Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CLEAR PICTURES SORRY! Please help on a-e , will give thumbs up! just need d & e unless you need to complete a-c to complete

CLEAR PICTURES SORRY! Please help on a-e , will give thumbs up!

just need d & e unless you need to complete a-c to complete d & e

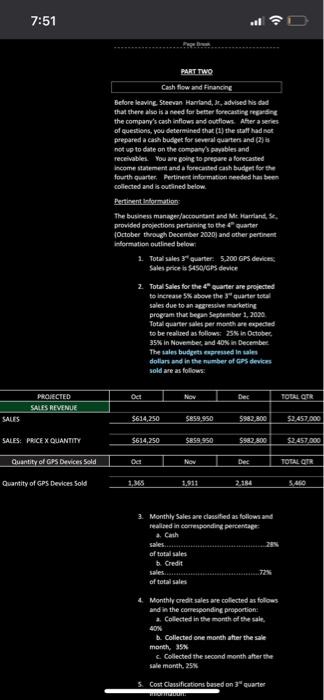

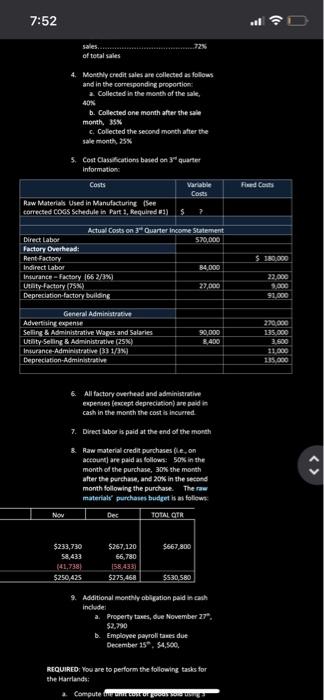

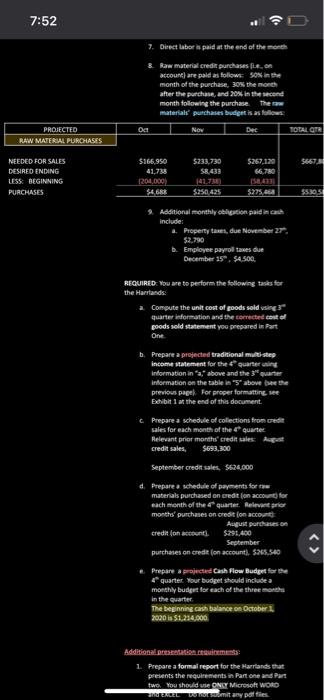

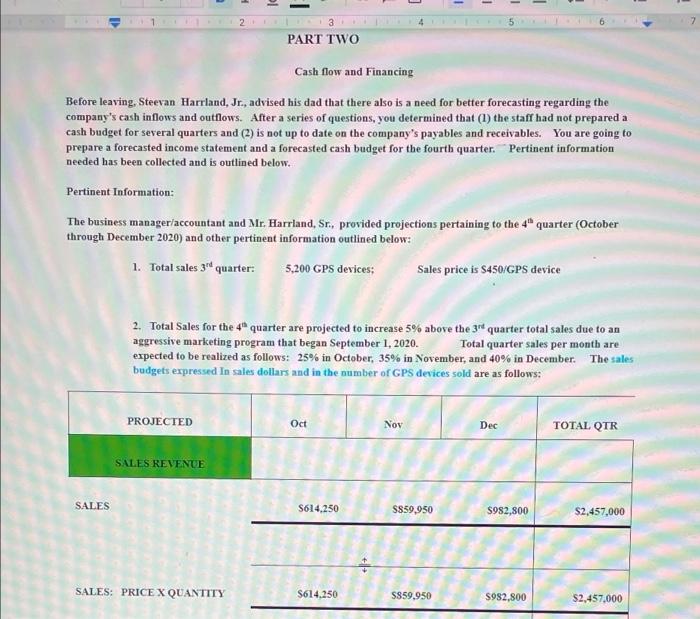

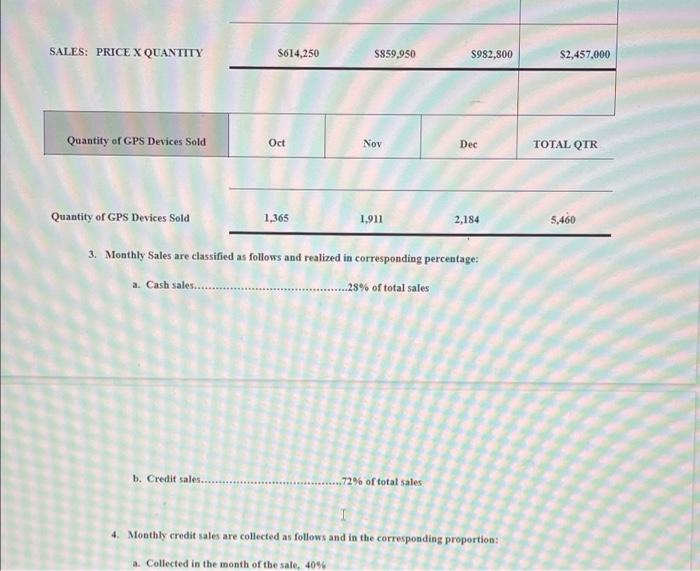

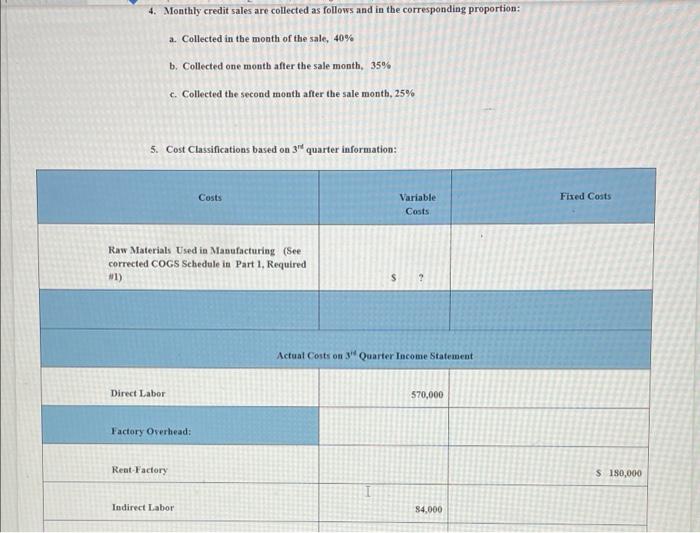

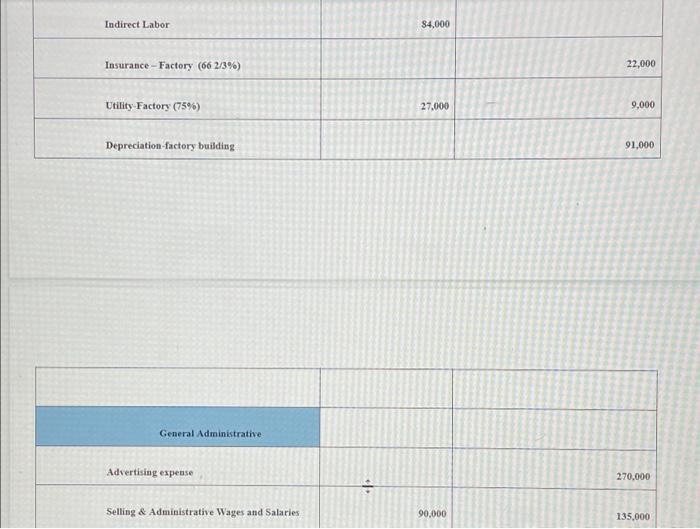

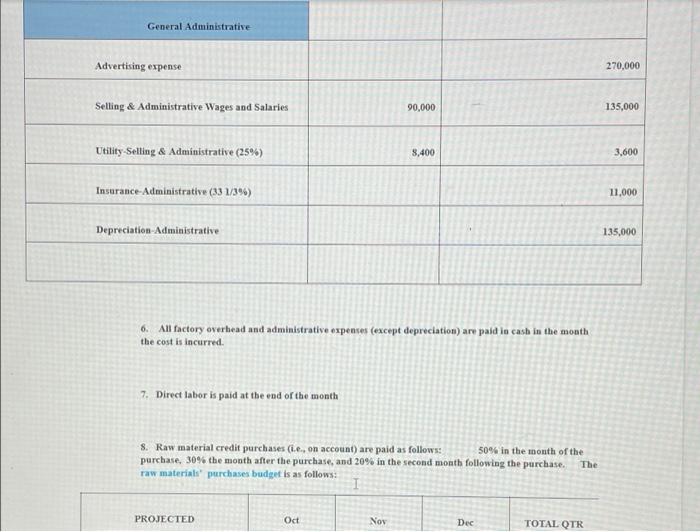

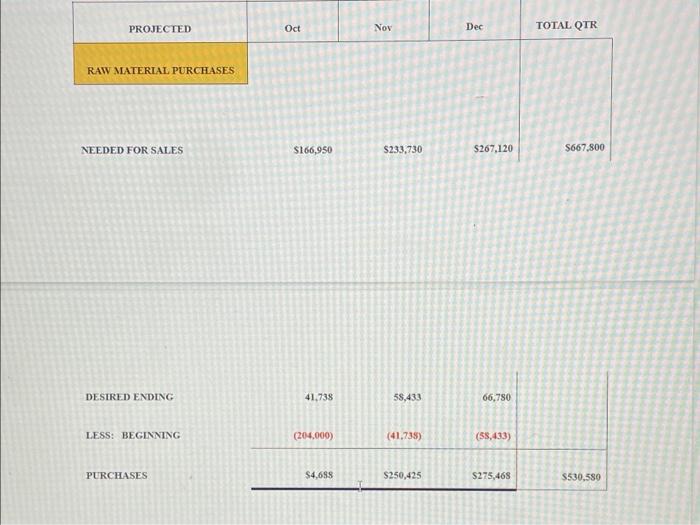

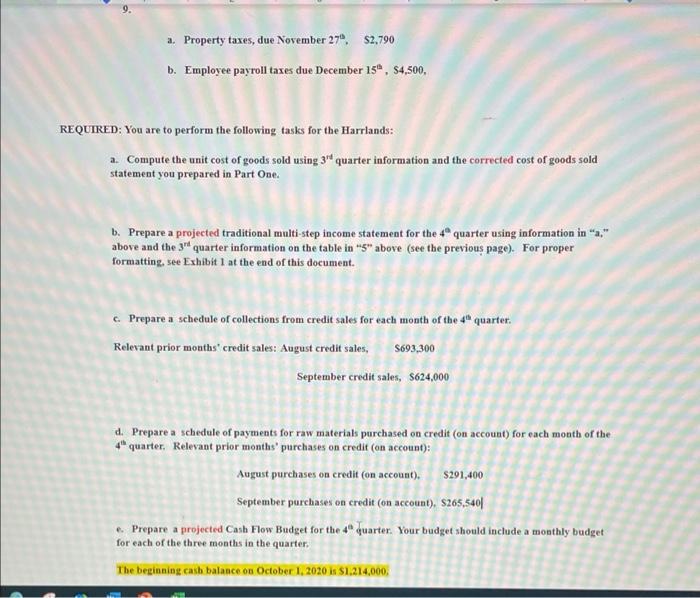

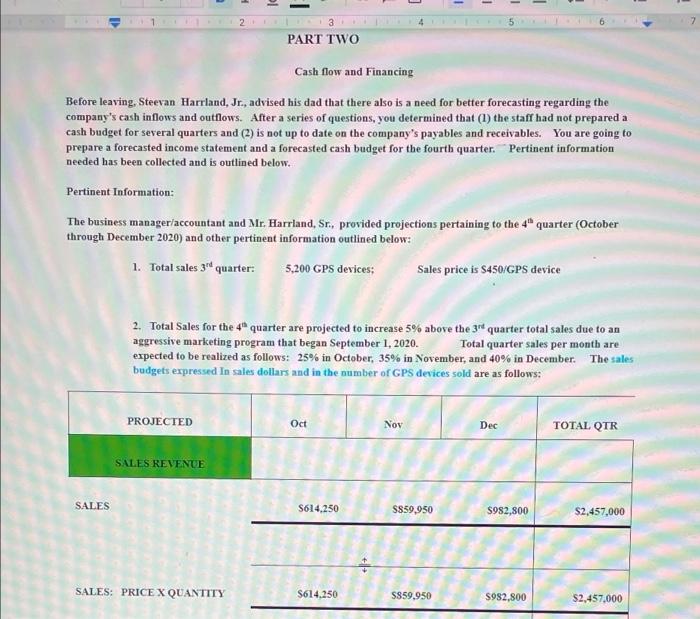

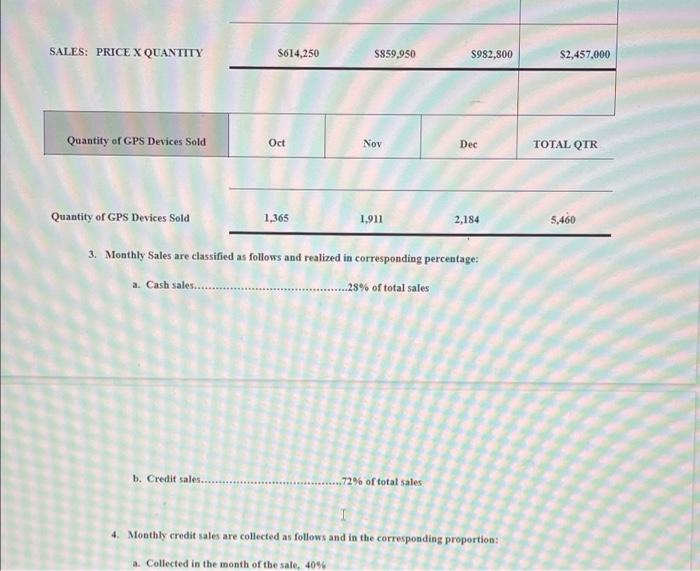

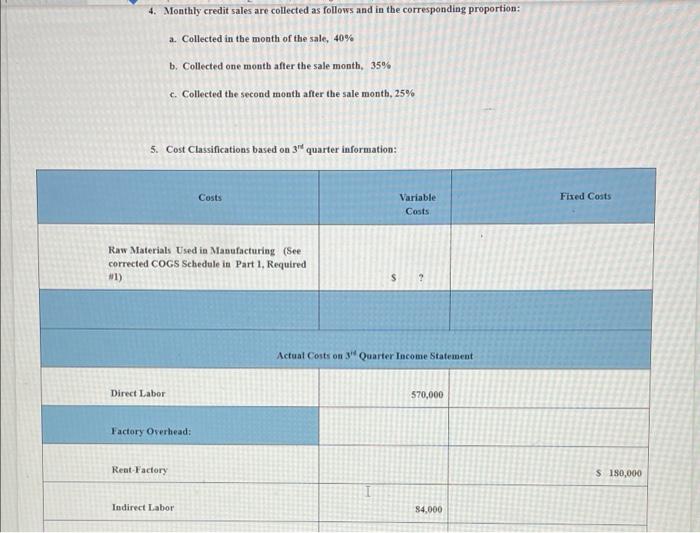

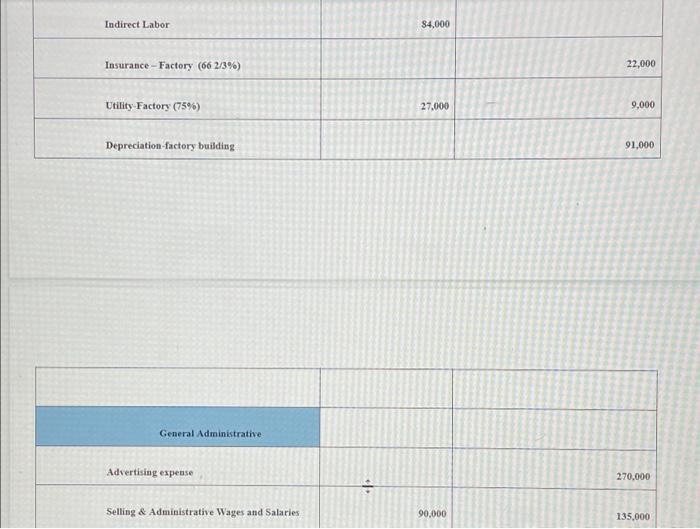

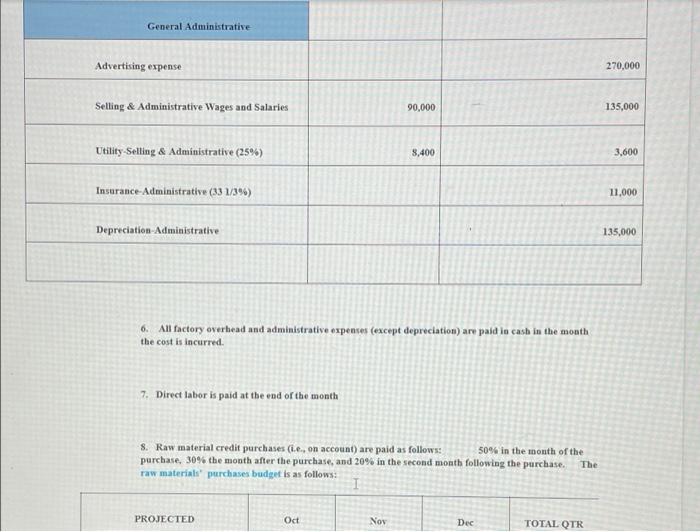

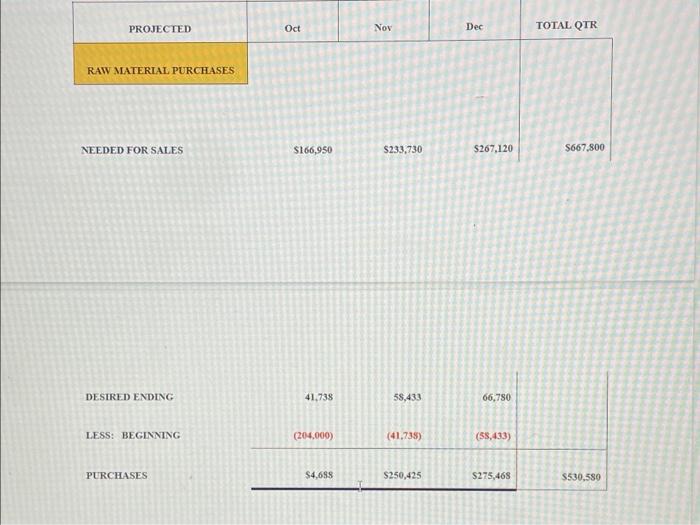

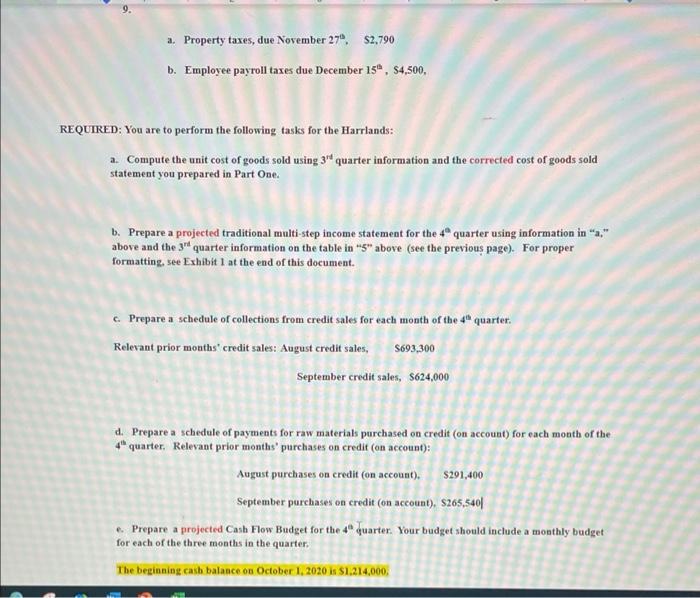

7:51 PART TWO Cash flow and Financing Before leaving Steevan Harrland, c.advised his dad that there also is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the staff had not prepared a cash budget for several quarters and (2) is not up to date on the company's payables and receivables. You are going to prepare a forecasted Income statement and a forecasted cash budget for the fourth quarter Pertinent information needed has been collected and is outined below. Pertinent information The business manager/accountant and Mr. Harrland, S. provided projections pertaining to the quarter October through December 2020 and other pertinent information outlined below 1 Total sales 3 quarter. 5.200 GPS devices Sales prices $450/GPS device 2 Total Sales for the quarter are projected to increase 5% above the quarter total sales due to an aggressive marketing program that began September 1, 2020 Total quarter sales per month are expected to be realized as follows 25% in October 35% in November, and 40% in December The sales budgets expressed in sales dollars and in the number of GPS devices sold are as follows: Oct Det TOEL OTR PROJECTED SALES REVENUE SALES $614,250 $59.950 5982.300 52.457.000 SALES: PRICEX QUANTITY $614,250 $899 450 $982.800 $2.457.000 Quantity of GPS Devices Sold Oct NON Det TOTAL OR Quantity of GPS Devices Sold 1,35 1911 2.114 SALO 3. Monthly Sales are classified as follow and realized incorresponding percentage .. Cash sales. of total sales b. Credit of total sales 4 Monthly credit sales are collected as follows and in the corresponding proportion 2. Collected in the month of the sale. 40 b. Collected one month after the sale month, 95 c Collected the second month after the sale month 25% 5. Cost Classifications based on 3 Quarter 7:52 sales, of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion 2. Collected in the month of the sale, AON b. Collected one month after the sale month, 35% c. Colected the second month after the sale month 25% Feed Cons 5. Cost Classification based on 3 quarter Information: Costs Variable Cosas Raw Materials used in Manufacturing See corrected COGS Schedule in Part 1, Required) $ Actual Costs on 3 Quarter Income Statement Direct Labor 570.000 Factory Overhead Rent Factory Indirect Labor 34.000 murance - Factory (66 2/3%) Utaty Factory (754) 27,000 Depreciation factory building $ 180,000 22.000 9,000 92.000 General Administrative Advertising expense Seling & Administrative Wapes and Salaries Utility Seling & Administrative (25) Inwrance-Administrative (331/3%) Depreciation Administrative 90,000 2.400 270.000 135.000 3.600 31.000 135.000 6. All factory overhead and administrative expenses fexcept depreciation we paid in cash in the month the cost is incurred 7. Direct labor is paid at the end of the month & Raw material credit purchases (le, on account) are paid as follows: 50% in the month of the purchase, 30% the month after the purchase, and 20% in the second month following the purchase. There material purchases budget is as follows: Nov Dec TOTAL OTR $667,800 $233,730 58,433 (41,738 $250 425 $267,120 66,780 158.4331 $275,468 $530, 580 9. Additional monthly obligation paid in cash include a Property taxes, due November 27" $2.790 b. Employee payroll taxes due December 15. $4.500 REQUIRED: You are to perform the following tasks for the Harrlands Computers 7:52 SD 7. Direct laboris paid at the end of the month & Raw material credit purchases Leon account) are paid as follows 50% in the month of the purchase, 30the month after the purchase, and 20% in the second month following the purchase Then material purchases budget is as follows Oa NOW Dec TOTAL GTR PROJECTED RAW MATERIAL PURCHASES 5667 NEEDED FOR SALES DESIRED ENDING LESS BEGINNING PURCHASES $166.950 41,738 1204,000 $233,730 $8.433 1417 $250 425 $267.129 66.780 8.31 $275,662 95.305 9. Additional monthly obligation paid in cash include 4. Property taxes, due November 27, $2.790 b. Employee payroll taxes due December 15, $4.500. REQUIRED: You are to perform the following tasks for the Harstands 2. Compute the unit cost of goods sold sing 3" quarter information and the corrected cost of poods sold statement you prepared in Part One b. Prepare a projected traditional multi-step income statement for the quartering Information in a.* above and the 3 quart information on the table in "S* above the previous papel For proper formatting see Exhibit 1 at the end of this document Prepare a schedule of collections from credit sales for each month of the quarter Relevant prior months' credit sales Augst credit sales, $693,300 September credit sales. 5524.000 d. Prepare a schedule of payments for materials purchased on credit to account for each month of the quarter Relevant prie months' purchases on credit on account August purchases on credit fonccount. $291,400 September purchases on credit on account, $265.540 C Prepare a proiecte Cash Flow Budget for the 4 quarter. Your budget should include a monthly budget for each of the three months in the quarter The beginning cash balance on October 2020 is $1.214.000 Additional presentationem 1. Prepare a formal report for the Harriands that presents the requirements in Partone and Part two. You should use ONLY Microsoft WORD WERDER Bitany pof fies 1 - - 4 5 6 3 PART TWO Cash flow and Financing Before leaving. Steevan Harrland, Jr., advised his dad that there also is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the staff had not prepared a cash budget for several quarters and (2) is not up to date on the company's payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Mr. Harrland, Sr., provided projections pertaining to the 4" quarter (October through December 2020) and other pertinent information outlined below: 1. Total sales 3d quarter: 5,200 GPS devices; Sales price is $450/GPS device 2. Total Sales for the 4" quarter are projected to increase 5% above the 3 quarter total sales due to an aggressive marketing program that began September 1, 2020. Total quarter sales per month are expected to be realized as follows: 25% in October, 35% in November, and 40% in December. The sales budgets expressed in sales dollars and in the number of GPS devices sold are as follows: PROJECTED Oct Nov Dec TOTAL QTR SALES REVENUE SALES S614.250 S859.950 S982,800 $2,457,000 SALES: PRICE X QUANTITY S614.250 5859,950 S982.800 $2.457.000 SALES: PRICE X QUANTITY S614,250 S859,950 S982,800 S2,457.000 Quantity of GPS Devices Sold Oct Nov Dec TOTAL QTR Quantity of GPS Devices Sold 1,365 1,911 2.184 5,460 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales.... ..28% of total sales b. Credit sales..... 72% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: Collected in the month of the sale. 40% 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 40% b. Collected one month after the sale month, 35% c. Collected the second month after the sale month, 25% 5. Cost Classifications based on 3 quarter information: Costs Fixed Costs Variable Costs Kaw Materials Used in Manufacturing (See corrected COGS Schedule in Part 1, Required 01) s ? Actual Costs on 3 Quarter Income Statement Direct Labor 570,000 Factory Overhead: Rent Factory $ 180,000 Indirect Labor 84.000 Indirect Labor 84,000 Insurance - Factory (66 2/3%) 22,000 Utility Factory (75%) 27,000 9,000 Depreciation factory building 91,000 General Administrative Advertising expense 270,000 Selling & Administrative Wages and Salaries 90,000 135,000 General Administrative Advertising expense 270,000 Selling & Administrative Wages and Salaries 90,000 135,000 Utility-Selling & Administrative (25%) 8,400 3,600 Insurance Administrative (331/3%) 11,000 Depreciation-Administrative 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid to cash in the mouth the cost is incurred 7. Direct labor is paid at the end of the month S. Raw material credit purchases (.e., on account) are paid as follows: 5096 in the month of the purchase, 30% the month after the purchase, and 20% in the second month following the purchase. raw materials purchases budget is as follows: The PROJECTED Oct Nov Dec TOTAL QTR PROJECTED Oct Nov Dec TOTAL QTR RAW MATERIAL PURCHASES NEEDED FOR SALES 166,950 $233,730 $267,120 $667,800 DESIRED ENDING 41,738 58,433 66,780 LESS: BEGINNING (204,000) (41,735) (58,433) PURCHASES $4,688 S250,425 $275,468 $530.580 a. Property taxes, due November 270, S2,790 b. Employee payroll taxes due December 15, $4,500, REQUIRED: You are to perform the following tasks for the Harrlands: a. Compute the unit cost of goods sold using 3" quarter information and the corrected cost of goods sold statement you prepared in Part One. 1. Prepare a projected traditional multi-step income statement for the 4 quarter using information in "." above and the 3 quarter information on the table in "5" above (see the previous page). For proper formatting, see Exhibit I at the end of this document. c. Prepare a schedule of collections from credit sales for each month of the 4 quarter. Relevant prior months' credit sales: August credit sales, S693,300 September credit sales, S624,000 d. Prepare a schedule of payments for raw materials purchased on credit (on account) for each month of the 4" quarter. Relevant prior months' purchases on credit (on account): August purchases on credit on account). 5291,400 September purchases on credit (on account), 8265,540 . Prepare a projected Cash Flow Budget for the 4* quarter. Your budget should include a monthly budget for each of the three months in the quarter. The beginning cash balance on October 1, 2020 is $1.214,000 7:51 PART TWO Cash flow and Financing Before leaving Steevan Harrland, c.advised his dad that there also is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the staff had not prepared a cash budget for several quarters and (2) is not up to date on the company's payables and receivables. You are going to prepare a forecasted Income statement and a forecasted cash budget for the fourth quarter Pertinent information needed has been collected and is outined below. Pertinent information The business manager/accountant and Mr. Harrland, S. provided projections pertaining to the quarter October through December 2020 and other pertinent information outlined below 1 Total sales 3 quarter. 5.200 GPS devices Sales prices $450/GPS device 2 Total Sales for the quarter are projected to increase 5% above the quarter total sales due to an aggressive marketing program that began September 1, 2020 Total quarter sales per month are expected to be realized as follows 25% in October 35% in November, and 40% in December The sales budgets expressed in sales dollars and in the number of GPS devices sold are as follows: Oct Det TOEL OTR PROJECTED SALES REVENUE SALES $614,250 $59.950 5982.300 52.457.000 SALES: PRICEX QUANTITY $614,250 $899 450 $982.800 $2.457.000 Quantity of GPS Devices Sold Oct NON Det TOTAL OR Quantity of GPS Devices Sold 1,35 1911 2.114 SALO 3. Monthly Sales are classified as follow and realized incorresponding percentage .. Cash sales. of total sales b. Credit of total sales 4 Monthly credit sales are collected as follows and in the corresponding proportion 2. Collected in the month of the sale. 40 b. Collected one month after the sale month, 95 c Collected the second month after the sale month 25% 5. Cost Classifications based on 3 Quarter 7:52 sales, of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion 2. Collected in the month of the sale, AON b. Collected one month after the sale month, 35% c. Colected the second month after the sale month 25% Feed Cons 5. Cost Classification based on 3 quarter Information: Costs Variable Cosas Raw Materials used in Manufacturing See corrected COGS Schedule in Part 1, Required) $ Actual Costs on 3 Quarter Income Statement Direct Labor 570.000 Factory Overhead Rent Factory Indirect Labor 34.000 murance - Factory (66 2/3%) Utaty Factory (754) 27,000 Depreciation factory building $ 180,000 22.000 9,000 92.000 General Administrative Advertising expense Seling & Administrative Wapes and Salaries Utility Seling & Administrative (25) Inwrance-Administrative (331/3%) Depreciation Administrative 90,000 2.400 270.000 135.000 3.600 31.000 135.000 6. All factory overhead and administrative expenses fexcept depreciation we paid in cash in the month the cost is incurred 7. Direct labor is paid at the end of the month & Raw material credit purchases (le, on account) are paid as follows: 50% in the month of the purchase, 30% the month after the purchase, and 20% in the second month following the purchase. There material purchases budget is as follows: Nov Dec TOTAL OTR $667,800 $233,730 58,433 (41,738 $250 425 $267,120 66,780 158.4331 $275,468 $530, 580 9. Additional monthly obligation paid in cash include a Property taxes, due November 27" $2.790 b. Employee payroll taxes due December 15. $4.500 REQUIRED: You are to perform the following tasks for the Harrlands Computers 7:52 SD 7. Direct laboris paid at the end of the month & Raw material credit purchases Leon account) are paid as follows 50% in the month of the purchase, 30the month after the purchase, and 20% in the second month following the purchase Then material purchases budget is as follows Oa NOW Dec TOTAL GTR PROJECTED RAW MATERIAL PURCHASES 5667 NEEDED FOR SALES DESIRED ENDING LESS BEGINNING PURCHASES $166.950 41,738 1204,000 $233,730 $8.433 1417 $250 425 $267.129 66.780 8.31 $275,662 95.305 9. Additional monthly obligation paid in cash include 4. Property taxes, due November 27, $2.790 b. Employee payroll taxes due December 15, $4.500. REQUIRED: You are to perform the following tasks for the Harstands 2. Compute the unit cost of goods sold sing 3" quarter information and the corrected cost of poods sold statement you prepared in Part One b. Prepare a projected traditional multi-step income statement for the quartering Information in a.* above and the 3 quart information on the table in "S* above the previous papel For proper formatting see Exhibit 1 at the end of this document Prepare a schedule of collections from credit sales for each month of the quarter Relevant prior months' credit sales Augst credit sales, $693,300 September credit sales. 5524.000 d. Prepare a schedule of payments for materials purchased on credit to account for each month of the quarter Relevant prie months' purchases on credit on account August purchases on credit fonccount. $291,400 September purchases on credit on account, $265.540 C Prepare a proiecte Cash Flow Budget for the 4 quarter. Your budget should include a monthly budget for each of the three months in the quarter The beginning cash balance on October 2020 is $1.214.000 Additional presentationem 1. Prepare a formal report for the Harriands that presents the requirements in Partone and Part two. You should use ONLY Microsoft WORD WERDER Bitany pof fies 1 - - 4 5 6 3 PART TWO Cash flow and Financing Before leaving. Steevan Harrland, Jr., advised his dad that there also is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the staff had not prepared a cash budget for several quarters and (2) is not up to date on the company's payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Mr. Harrland, Sr., provided projections pertaining to the 4" quarter (October through December 2020) and other pertinent information outlined below: 1. Total sales 3d quarter: 5,200 GPS devices; Sales price is $450/GPS device 2. Total Sales for the 4" quarter are projected to increase 5% above the 3 quarter total sales due to an aggressive marketing program that began September 1, 2020. Total quarter sales per month are expected to be realized as follows: 25% in October, 35% in November, and 40% in December. The sales budgets expressed in sales dollars and in the number of GPS devices sold are as follows: PROJECTED Oct Nov Dec TOTAL QTR SALES REVENUE SALES S614.250 S859.950 S982,800 $2,457,000 SALES: PRICE X QUANTITY S614.250 5859,950 S982.800 $2.457.000 SALES: PRICE X QUANTITY S614,250 S859,950 S982,800 S2,457.000 Quantity of GPS Devices Sold Oct Nov Dec TOTAL QTR Quantity of GPS Devices Sold 1,365 1,911 2.184 5,460 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales.... ..28% of total sales b. Credit sales..... 72% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: Collected in the month of the sale. 40% 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 40% b. Collected one month after the sale month, 35% c. Collected the second month after the sale month, 25% 5. Cost Classifications based on 3 quarter information: Costs Fixed Costs Variable Costs Kaw Materials Used in Manufacturing (See corrected COGS Schedule in Part 1, Required 01) s ? Actual Costs on 3 Quarter Income Statement Direct Labor 570,000 Factory Overhead: Rent Factory $ 180,000 Indirect Labor 84.000 Indirect Labor 84,000 Insurance - Factory (66 2/3%) 22,000 Utility Factory (75%) 27,000 9,000 Depreciation factory building 91,000 General Administrative Advertising expense 270,000 Selling & Administrative Wages and Salaries 90,000 135,000 General Administrative Advertising expense 270,000 Selling & Administrative Wages and Salaries 90,000 135,000 Utility-Selling & Administrative (25%) 8,400 3,600 Insurance Administrative (331/3%) 11,000 Depreciation-Administrative 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid to cash in the mouth the cost is incurred 7. Direct labor is paid at the end of the month S. Raw material credit purchases (.e., on account) are paid as follows: 5096 in the month of the purchase, 30% the month after the purchase, and 20% in the second month following the purchase. raw materials purchases budget is as follows: The PROJECTED Oct Nov Dec TOTAL QTR PROJECTED Oct Nov Dec TOTAL QTR RAW MATERIAL PURCHASES NEEDED FOR SALES 166,950 $233,730 $267,120 $667,800 DESIRED ENDING 41,738 58,433 66,780 LESS: BEGINNING (204,000) (41,735) (58,433) PURCHASES $4,688 S250,425 $275,468 $530.580 a. Property taxes, due November 270, S2,790 b. Employee payroll taxes due December 15, $4,500, REQUIRED: You are to perform the following tasks for the Harrlands: a. Compute the unit cost of goods sold using 3" quarter information and the corrected cost of goods sold statement you prepared in Part One. 1. Prepare a projected traditional multi-step income statement for the 4 quarter using information in "." above and the 3 quarter information on the table in "5" above (see the previous page). For proper formatting, see Exhibit I at the end of this document. c. Prepare a schedule of collections from credit sales for each month of the 4 quarter. Relevant prior months' credit sales: August credit sales, S693,300 September credit sales, S624,000 d. Prepare a schedule of payments for raw materials purchased on credit (on account) for each month of the 4" quarter. Relevant prior months' purchases on credit (on account): August purchases on credit on account). 5291,400 September purchases on credit (on account), 8265,540 . Prepare a projected Cash Flow Budget for the 4* quarter. Your budget should include a monthly budget for each of the three months in the quarter. The beginning cash balance on October 1, 2020 is $1.214,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started