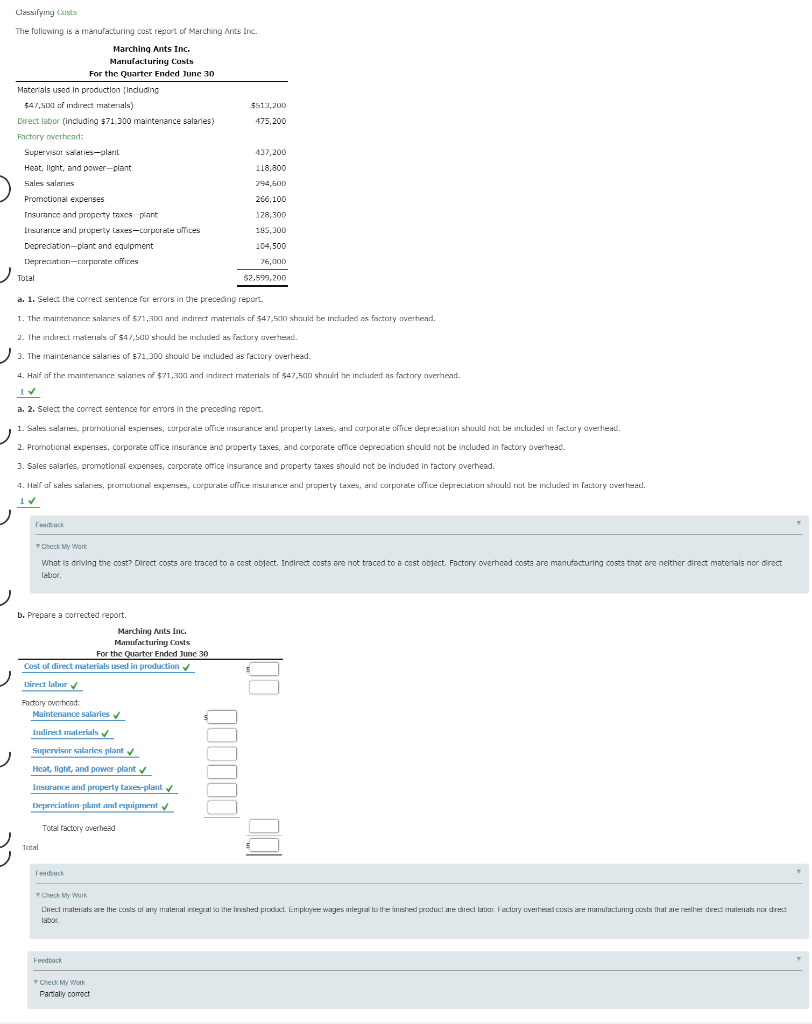

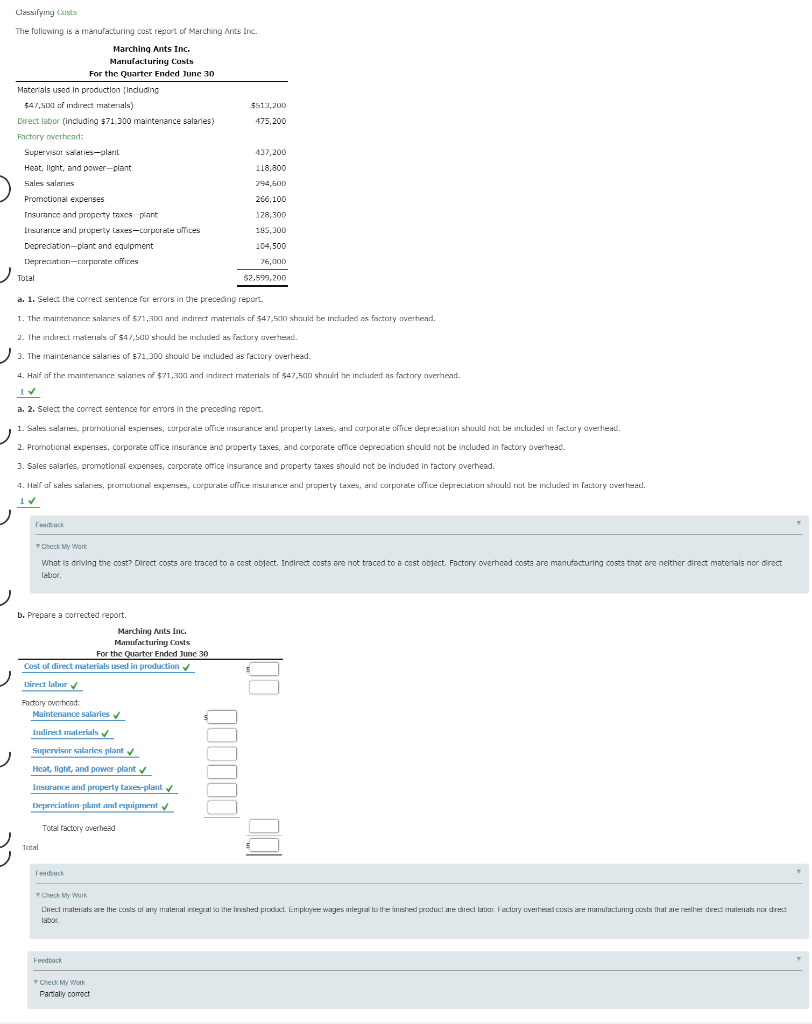

Classifying Custs The following is a manufacturing cost report of Marching Ants Inc. Marching Ants Inc. Manufacturing Costs For the Quarter Ended luns 30 $513,200 475,200 Materials used in production (including $47,500 of indirect materials) Direct labor (including $71,300 maintenance salaries) Factory overhead: Supervisor salaries-plant Heat, light, and power-plant Sales salaries Promotional expenses Insurance and property taxes plant Insurance and property taxes-corporate offices Deprecation-plant and equipment Depreciation-corporate offices 437,200 118,800 294,600 266,100 128,300 185,300 104,500 76,000 $2,599,200 a. 1. Select the correct sentence for errors in the preceding report. 1. The maintenance salaries of $71,300 and indirect materials of $47,500 should be included as factory overhead. 2. The indirect materials of $47,50D Shuld be induced a factory overhead. 3. The maintenance salaries of $71,300 should be included as factory overhead. 4. Half of the maintenance salaries of $71,300 and indirect materials of $47,500 should be induced as factory averhead. 1 a. 2. Select the correct sentence for errors in the preceding report 1. Sales salaries, promotional experises, corporale office insurance and property taxes, and corporale office deprecation should not be included in factory overhead. 2. Promotional expenses, corporate office insurance and property taxes, and corporate office depreciation should not be included in factory overhead. 3. Sales salaries, promotional expenses, corporate office insurance and property taxes should not be included in factory overhead. 4. Hall of sales salaries, promotional expenses, corporale office insurance and property taxes, and corporate office depreciation should not be included in factory overhead. 17 F ACE Check My Work What is driving the cost? Direct costs are traced to a cost object. Indirect costs are not traced to a cost object. Factory overhead costs are manufacturing costs that are neither direct materials nor direct labor. D. Prepare a corrected report. Marching Ants Inc. Manufacturing Costs For the Quarter Ended June 30 Cost of direct materials used in production Direct labor Factory Overhead: Maintenance salaries Indirect materials Supervisor salaries plant Heat, light, and power plant Insurance and property taxes-plant Depreciation-plant and equipment Total factory overhead Total Feedback Check My Work Durecimales are the basis of any me labor. ntegral a therusted produd. Employee wages ilegal to the finished product are cred Factory Overhead costs are manufacturing costs are neither doet mens nordrect Feedback Check My Work Partially correct