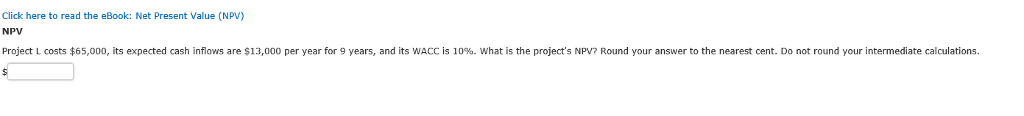

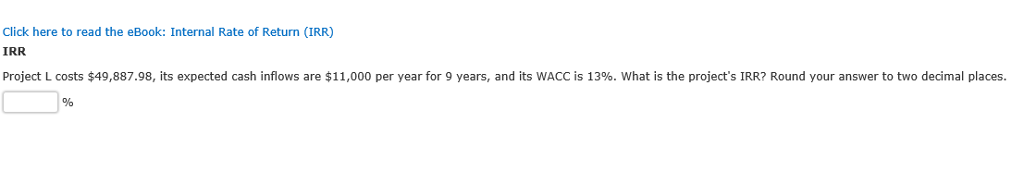

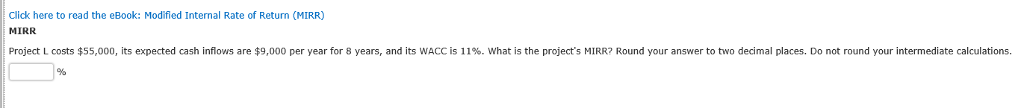

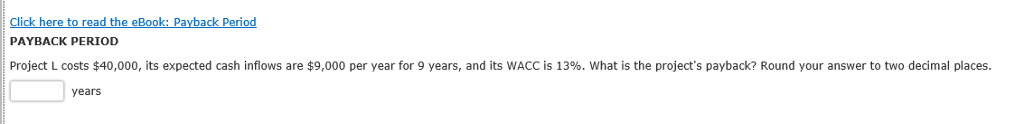

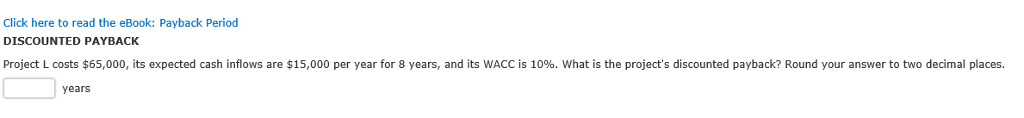

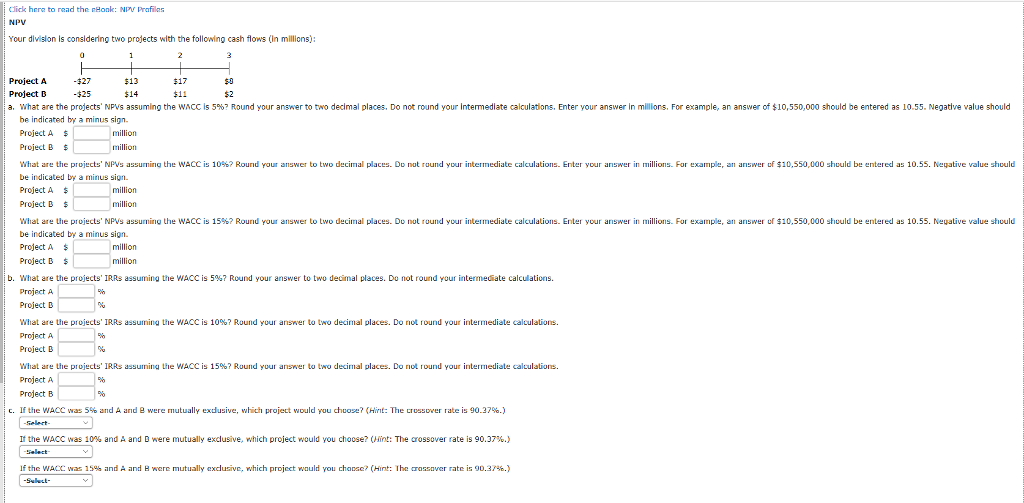

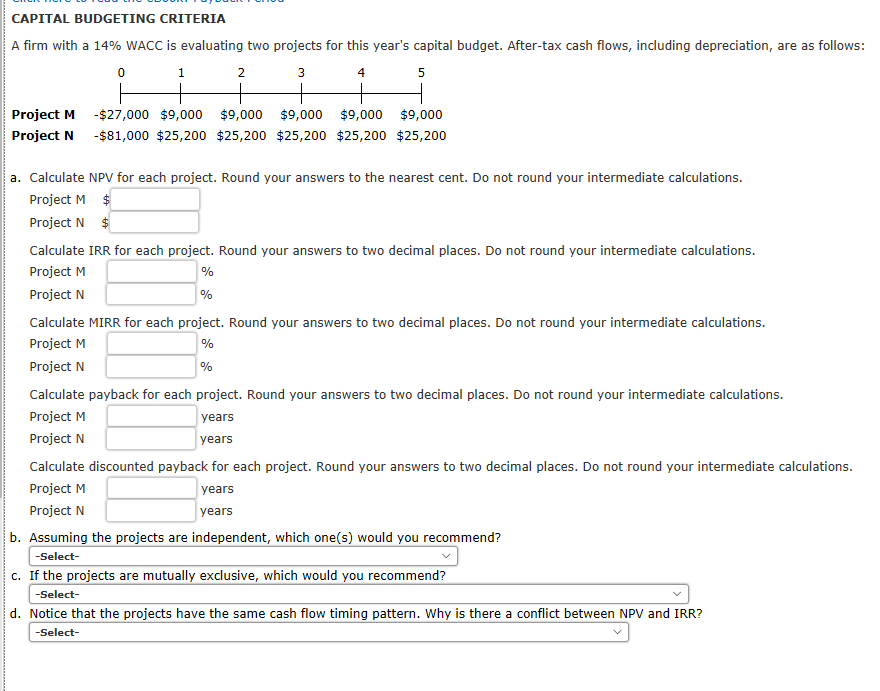

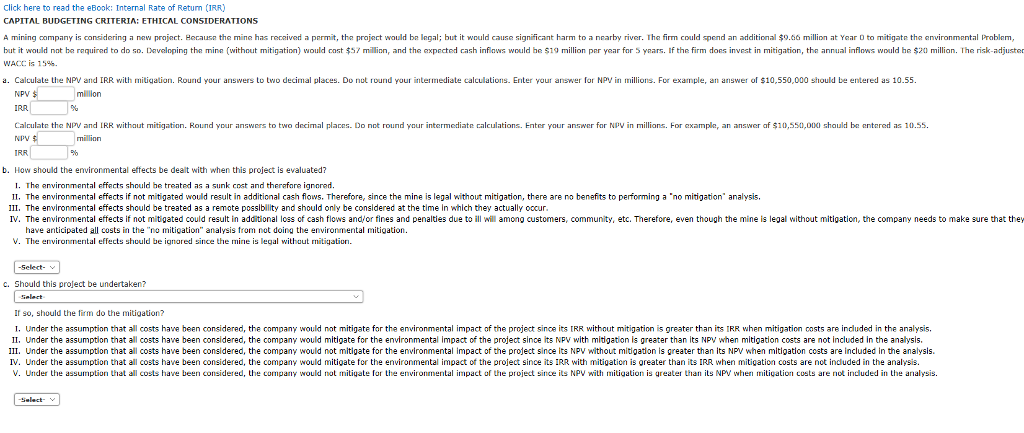

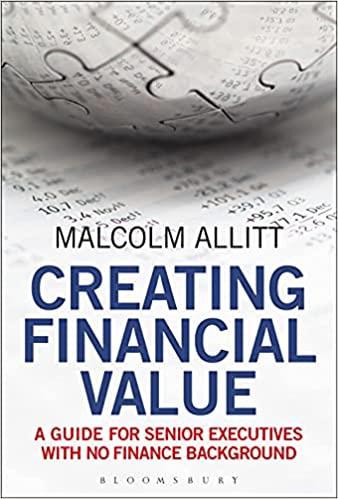

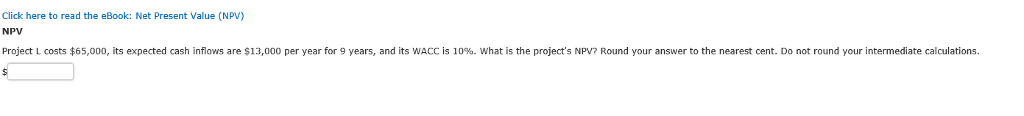

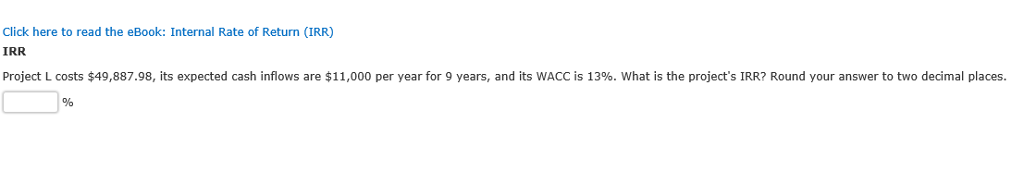

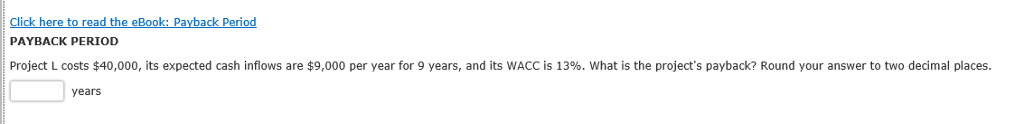

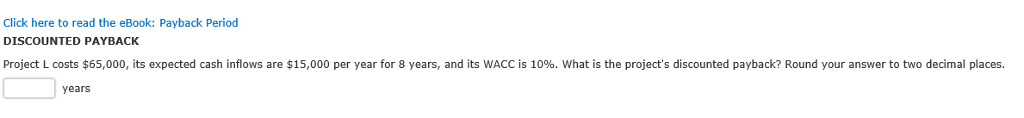

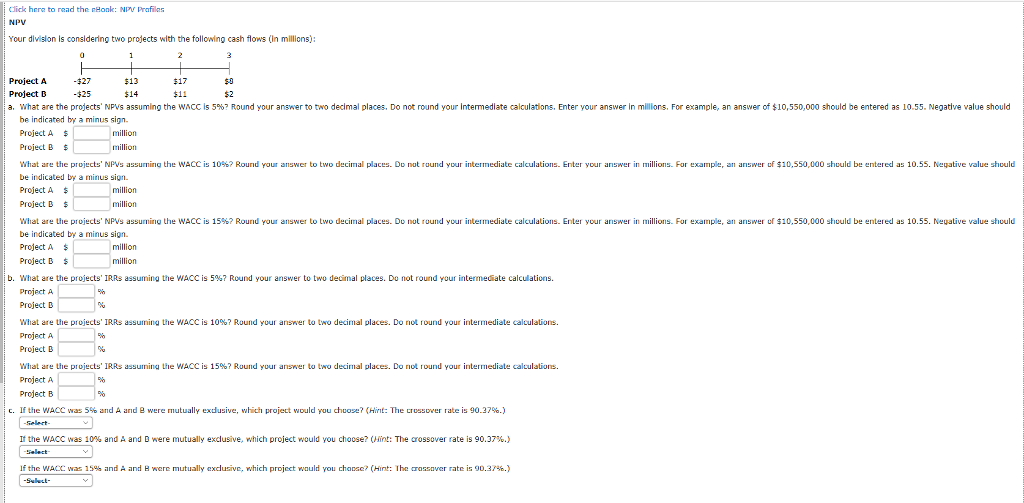

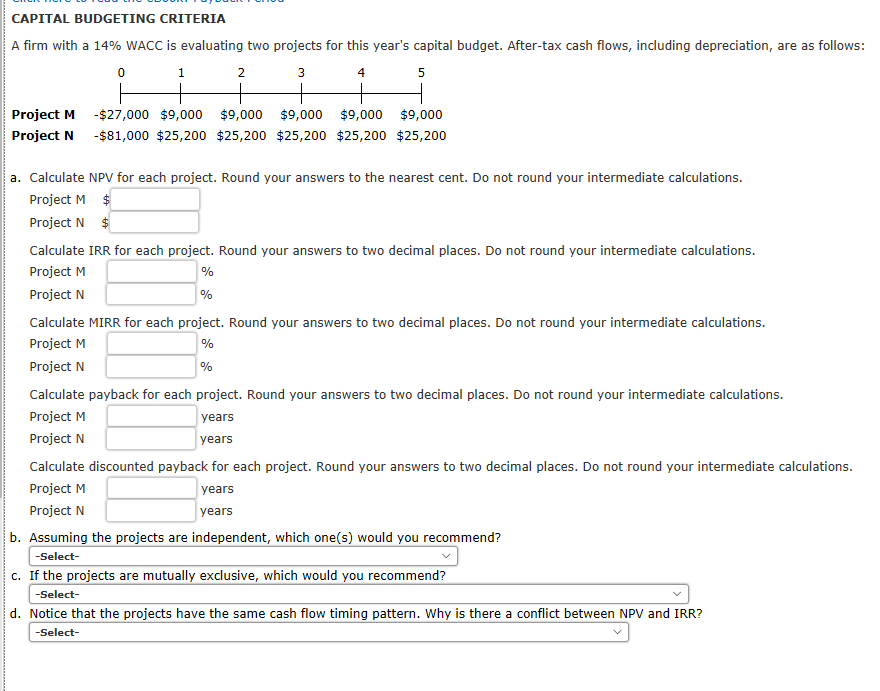

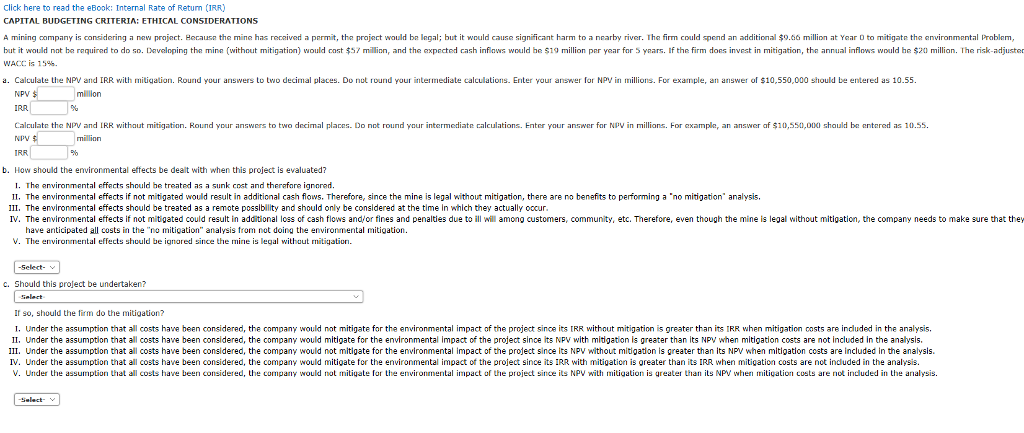

Click here to read the eBook: Net Present Value (NPV) NPV Project L costs $65,000, its expected cash inflows are $13,000 per year for 9 years, and its WACC is 10%. what is the project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Click here to read the eBook: Internal Rate of Return (IRR) IRR Project L costs $49,887.98, its expected cash inflows are $11,000 per year for 9 years, and its WAC is 13%, what is the pro et S R Rurnd your answer tot de a pla es. Click here to read the eBook: Modified Internal Rate of Return (MIRR) MIRR Project L costs $55,000, its expected cash inflows are $9,000 per year for 8 years, and its WACC is 11%, what is the project's MIRR7 Round your answer to two decimal places. Do not round your intermediate calculations. Click here to read the eBook: Payback Period PAYBACK PERIOD Project L costs $40,000, its expected cash inflows are $9,000 per year for 9 years, and its WACC is 13%. What is the project's payback? Round your answer to two decimal places. years Click here to read the eBook: Payback Period DISCOUNTED PAYBACK Project L costs $65,000, its expected cash inflows are $15,000 per year for 8 years, and its WACC is 10%, what is the project's discounted payback? Round your answer to two decimal places. years lick hera to read the nHonk: NPY Prafiles NPV Your division is considering two projects with the following cash flows (in millions): Project A Project D a. what are the pro ects' NP s assuming the WACC s 5%? Round your answer to two decimal places. Do not round your $13 $14 -$27 -$25 $11 $2 termed ate calculat ons. Enter your answer n m ons. For example, an answer of $10,550,000 should be entered as 10.55. Negat ve value should be indicated by a minus sign Project A $ Project B $ what are the pro ects NPvs assuming he WAC is 09 ? Round your arswer o two dec mal places Do not ruund your intermediate calculations Enter your ans er in millions for examp , an answer u 10,550 000 should be n ered as 10.55 Negative value should be indicated by a minus sign Project A Project B wh are uie plu ects PVs assuming the WAC is 15% ? Round your answer o decima places u nu rund your in ermediate calculations. En your answer in millions For exampe an answer u $10,550 000 shuuld be en el e as 10.55 Neuauve value shuuld be indicated by a minus sign Project A Project B What are the projects, IRAs assuming the WACC is 5%? Round your answer to two decimal places. D not round your intermediate calculations. Project A Project B what are ule projects' IRAs assuming ule WACC is 10%? Round you' answer to two decimal places. Do not lound your intermediate calculations. Project A Project B What are uie projects IRRs assuming the WACC is 15%? Round you' answer to two decimal places. Do not round your intermediate calculations. Project A Project B million million million million million b. c. If the WACC was S% and A ard e were mutually exdusive, which project would you choose? (Hint: The crossover rate is 90.37%.) the WACC was 10% and A and D were mutually exclusive, which project would you choose? (Hint: The crossover rate is 90.37%.) if the WACC was 15% and A and H were mutually exclusive, which project would you choose? (Hint: I he aassaver rate is gD.37%.) CAPITAL BUDGETING CRITERIA A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 4 Project M -$27,000 $9,000 $9,000 $9,000 $9,000 $9,000 Project N -$81,000 $25,200 $25,200 $25,200 $25,200 $25,200 a. Calculate NPV for each project. Round your answers to the nearest cent. Do not round your intermediate calculations. Project M Project N Calculate IRR for each project. Round your answers to two decimal places. Do not round your intermediate calculations Project M Project N Calculate MIRR for each project. Round your answers to two decimal places. Do not round your intermediate calculations. Project M Project N Calculate payback for each project. Round your answers to two decimal places. Do not round your intermediate calculations Project M Project N Calculate discounted payback for each project. Round your answers to two decimal places. Do not round your intermediate calculations. Project M Project N years years years years b. Assuming the projects are independent, which one(s) would you recommend? c. If the projects are mutually exclusive, which would you recommend? d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR? Click here to read the eBook: Internal Rate of Return (IRR) CAPITAL BUDGETING CRITERIA: ETHICAL CONSIDERATIONS A mining companyis cons dering a new pra act. Hecause he m ne has recalved a per t, he pra ec would bn nga bu it would cause significant harm to a nearby rrver. hc firm could spend an additional9.66 million at Year D o m gate he ronmn ntal roblem, but it wold nat be required to do so. Daveloping the mine (without mitigation) would cost $57 millinn, and the axpected cash infiows would he $19 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would he $20 millian. The risk-adjuster WACC is 15%. a. Calculate the NPV and IRR with mitigation. Rournd your answers to two decimal places. Do not round your intermediate calculations. Enter your answer for NPVin millions. For example, an answer of $10,550,000 should be entered as 10.55 million NPV IRR Calculate th N NPV IRR and I R wit au mit gatan. Round your answers to two decr a p aces. Do no round our intermediate calculation million Enter your answer ar v n millions. For examp e an answer a $10,550,000 shaul be entered as 10.55 b. How should the environmental effects be dealt with when this project is evaluated? I. The environmental effects should he treated as a sunk cost and therefare ignored. 1. The environmental effects if not mit gated would result in additional cash flows. Therefore, since the mine is legal hout mit gation, there are no benefits to peorming a no mit gation analys II. The environmental effects should be treated as a remote possiblity and should only be consldered at the time in which they actually oocur IV. The environmental effects if not mitigated could result in additional loss of cash flows and/or fines and penalties due to ill wil among customers, community, etc. Therefore, even though the mine is legal without mitigation, the company needs to make sure that they have anticipated all costs in the "no mitigation" analysis trom not doing the environmental mitigation V. Thnvironmental effects should be ignored since the mine is legal without mtiqation. c. Should this project be undertaken? If so, should the firm do the mitigation? I. Under the assumption that all costs have been considered, the company would not mitigate for the environmental impact of the project since its IRR without mitigation is greater than its RR when mitigation costs are indluded in the analysis. . Under the assumption that all costs have been considered, the company would mitigate for the environmental mpact of the pro ect since its NPV with midgat on s greater than its NPV when mit gation costs are not included in the ana sis. II. Under the assumption that all costs have been considered, the company would not mitigate for the environmental impact of the project since its NPV without mitigation is greater than its NPV when mitigation costs are included in the analysis IV. Under the assumption that all costs have been considered, the company would mitigate for the environmental impact of the project since its IRR with mitigation is oreater than its IRR when mitigation costs are not indluded in the analysis. v under he assumption hat all cos s have been considered, he company would not mitiuate r he envr onrnental impac of the pro ect since its N y 1 h mitigation is greater han its NP when mitiution custs are not rduded in he analysis