Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Consider an auction for Elvis memorabilia. There are two bidders, i and j, with private values who compete in a first-price auction. Each

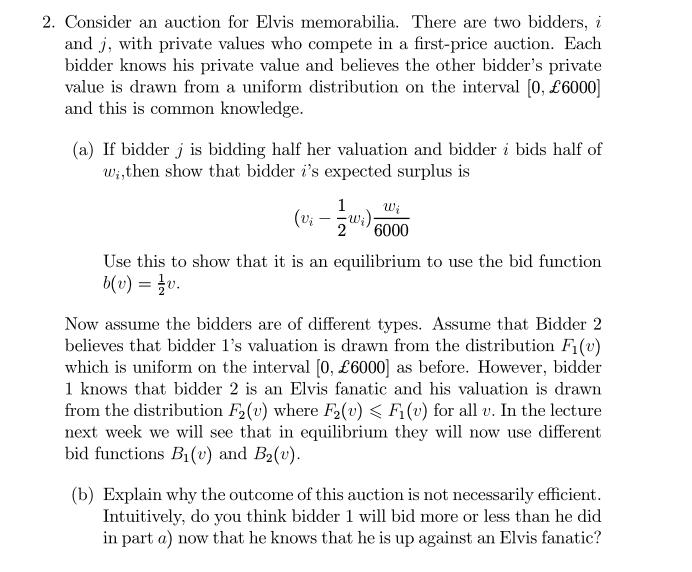

2. Consider an auction for Elvis memorabilia. There are two bidders, i and j, with private values who compete in a first-price auction. Each bidder knows his private value and believes the other bidder's private value is drawn from a uniform distribution on the interval [0, 6000] and this is common knowledge. (a) If bidder j is bidding half her valuation and bidder i bids half of w,,then show that bidder i's expected surplus is Wi (vi -1/2) 6000 Use this to show that it is an equilibrium to use the bid function b(v) = v. Now assume the bidders are of different types. Assume that Bidder 2 believes that bidder 1's valuation is drawn from the distribution Fi(v) which is uniform on the interval [0, 6000] as before. However, bidder 1 knows that bidder 2 is an Elvis fanatic and his valuation is drawn from the distribution F (v) where F(v) < F (v) for all u. In the lecture next week we will see that in equilibrium they will now use different bid functions B(v) and B (v). (b) Explain why the outcome of this auction is not necessarily efficient. Intuitively, do you think bidder 1 will bid more or less than he did in part a) now that he knows that he is up against an Elvis fanatic?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a a Eis surplus Eis value Ejs value 12Eis value 12Ejs value 12Eis value 126000 Eis value Eis value 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started