Answered step by step

Verified Expert Solution

Question

1 Approved Answer

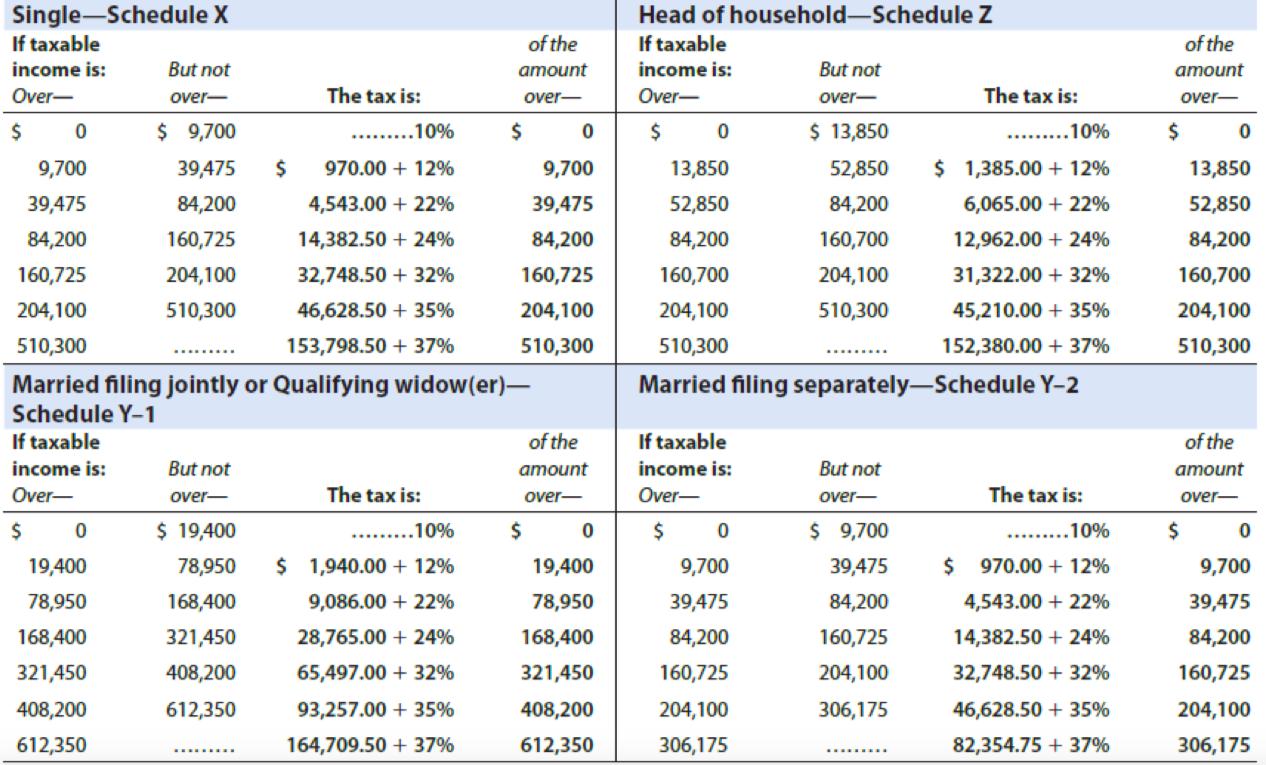

Click here to access the 2019 tax rate schedule. If required, round the tax liability the nearest dollar. When required, round the average rates to

Click here to access the 2019 tax rate schedule. If required, round the tax liability the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage (i.e. .67073 would be rounded to .6707 and entered as 67.07%).

a. Chandler, who files as a single taxpayer, has taxable income of $94,800. Tax liability: $ Marginal rate: 24 % Average rate: %

b. Lazare, who files as a head of household, has taxable income of $57,050. Tax liability: $ Marginal rate: 22 % Average rate:

Single-Schedule X But not over- If taxable income is: Over- $ income is: Over- $ $ 9,700 39,475 84,200 160,725 204,100 510,300 0 19,400 78,950 168,400 321,450 408,200 612,350 0 9,700 39,475 84,200 160,725 204,100 510,300 Married filing jointly or Qualifying widow(er)- Schedule Y-1 If taxable ******** But not over- $ 19,400 78,950 168,400 321,450 408,200 612,350 The tax is: $ .........10% 970.00 + 12% 4,543.00 +22% 14,382.50 +24% 32,748.50+32% 46,628.50+ 35% 153,798.50+ 37% The tax is: of the amount over- .........10% $ 1,940.00 + 12% 9,086.00 +22% 28,765.00 +24% 65,497.00+ 32% 93,257.00+ 35% 164,709.50 + 37% $ 0 9,700 39,475 84,200 160,725 204,100 510,300 of the amount over- $ 0 19,400 78,950 168,400 321,450 408,200 612,350 Head of household-Schedule Z If taxable income is: Over- $ 0 If taxable income is: Over- $ But not over- 0 9,700 39,475 84,200 160,725 204,100 306,175 $ 13,850 52,850 84,200 160,700 204,100 510,300 13,850 $ 1,385.00+ 12% 52,850 6,065.00 +22% 84,200 12,962.00 +24% 160,700 31,322.00 + 32% 204,100 45,210.00+ 35% 510,300 152,380.00 + 37% Married filing separately-Schedule Y-2 But not over- $ 9,700 39,475 84,200 160,725 204,100 306,175 The tax is: .........10% $ The tax is: .........10% 970.00 +12% 4,543.00 +22% 14,382.50 +24% 32,748.50 + 32% 46,628.50 +35% 82,354.75 + 37% of the amount over- $ 0 13,850 52,850 84,200 160,700 204,100 510,300 of the amount over- $ 0 9,700 39,475 84,200 160,725 204,100 306,175

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Taxable Income of Chandler 94800 Schedule X single taxpayer is applicable therefore Tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started