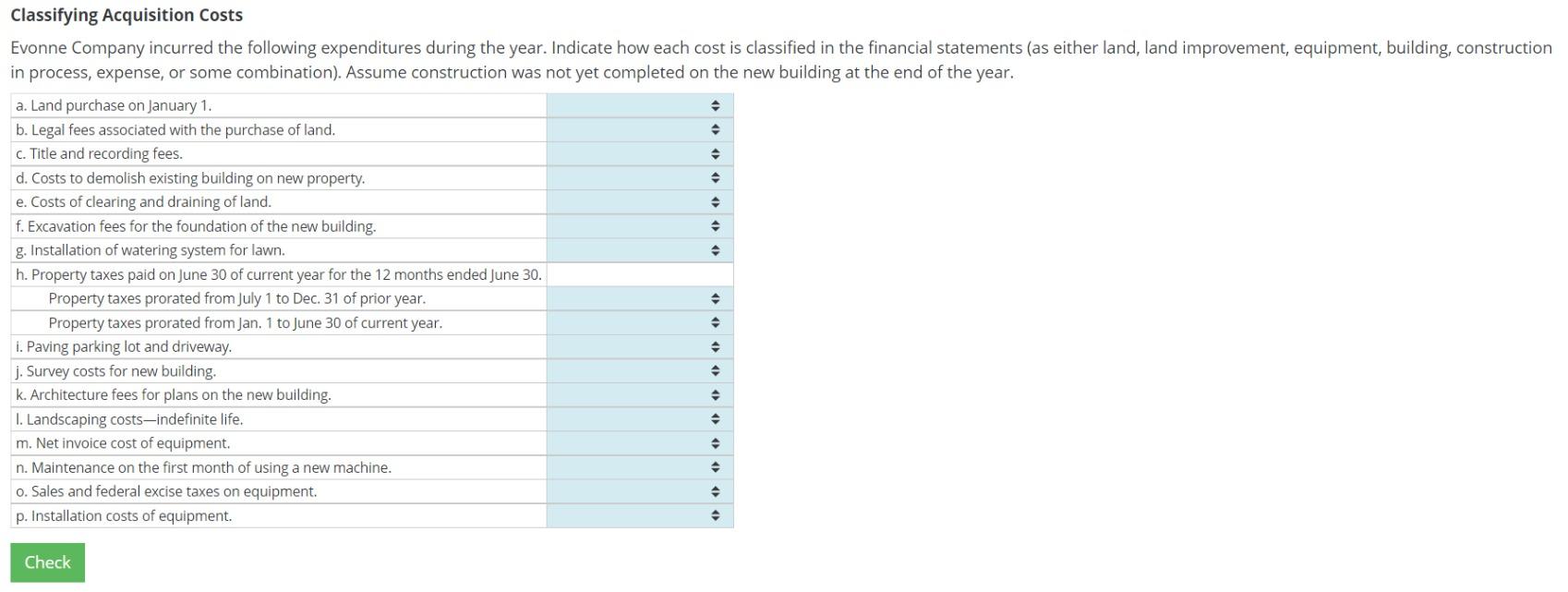

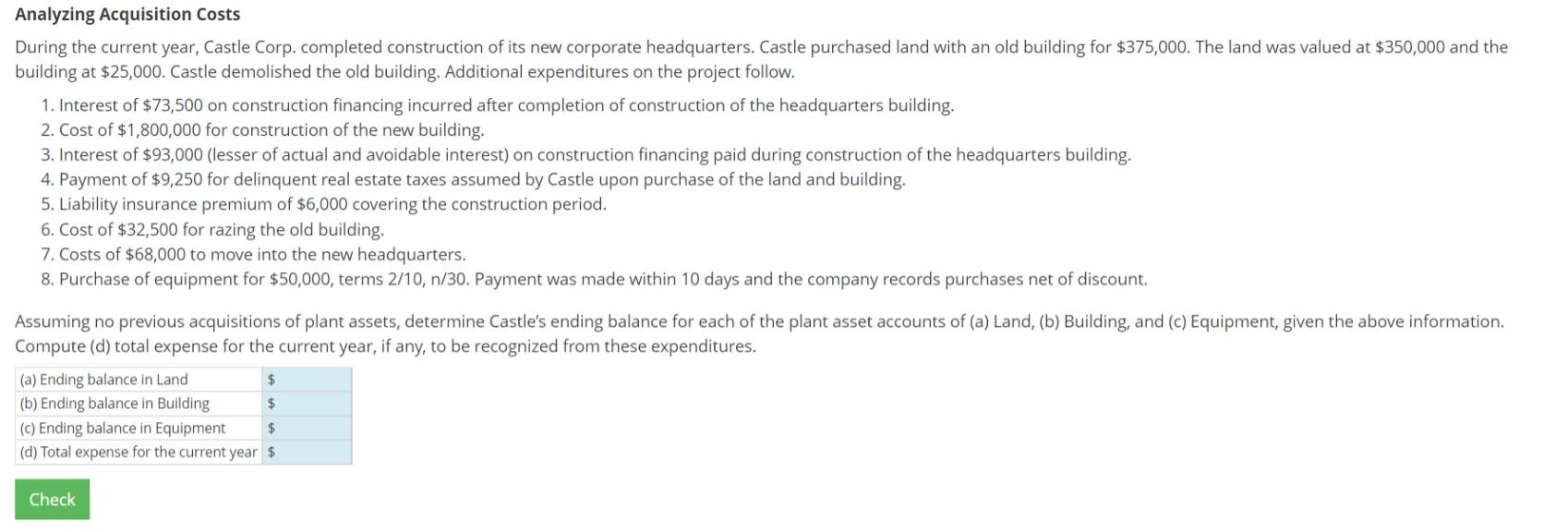

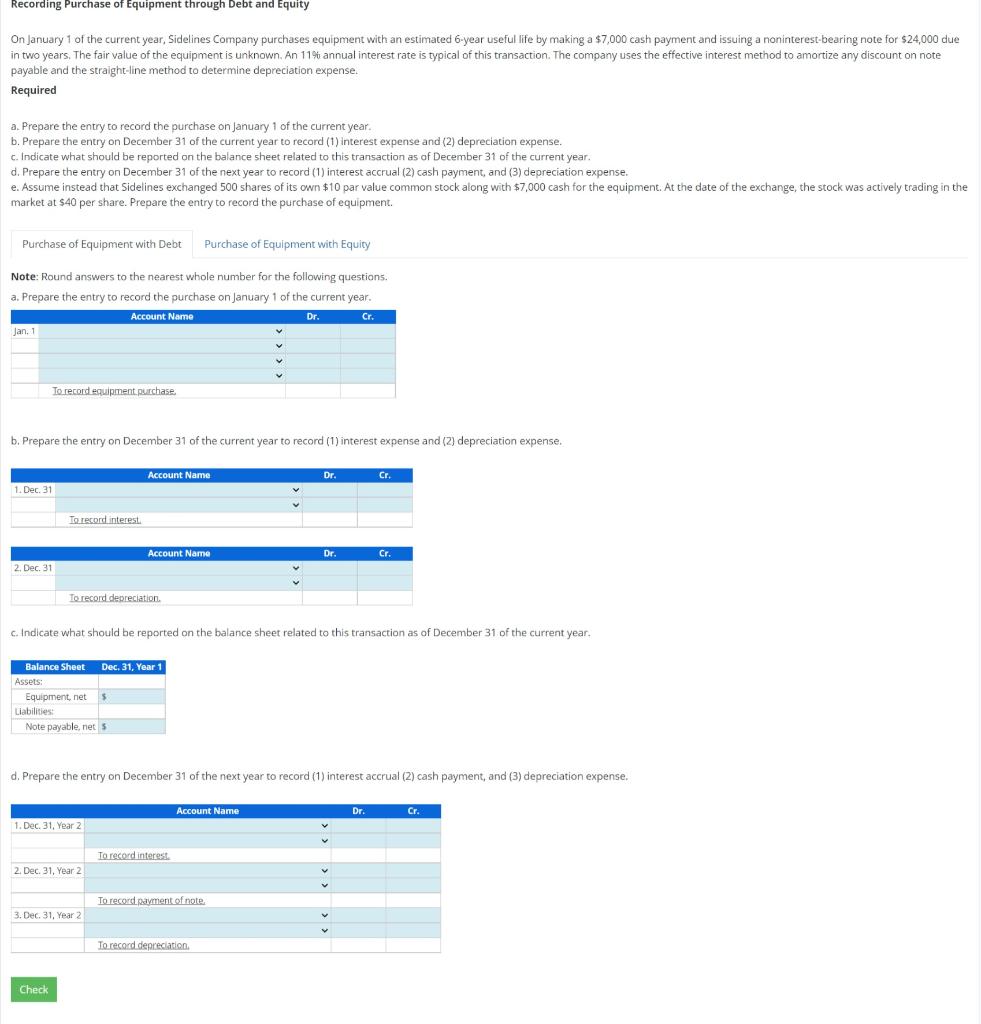

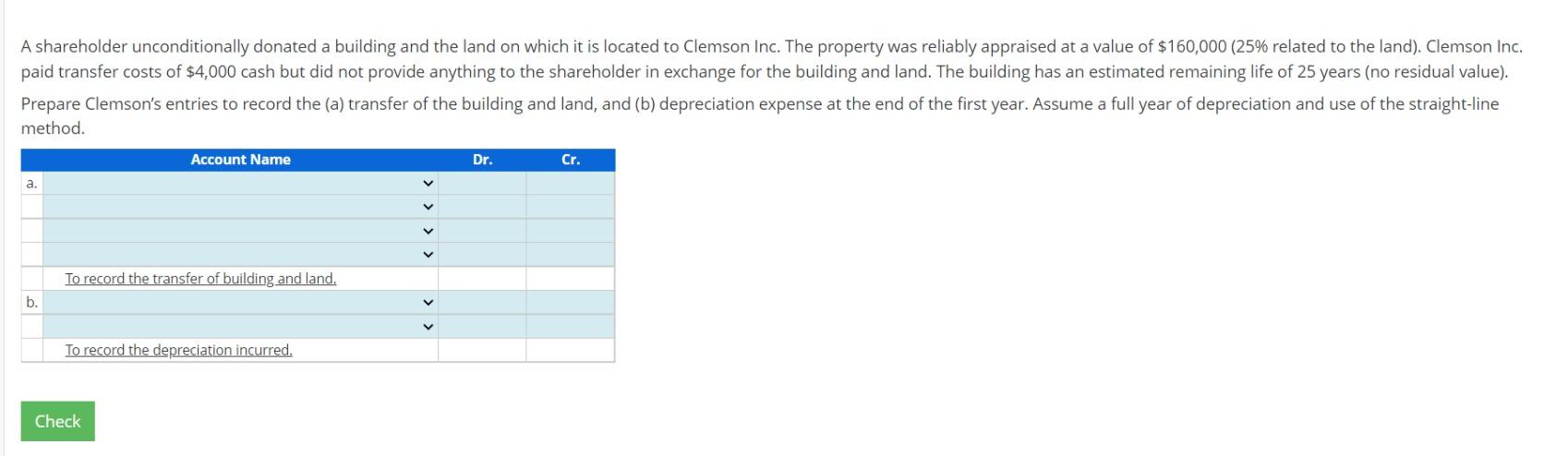

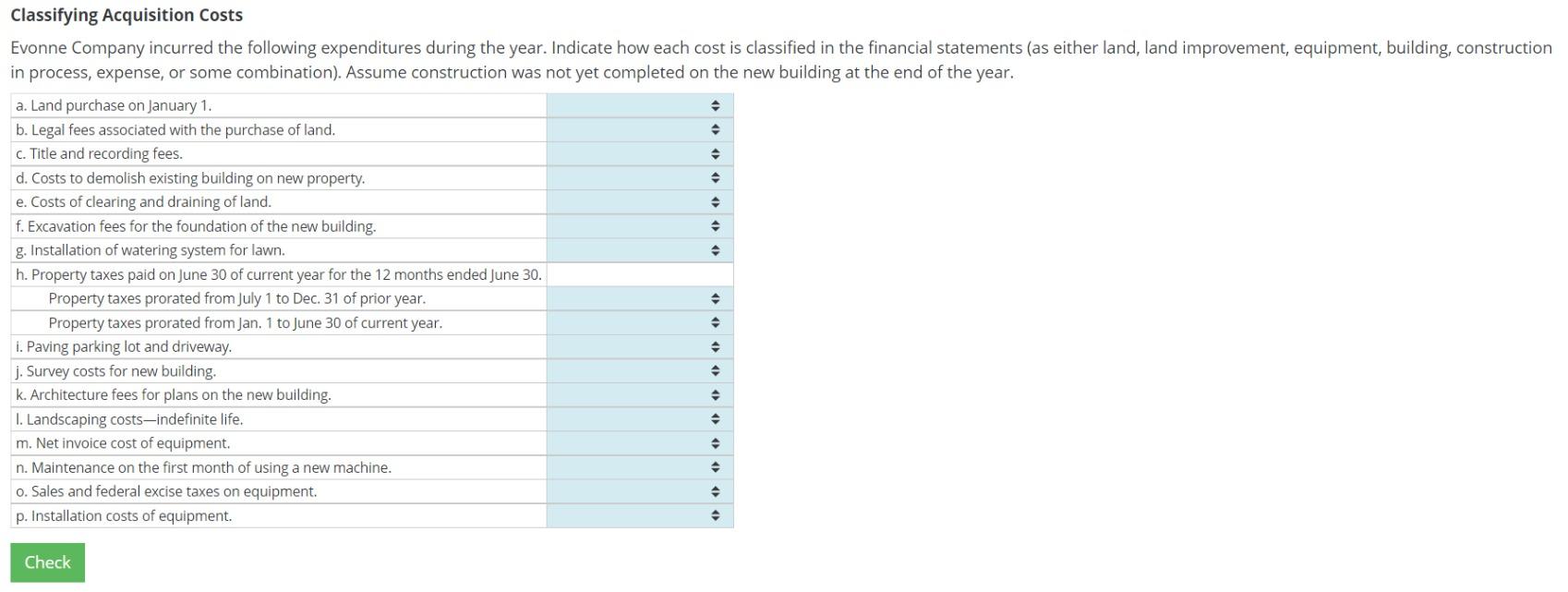

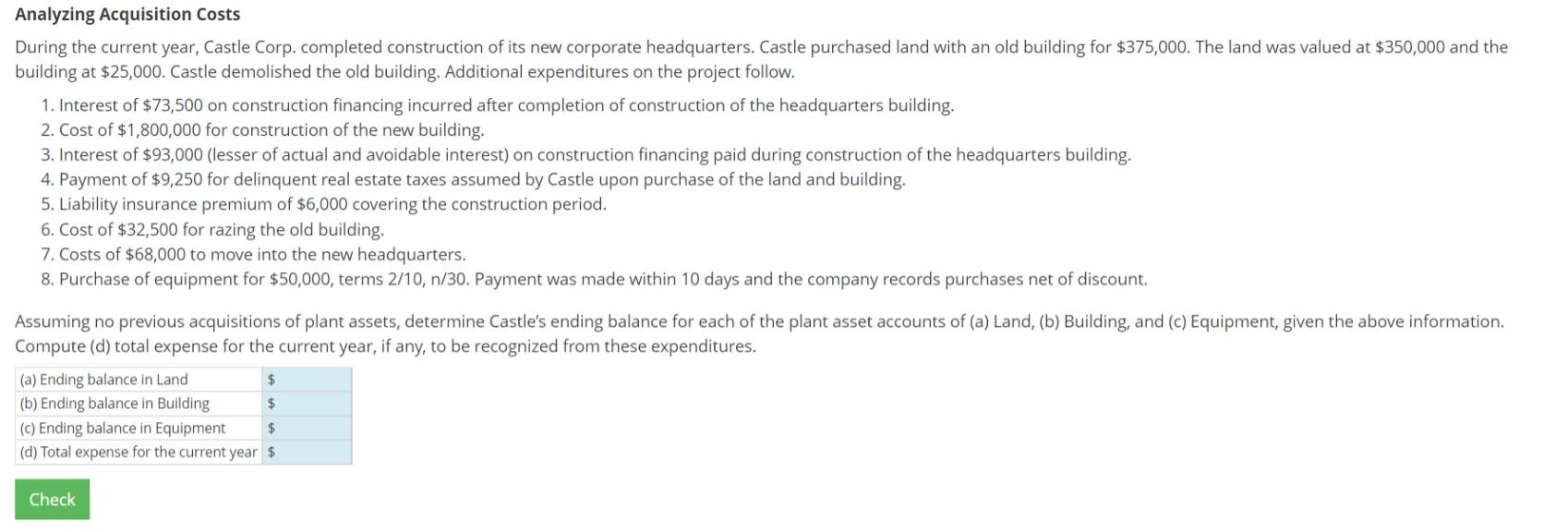

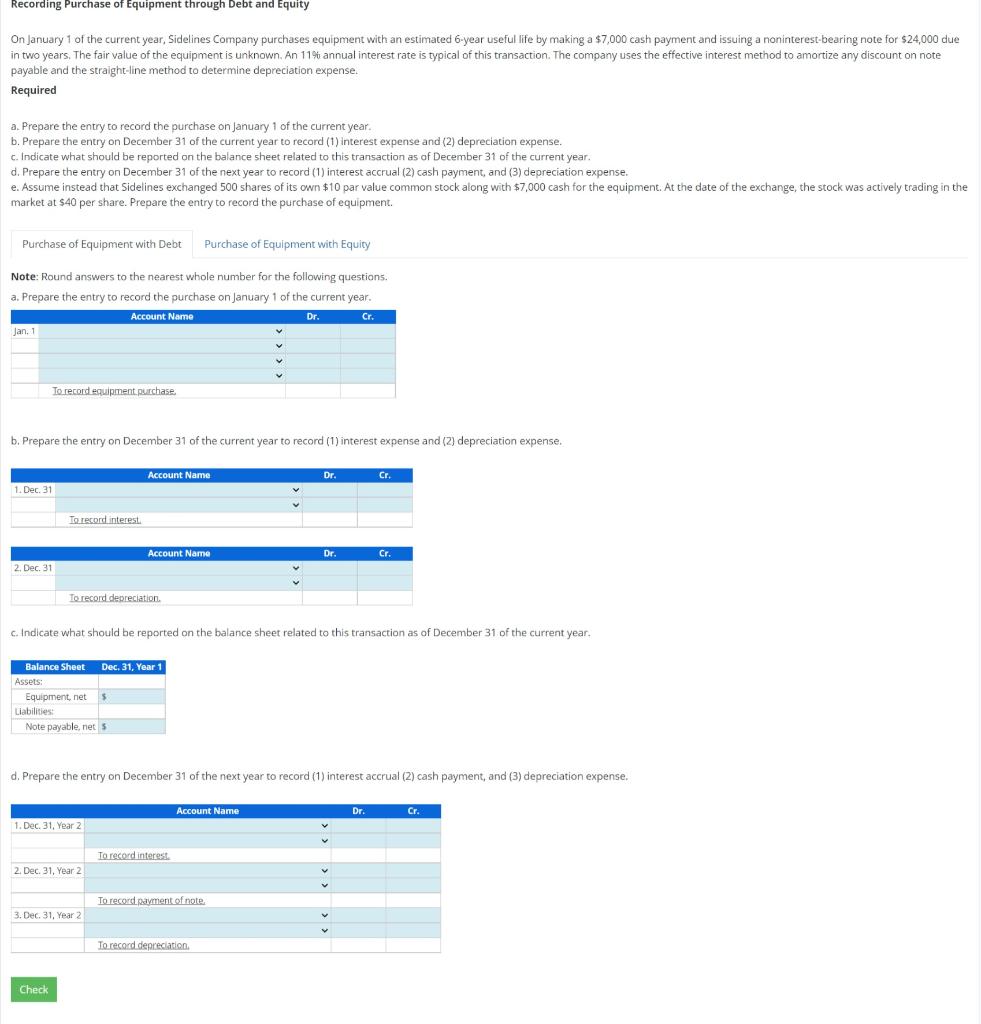

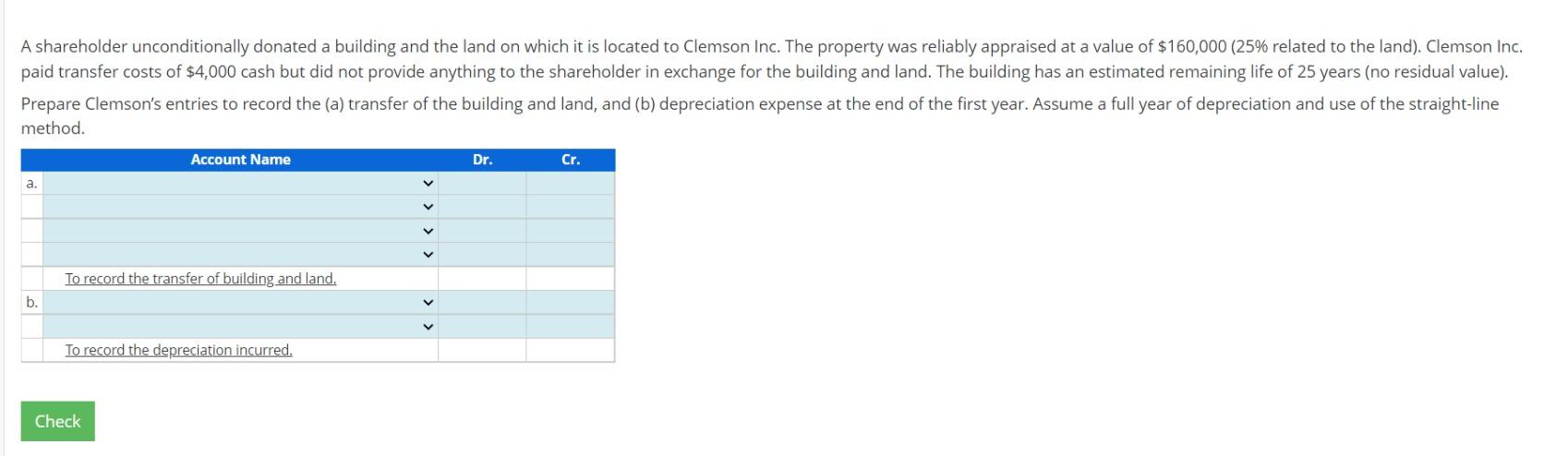

Classifying Acquisition Costs Evonne Company incurred the following expenditures during the year. Indicate how each cost is classified in the financial statements (as either land, land improvement, equipment, building, construction in process, expense, or some combination). Assume construction was not yet completed on the new building at the end of the year. During the current year, Castle Corp. completed construction of its new corporate headquarters. Castle purchased land with an old building for $375,000. The land was valued at $350,000 and the building at $25,000. Castle demolished the old building. Additional expenditures on the project follow. 1. Interest of $73,500 on construction financing incurred after completion of construction of the headquarters building. 2. Cost of $1,800,000 for construction of the new building. 3. Interest of $93,000 (lesser of actual and avoidable interest) on construction financing paid during construction of the headquarters building. 4. Payment of $9,250 for delinquent real estate taxes assumed by Castle upon purchase of the land and building. 5. Liability insurance premium of $6,000 covering the construction period. 6. Cost of $32,500 for razing the old building. 7. Costs of $68,000 to move into the new headquarters. 8. Purchase of equipment for $50,000, terms 2/10,n/30. Payment was made within 10 days and the company records purchases net of discount. Assuming no previous acquisitions of plant assets, determine Castle's ending balance for each of the plant asset accounts of (a) Land, (b) Building, and (c) Equipment, given the above information. Recording Purchase of Equipment through Debt and Equity On January 1 of the current year, Sidelines Company purchases equipment with an estimated 6-year useful life by making a $7,000 cash payment and issuing a noninterest-bearing note for $24,000 due in two years. The fair value of the equipment is unknown. An 11% annual interest rate is typical of this transaction. The company uses the effective interest method to amortize any discount on note payable and the straight-line method to determine depreciation expense. Required a. Prepare the entry to record the purchase on January 1 of the current year. b. Prepare the entry on December 31 of the current year to record (1) interest expense and (2) depreciation expense. c. Indicate what should be reported on the balance sheet related to this transaction as of December 31 of the current year. d. Prepare the entry on December 31 of the next year to record (1) interest accrual (2) cash payment, and (3) depreciation expense. e. Assume instead that Sidelines exchanged 500 shares of its own $10 par value common stock along with $7,000 cash for the equipment. At the date of the exchange, the stock was actively trading in the market at $40 per share. Prepare the entry to record the purchase of equipment. Note: Round answers to the nearest whole number for the following questions. a. Prepare the entry to record the purchase on January 1 of the current year. b. Prepare the entry on December 31 of the current year to record (1) interest expense and (2) depreciation expense. c. Indicate what should be reported on the balance sheet related to this transaction as of December 31 of the current year. d. Prepare the entry on December 31 of the next year to record (1) interest accrual (2) cash payment, and (3) depreciation expense. A shareholder unconditionally donated a building and the land on which it is located to Clemson Inc. The property was reliably appraised at a value of $160,000 ( 25% related to the land). Clemson Inc. paid transfer costs of $4,000 cash but did not provide anything to the shareholder in exchange for the building and land. The building has an estimated remaining life of 25 years (no residual value). Prepare Clemson's entries to record the (a) transfer of the building and land, and (b) depreciation expense at the end of the first year. Assume a full year of depreciation and use of the straight-line method