Clear information,

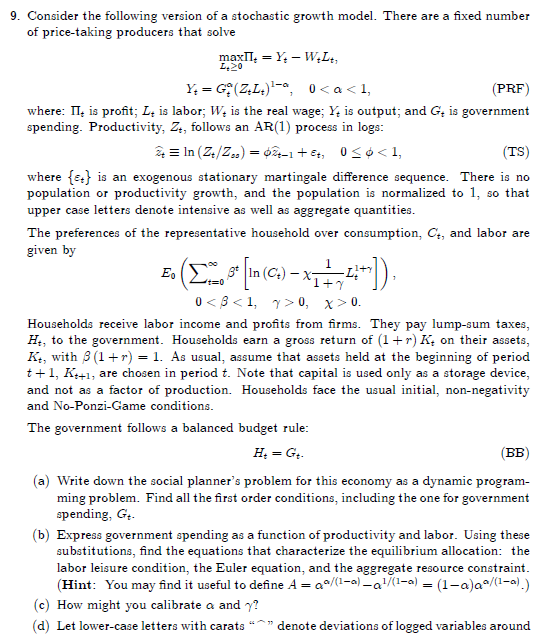

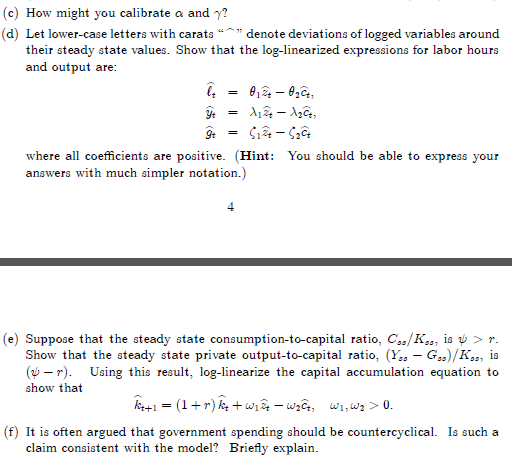

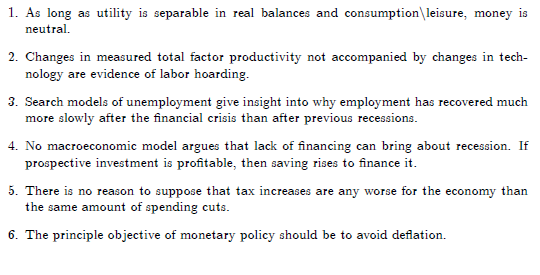

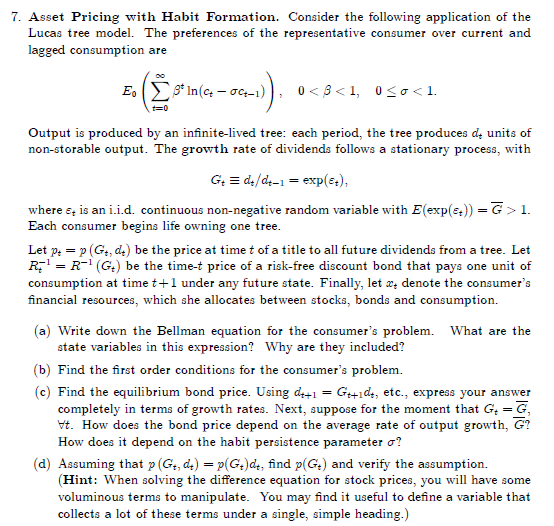

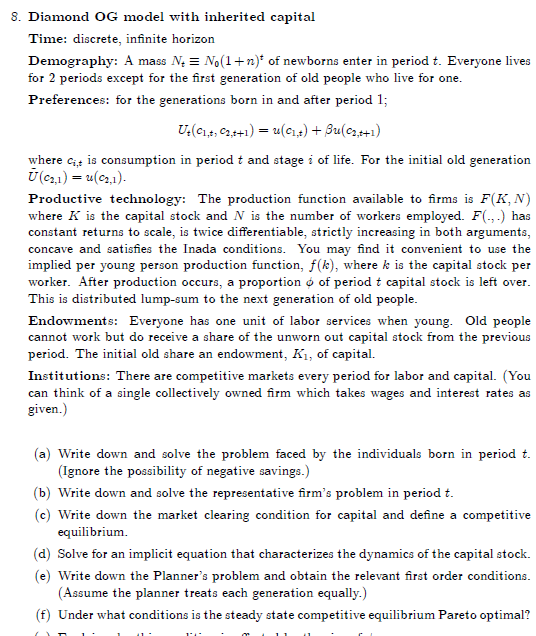

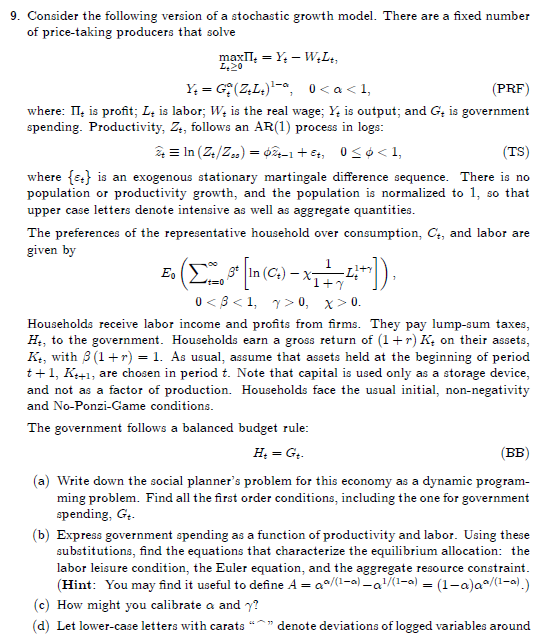

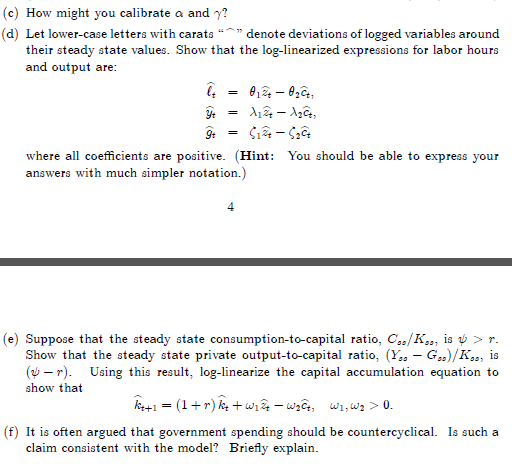

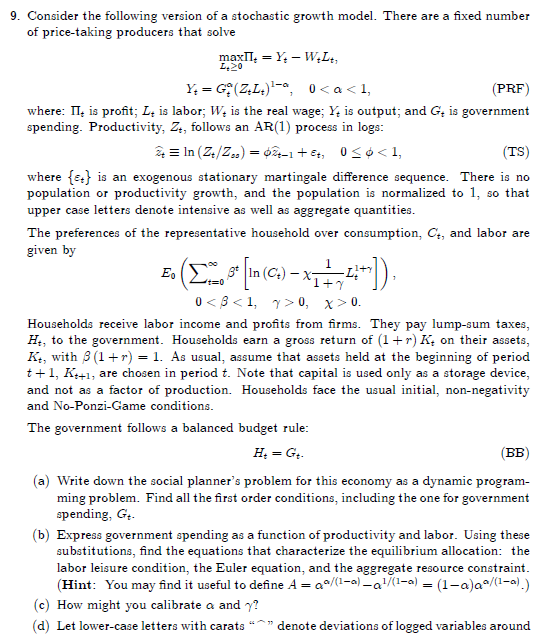

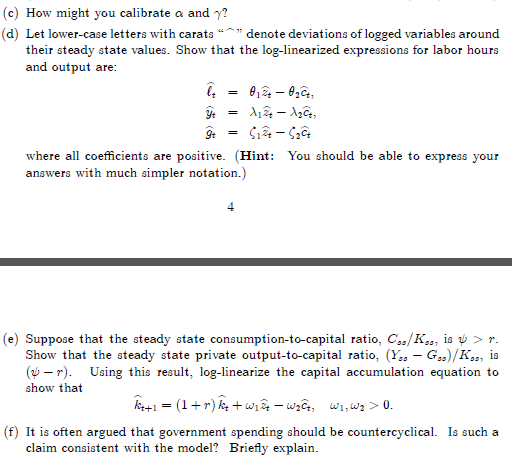

1. As long as utility is separable in real balances and consumptioninleisure.' money is neutral. 2. Changes in measured total factor productivity not accompanied by changes in tech nology are evidence of labor hoarding. 3. Search models of unemployment give insight into why employment has reoovered much more slowly after the nancial crisis than after previous recessions. 4. No macroeconomic model argue: that lack of nancing can bring about reoession. If prospective investment is protaliuleJ then saving rises to nance it. 5. There is no reason to suppose that tax increases are any worse for the economy than the same amount of spending cuts. 6. The principle objective of monetary policy should he to avoid deation. T. Asset Pricing with Habit Formation. Consider the following application of the Lucas tree model. The preferences of the representative consumer over current and lagged consumption are Eu (Zfl{gGC_1}), lil, DELI-:21. t=|l Output is produced by an innite-lived tree: each period, the tree produces d; units of non-storable output. The growth rate of dividends follows a stationary process, with Gs E defile1 = BxP'l'tL where c} is an i.i.d. continuous nonnegative random variable 1iIIrith Efexpe} = E :.=- 1. Each consumer begins life owning one tree. Let p; = p [Gh iii} be the price at time t of a title to all future dividends from a tree. Let R? = R'1 {Gt} be the timet price of a riskfree discount bond that pays one unit of consumption at time t+ 1 under any future state. Finally, let 22 denote the consumer's nancial resources, which she allocates between stocks, bonds and consumption. {a} Write down the Bellman equation for the consumer's problem. What are the state variables in this expression? Why are they included? {b} Find the rst order conditions for the consumer's problem. {c} Find the equilibrium bond price. Using d1\" = Gldtl etc., express your answer completely in terms of growth rates. Next, suppose for the moment that Gt =5, 's't. HOW does the bond price depend on the average rate of output growth, G? How does it depend on the habit persistence parameter 0"." {d} Assuming that Era-{Chili} = prldh nd fifth} and verify the assumption. (Hint: 1|ui'li'hen solving the difference equation for stock prices, you \"ill. have some voluminous terms to manipulate. You may nd it useful to dene a variable that collects a lot ofthese terms under a single, simple heading.) 3. Diamond 0G model with inherited capital Time: discrete, innite horizon Dermgraphy: _-'-"L mass Nt E Nl +31}i of newborns enter in period t. Everyone lives for 2 periods except for the rst generation of old people who live for one. Preferences: for the generations born in and after period 1; Ut[51,tgct,t+1} = llies} +.311[53.15+1} where c\" is consumption in period t and stage i of life. For the initial old generation Elli-3,1} = \"(cell- Productive technology: The production function available to rms is F{K,N} where K is the capital stock and N is the number of workers employed. FL, .} has constant returns to scale, is twice di'erentiable, strictly increasing in both arguments, concave and satises the Inada conditions. You may nd it convenient to use the implied per young person production function, it}, where is: is the capital stock per worker. After production occurs, a proportion o of period t capital stock is left over. This is distributed lumpsum to the next generation of old people. Endowments: Everyone has one unit of labor services when young. 01d people cannot work but do receive a share of the unworn out capital stock from the previous period. The initial old share an endowment, K1, of capital. Institutions: There are competitive markets every period for labor and capital. l[You can think of a single collectively owned rm which takes wages and interest rates as given.) a Write down and solve the roblem faced the individuals born in eriod t. P P [Ignore the possibility of negative savings.) {b} Write down and solve the representative rm's problem in period t. {c} Write down the market clearing condition for capital and dene a competitive equilibrium. {:1} Solve for an implicit equation that characterizes the dynamics of the capital stock. e n e own e nner s ro em an c an t e re evant s or r con Itlons. W 't d tl] Pla ' p bl d bt ' h l r t the d' ' [Assume the planner treats each generation equally.) {f} Under what conditions is the steady state competitive equilibrium Pareto optimal? III-I. 1' I 11' 'I'I' ' Irv-:11 .1 ' rI 9. Consider the following version of a stochastic growth model. There are a fixed number of price-taking producers that solve maxll = Yt - W.Lt, C+20 Y = GF (Z,L.)]-, 0 0, x>0. Households receive labor income and profits from firms. They pay lump-sum taxes, He, to the government. Households earn a gross return of (1 + r) K, on their assets, Ke, with 8(1 +r) = 1. As usual, assume that assets held at the beginning of period t + 1, At+1, are chosen in period t. Note that capital is used only as a storage device, and not as a factor of production. Households face the usual initial, non-negativity and No-Ponzi-Game conditions. The government follows a balanced budget rule: H. = G+. (BB) (a) Write down the social planner's problem for this economy as a dynamic program- ming problem. Find all the first order conditions, including the one for government spending, Gt- (b) Express government spending as a function of productivity and labor. Using these substitutions, find the equations that characterize the equilibrium allocation: the labor leisure condition, the Euler equation, and the aggregate resource constraint. (Hint: You may find it useful to define A = Qo/(1-a)_al/(1-a) = (1-a)a^/(1-a).) (c) How might you calibrate a and y? (d) Let lower-case letters with carats "*" denote deviations of logged variables around