Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Clearview Window Company manufactures windows for the home-building industry. The window frames are produced in the Frame Division. The frames are then transferred to

.

.

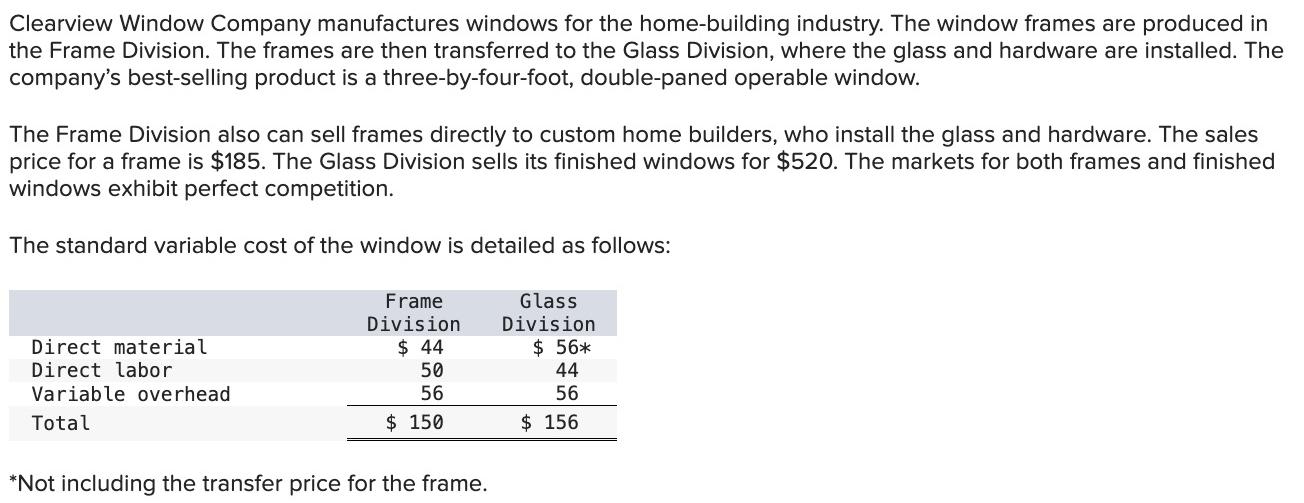

Clearview Window Company manufactures windows for the home-building industry. The window frames are produced in the Frame Division. The frames are then transferred to the Glass Division, where the glass and hardware are installed. The company's best-selling product is a three-by-four-foot, double-paned operable window. The Frame Division also can sell frames directly to custom home builders, who install the glass and hardware. The sales price for a frame is $185. The Glass Division sells its finished windows for $520. The markets for both frames and finished windows exhibit perfect competition. The standard variable cost of the window is detailed as follows: Frame Division Glass Division Direct material Direct labor Variable overhead Total $ 44 $ 56* 50 44 56 56 $ 150 $ 156 *Not including the transfer price for the frame.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the incremental contribution loss per window for Clearview Window Company as a whole we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started