clear writing please

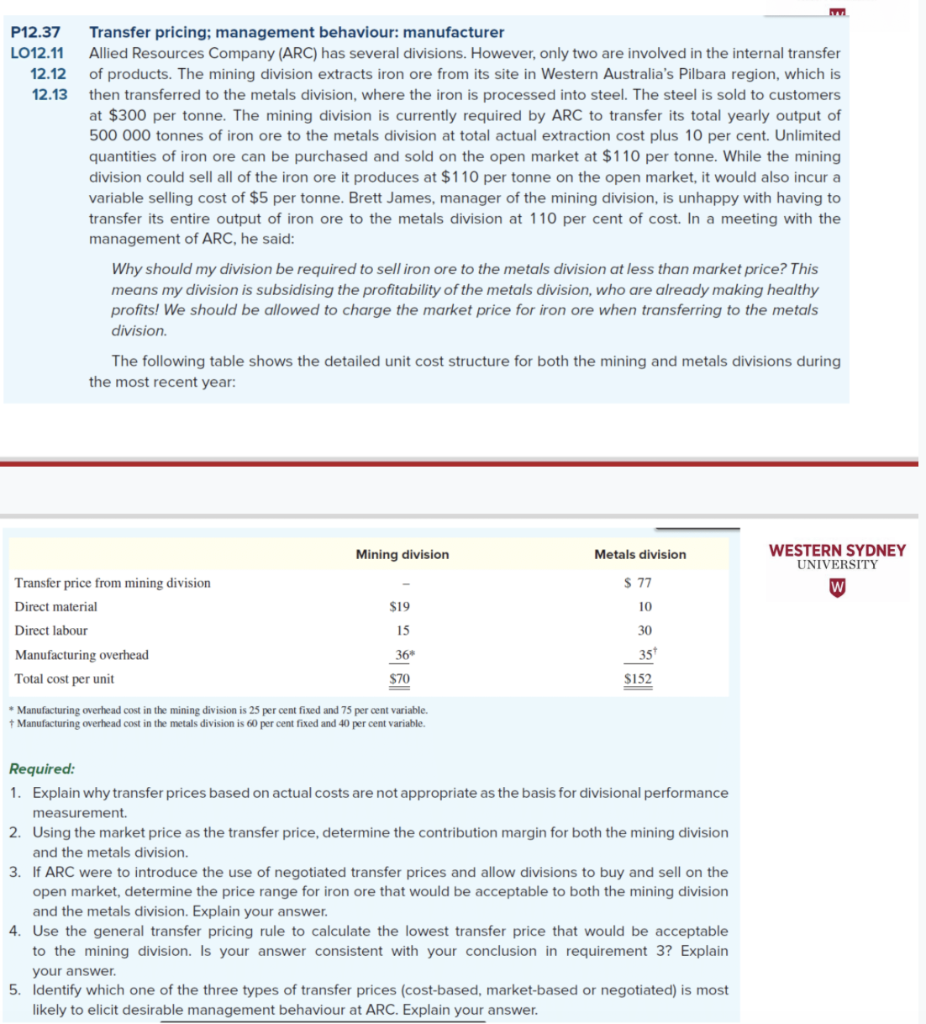

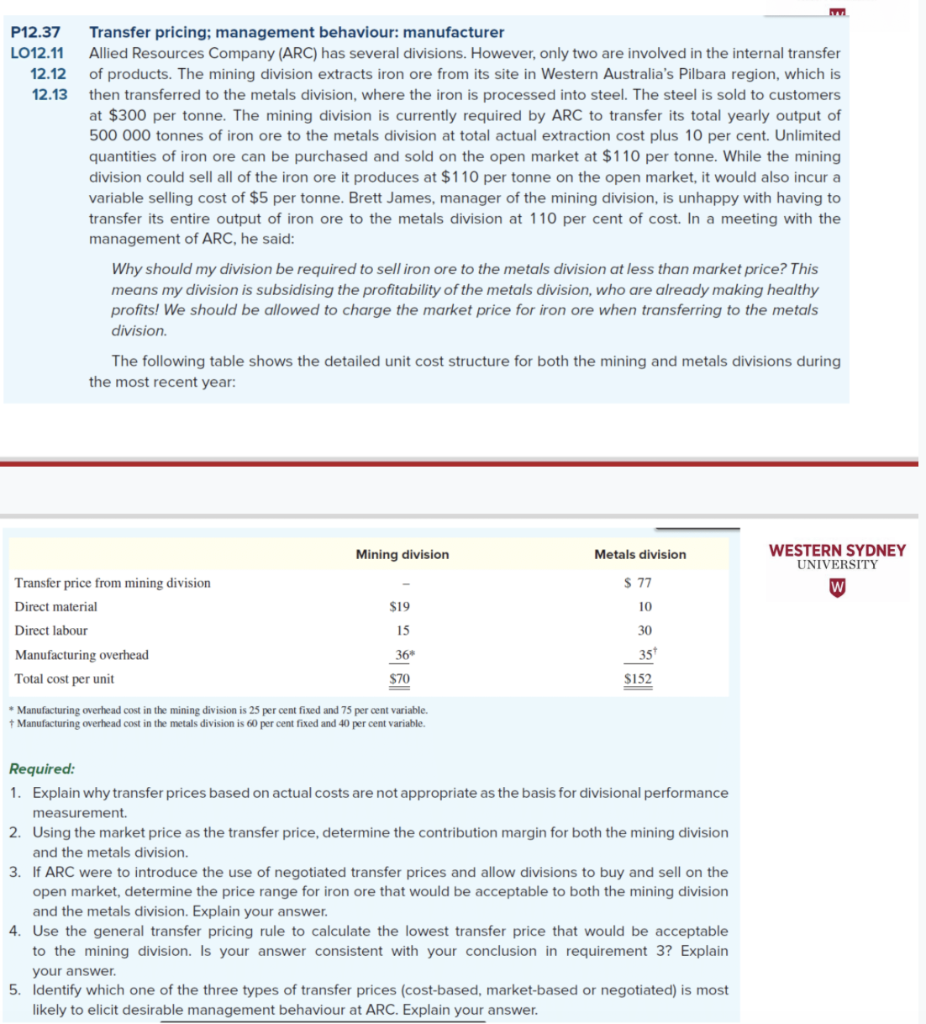

P12.37 LO12.11 12.12 12.13 Transfer pricing; management behaviour: manufacturer Allied Resources Company (ARC) has several divisions. However, only two are involved in the internal transfer of products. The mining division extracts iron ore from its site in Western Australia's Pilbara region, which is then transferred to the metals division, where the iron is processed into steel. The steel is sold to customers at $300 per tonne. The mining division is currently required by ARC to transfer its total yearly output of 500 000 tonnes of iron ore to the metals division at total actual extraction cost plus 10 per cent. Unlimited quantities of iron ore can be purchased and sold on the open market at $110 per tonne. While the mining division could sell all of the iron ore it produces at $110 per tonne on the open market, it would also incur a variable selling cost of $5 per tonne. Brett James, manager of the mining division, is unhappy with having to transfer its entire output of iron ore to the metals division at 110 per cent of cost. In a meeting with the management of ARC, he said: Why should my division be required to sell iron ore to the metals division at less than market price? This means my division is subsidising the profitability of the metals division, who are already making healthy profits! We should be allowed to charge the market price for iron ore when transferring to the metals division The following table shows the detailed unit cost structure for both the mining and metals divisions during the most recent year: Mining division Metals division WESTERN SYDNEY UNIVERSITY $ 77 $19 Transfer price from mining division Direct material Direct labour Manufacturing overhead Total cost per unit $70 $152 * Manufacturing overhead cost in the mining division is 25 per cent fixed and 75 per cent variable. Manufacturing overhead cost in the metals division is 60 per cent fixed and 40 per cent variable. Required: 1. Explain why transfer prices based on actual costs are not appropriate as the basis for divisional performance measurement. 2. Using the market price as the transfer price, determine the contribution margin for both the mining division and the metals division. 3. If ARC were to introduce the use of negotiated transfer prices and allow divisions to buy and sell on the open market, determine the price range for iron ore that would be acceptable to both the mining division and the metals division. Explain your answer. 4. Use the general transfer pricing rule to calculate the lowest transfer price that would be acceptable to the mining division. Is your answer consistent with your conclusion in requirement 3? Explain your answer. 5. Identify which one of the three types of transfer prices (cost-based, market-based or negotiated) is most likely to elicit desirable management behaviour at ARC. Explain your