Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To raise money for additional research, Dr. Aggarwal approached the federal government and received a $2.5 million grant in early July. The condition of

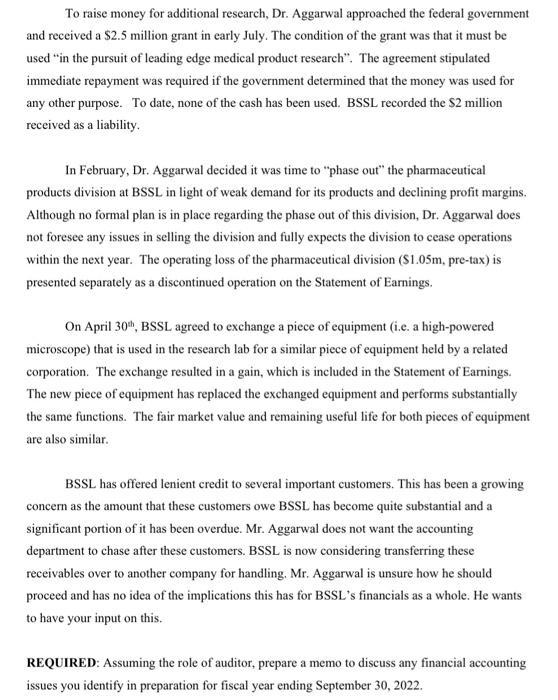

To raise money for additional research, Dr. Aggarwal approached the federal government and received a $2.5 million grant in early July. The condition of the grant was that it must be used in the pursuit of leading edge medical product research". The agreement stipulated immediate repayment was required if the government determined that the money was used for any other purpose. To date, none of the cash has been used. BSSL recorded the $2 million received as a liability. In February, Dr. Aggarwal decided it was time to "phase out" the pharmaceutical products division at BSSL in light of weak demand for its products and declining profit margins. Although no formal plan is in place regarding the phase out of this division, Dr. Aggarwal does not foresee any issues in selling the division and fully expects the division to cease operations within the next year. The operating loss of the pharmaceutical division ($1.05m, pre-tax) is presented separately as a discontinued operation on the Statement of Earnings. On April 30th, BSSL agreed to exchange a piece of equipment (i.e. a high-powered microscope) that is used in the research lab for a similar piece of equipment held by a related corporation. The exchange resulted in a gain, which is included in the Statement of Earnings. The new piece of equipment has replaced the exchanged equipment and performs substantially the same functions. The fair market value and remaining useful life for both pieces of equipment are also similar. BSSL has offered lenient credit to several important customers. This has been a growing concern as the amount that these customers owe BSSL has become quite substantial and a significant portion of it has been overdue. Mr. Aggarwal does not want the accounting department to chase after these customers. BSSL is now considering transferring these receivables over to another company for handling. Mr. Aggarwal is unsure how he should proceed and has no idea of the implications this has for BSSL's financials as a whole. He wants to have your input on this. REQUIRED: Assuming the role of auditor, prepare a memo to discuss any financial accounting issues you identify in preparation for fiscal year ending September 30, 2022.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To Management From Auditor Subject Financial Accounting Issues We have identified a number of financ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started