Answered step by step

Verified Expert Solution

Question

1 Approved Answer

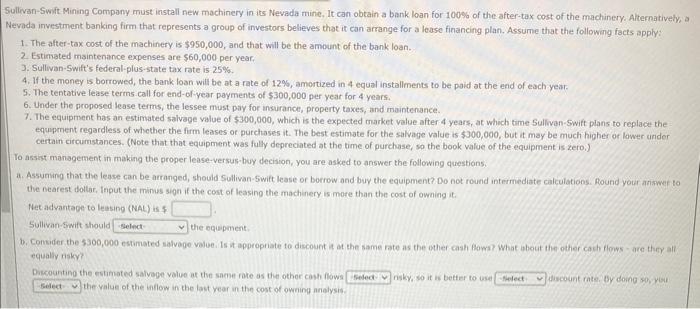

clear answers for each please Sullivan-Swyt Mining Company must install new machinery in its Nevada mine, It can obtain a bank loan for 100% of

clear answers for each please

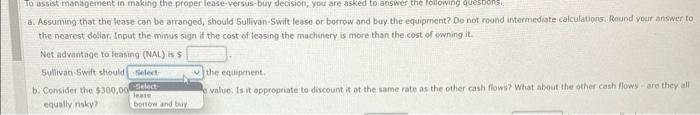

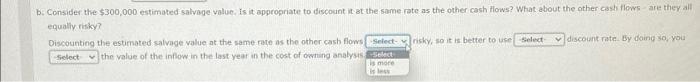

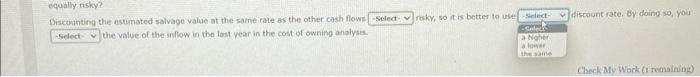

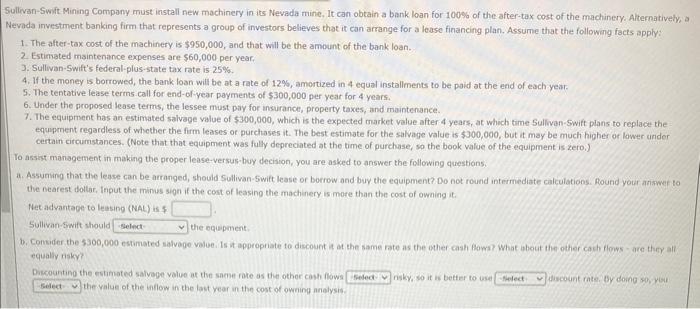

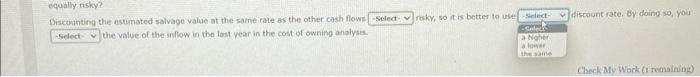

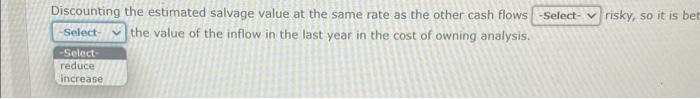

Sullivan-Swyt Mining Company must install new machinery in its Nevada mine, It can obtain a bank loan for 100% of the after-tax cost of the machinery. Alternatively, a Nevada investment banking firm that represents a group of investors believes that it can arrange for a lease financing plan. Assume that the following facts apply? 1. The after-tax oost of the machinery is $950,000, and that will be the amount of the bank loan. 2. Estimated maintenance expenses are $60,000 per year. 3. Sullivan-Swift's federal-plus-state tax rate is 25%. 4. If the money is borrowed, the bank loan will be at a rate of 12%, amortized in 4 equal installments to be paid at the end of each year. 5. The tentative fease terms call for end-of year payments of $300,000 per year for 4 years. 6. Under the proposed lease terms, the lessee must pay for insurance, property taxes, and maintenance. 7. The equipment has an estimated salvage value of $300,000, which is the expected market value after 4 years, at which tame Sulfivan-5wift plans to replace the equpment regardless of whether the firm leases of purchases it. The best estimate for the salvage value is $300,000, but it may be much higher or lawer under certain circumstances. (Note that that equipment was fully depreciated at the time of purchase, so the book value of the equipment is zero.) To assist management in making the proper lease-versus-buy decision, you are asked to answer the following questions: a. Assunung that the lease can be arranged, should Sullivan-5witt lease of borrow and buy the equipment? Do not round intermediate calculations. flound your ariswer to the nearest toltar, fnout the minus sign if the cost of leasing the machinery is more than the cost of owning it. Net advantage to leasing (NAL) is $. Sullivan-5wift should the equipment: b. Comsider the 5300,000 estimated salvage value. Is it appropnate to discount it at the same rate as the bher cash faws? What iobout the other cach flons - are ther all equaliy nisky? Diksountina the echinated salvage value at the saene rove as the other cash fows nisk, yi so it is better to use Aiscount rate, by doing soy yer the value of the inflow in the last year in the cost of oweing andysis. a. Assuming that the lease can be arranged, should 5 ullivan-Swit lease or borrow and buy the equipment? Do not rownd intermediate calculations. Round your answer to the nearest dollar, Input the minus sign if the cost of leasing the machinery is more than the cost of owning it. Net advantage to leasing (NAL) is 5 Sullivan Swit should the equipenent. b. Consider the $300,06 value: is it approphate to discount it at the same rate as the other cash flows? What about the other cash flows in are they all equally nsky? equaliy risky? Discounting the estimated salvade value at the same rate as the other cash flows risky, so it is better to use discoint rate. By doing so, you the value of the inflew in the last year in the cost of owning analyss Disctanding the nstumated salvage value at the same rate as the other cash flows rakicy, so tis better to usel tiscount rate. by doing so, you the value of the inflow in the last year in the cost of owning analysas. Check My Work (I remaining) Discounting the estimated salvage value at the same rate as the other cash flows risky, so it is bet the value of the inflow in the last year in the cost of owning analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started