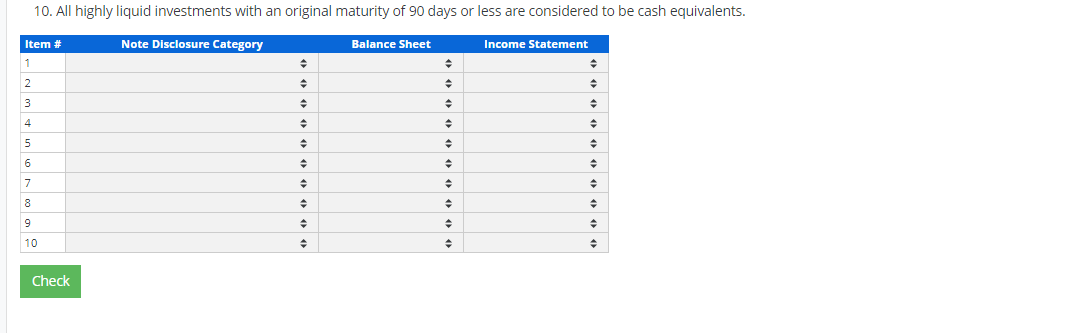

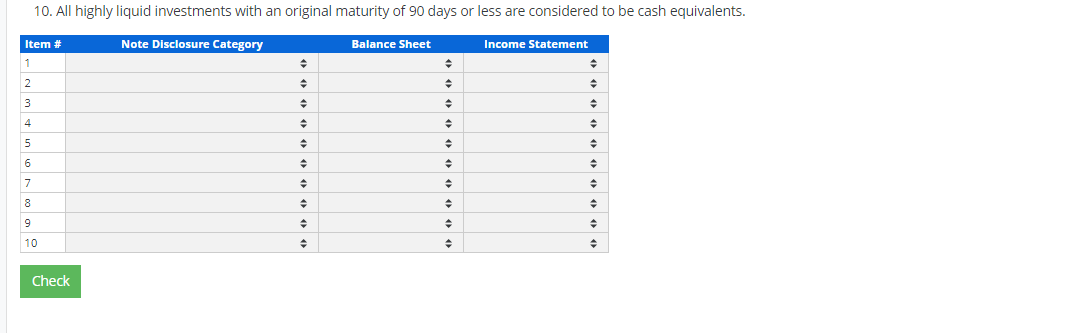

Classifying Disclosures and Analyzing Financial Statement Impact The following 10 items are considered in the preparation of financial statements for Forde Inc. for the year ended December 31, 2020. For each of the items listed, complete the table that follows. In completing the table, for the note disclosure category, choose from the following items: (1) summary of significant accounting policies, (2) fair value measurement, (3) related party transactions, (4) subsequent events, (5) errors, fraud, and illegal acts. For each item, indicate whether we would expect to potentially see an item affected on the face of the balance sheet and/or on the face of the income statement. 1. The company is currently investigating whether a foreign division paid bribes to governmental officials in the Bahamas in order to obtain a sales contract with the government. The company is working with the SEC to resolve the matter. 2. A loan to a 5% shareholder was made on June 30, 2020, for $10,000. Interest is due annually beginning one year from the origination of the loan. 3. On January 15, 2021, a business component met the criteria to be classified as held for sale. At that time, impairment is estimated to be $30,000. 4. Short-term investments are valued at Level 1 in the fair value hierarchy for $40,550. Total net unrealized gain (affecting net income) related to the investments is $1,500. 5. Depreciation is determined on a straight-line basis for buildings and leasehold improvements over 2 to 40 years. 6. On February 1, 2021, the company declared a quarterly cash dividend of $0.40 per share, payable on March 15, 2021, for shareholders of record on March 10, 2021. 7. Goodwill and other acquired intangible assets with indefinite lives are not amortized but are tested for impairment annually. 8. Equipment is measured at fair value of $27,000 on a nonrecurring basis using significant unobservable inputs (Level 3). The total related impairment loss is $3,000. 9. Land was sold to the company president at a price significantly under its appraised value. 10. All highly liquid investments with an original maturity of 90 days or less are considered to be cash equivalents. 10. All highly liquid investments with an original maturity of 90 days or less are considered to be cash equivalents. Item # Note Disclosure Category Balance Sheet Income Statement 1 . 2 3 2 4 5 6 7 8 9 10 Check Classifying Disclosures and Analyzing Financial Statement Impact The following 10 items are considered in the preparation of financial statements for Forde Inc. for the year ended December 31, 2020. For each of the items listed, complete the table that follows. In completing the table, for the note disclosure category, choose from the following items: (1) summary of significant accounting policies, (2) fair value measurement, (3) related party transactions, (4) subsequent events, (5) errors, fraud, and illegal acts. For each item, indicate whether we would expect to potentially see an item affected on the face of the balance sheet and/or on the face of the income statement. 1. The company is currently investigating whether a foreign division paid bribes to governmental officials in the Bahamas in order to obtain a sales contract with the government. The company is working with the SEC to resolve the matter. 2. A loan to a 5% shareholder was made on June 30, 2020, for $10,000. Interest is due annually beginning one year from the origination of the loan. 3. On January 15, 2021, a business component met the criteria to be classified as held for sale. At that time, impairment is estimated to be $30,000. 4. Short-term investments are valued at Level 1 in the fair value hierarchy for $40,550. Total net unrealized gain (affecting net income) related to the investments is $1,500. 5. Depreciation is determined on a straight-line basis for buildings and leasehold improvements over 2 to 40 years. 6. On February 1, 2021, the company declared a quarterly cash dividend of $0.40 per share, payable on March 15, 2021, for shareholders of record on March 10, 2021. 7. Goodwill and other acquired intangible assets with indefinite lives are not amortized but are tested for impairment annually. 8. Equipment is measured at fair value of $27,000 on a nonrecurring basis using significant unobservable inputs (Level 3). The total related impairment loss is $3,000. 9. Land was sold to the company president at a price significantly under its appraised value. 10. All highly liquid investments with an original maturity of 90 days or less are considered to be cash equivalents. 10. All highly liquid investments with an original maturity of 90 days or less are considered to be cash equivalents. Item # Note Disclosure Category Balance Sheet Income Statement 1 . 2 3 2 4 5 6 7 8 9 10 Check