clear photo for each question

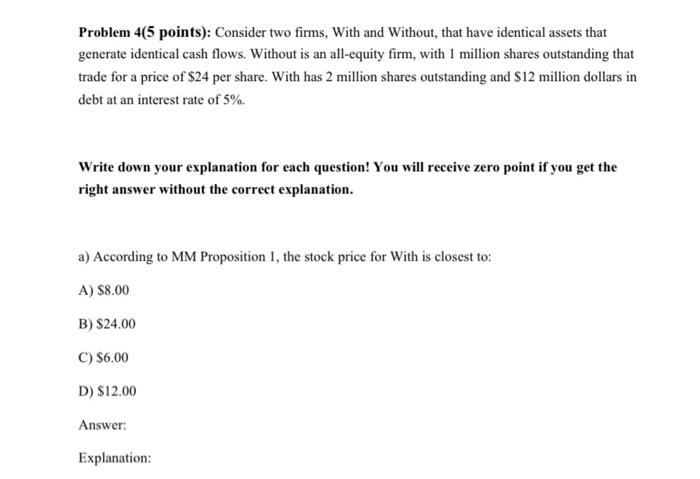

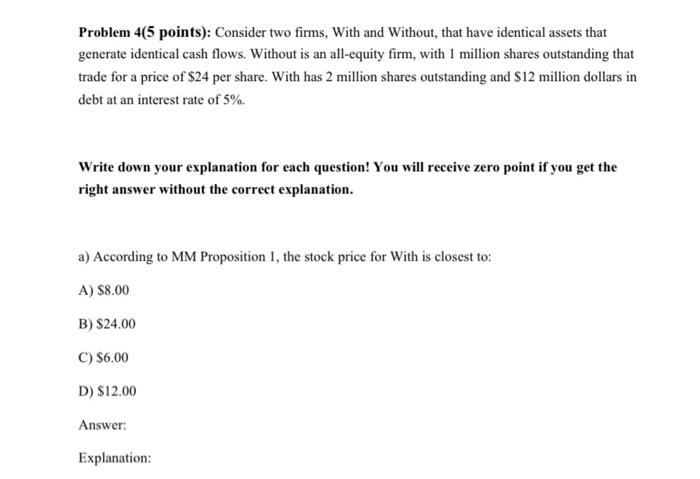

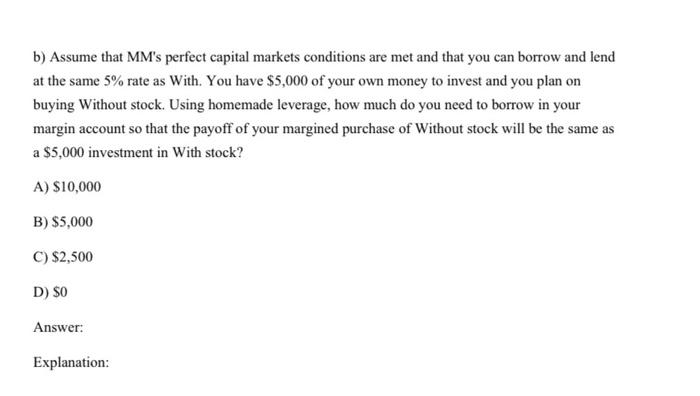

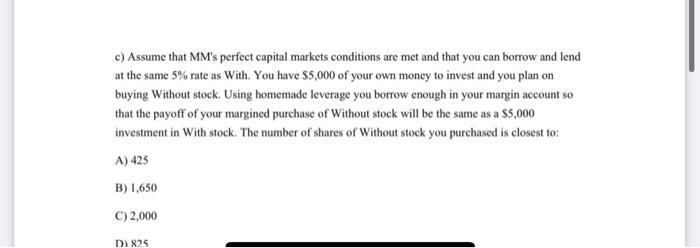

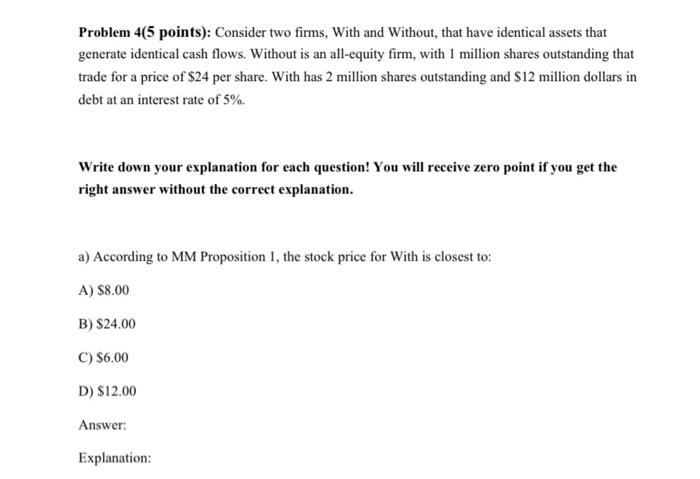

Problem 45 points): Consider two fim. With and without that have identical the penerate identical case Without is an acquiry firm, wil milliet trade for a price of 24 per share. With tas 2 millioner standing and $12 debatan interest rate of Write down your explanation for each question You will rece ser point if you get the righter without the correct explanation *) According to MM Preposition, the stock price for the ASR 8) 524.00 D: 512.00 Aniver: Explanation b) Assun that MM's perfect capital market conditions are met and that you can be the same meas With Your 55.000 of your own invest and you buying With deck. Ungde leverage how much do you see you margin account that the proff your margine purchase of Watu will 55.000 mest is With A) $10,000 155.000 C) 52.00 DISO Antwer Explanation w the same as Wah. You have 55.000 of your own my mend you yine Withock. Lingumagyon me that the payoff of your mured purchase of Witte will be the same as 55.000 investment in Wilheck. The number of them without tack yo pacto de A) 45 1) 1.650 2.000 TI Problem 4(5 points): Consider two firms, With and Without, that have identical assets that generate identical cash flows. Without is an all-equity firm, with 1 million shares outstanding that trade for a price of $24 per share. With has 2 million shares outstanding and $12 million dollars in debt at an interest rate of 5%. Write down your explanation for each question! You will receive zero point if you get the right answer without the correct explanation. a) According to MM Proposition 1, the stock price for With is closest to: A) $8.00 B) $24.00 C) $6.00 D) $12.00 Answer: Explanation: b) Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With. You have $5,000 of your own money to invest and you plan on buying Without stock. Using homemade leverage, how much do you need to borrow in your margin account so that the payoff of your margined purchase of Without stock will be the same as a $5,000 investment in With stock? A) $10,000 B) $5,000 C) $2,500 D) SO Answer: Explanation: c) Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With. You have $5,000 of your own money to invest and you plan on buying Without stock. Using homemade leverage you borrow enough in your margin account so that the payoff of your margined purchase of Without stock will be the same as a $5,000 investment in With stock. The number of shares of Without stock you purchased is closest to A) 425 B) 1.650 C) 2,000 D) R25 Problem 45 points): Consider two fim. With and without that have identical the penerate identical case Without is an acquiry firm, wil milliet trade for a price of 24 per share. With tas 2 millioner standing and $12 debatan interest rate of Write down your explanation for each question You will rece ser point if you get the righter without the correct explanation *) According to MM Preposition, the stock price for the ASR 8) 524.00 D: 512.00 Aniver: Explanation b) Assun that MM's perfect capital market conditions are met and that you can be the same meas With Your 55.000 of your own invest and you buying With deck. Ungde leverage how much do you see you margin account that the proff your margine purchase of Watu will 55.000 mest is With A) $10,000 155.000 C) 52.00 DISO Antwer Explanation w the same as Wah. You have 55.000 of your own my mend you yine Withock. Lingumagyon me that the payoff of your mured purchase of Witte will be the same as 55.000 investment in Wilheck. The number of them without tack yo pacto de A) 45 1) 1.650 2.000 TI Problem 4(5 points): Consider two firms, With and Without, that have identical assets that generate identical cash flows. Without is an all-equity firm, with 1 million shares outstanding that trade for a price of $24 per share. With has 2 million shares outstanding and $12 million dollars in debt at an interest rate of 5%. Write down your explanation for each question! You will receive zero point if you get the right answer without the correct explanation. a) According to MM Proposition 1, the stock price for With is closest to: A) $8.00 B) $24.00 C) $6.00 D) $12.00 Answer: Explanation: b) Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With. You have $5,000 of your own money to invest and you plan on buying Without stock. Using homemade leverage, how much do you need to borrow in your margin account so that the payoff of your margined purchase of Without stock will be the same as a $5,000 investment in With stock? A) $10,000 B) $5,000 C) $2,500 D) SO Answer: Explanation: c) Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With. You have $5,000 of your own money to invest and you plan on buying Without stock. Using homemade leverage you borrow enough in your margin account so that the payoff of your margined purchase of Without stock will be the same as a $5,000 investment in With stock. The number of shares of Without stock you purchased is closest to A) 425 B) 1.650 C) 2,000 D) R25