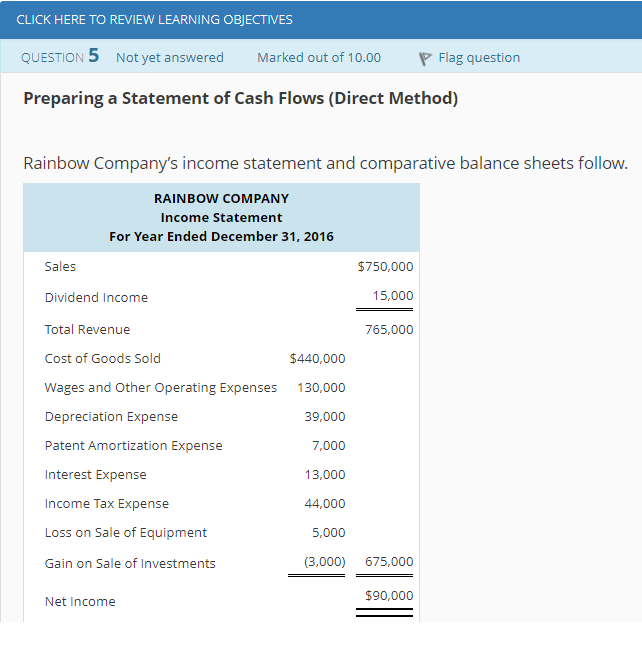

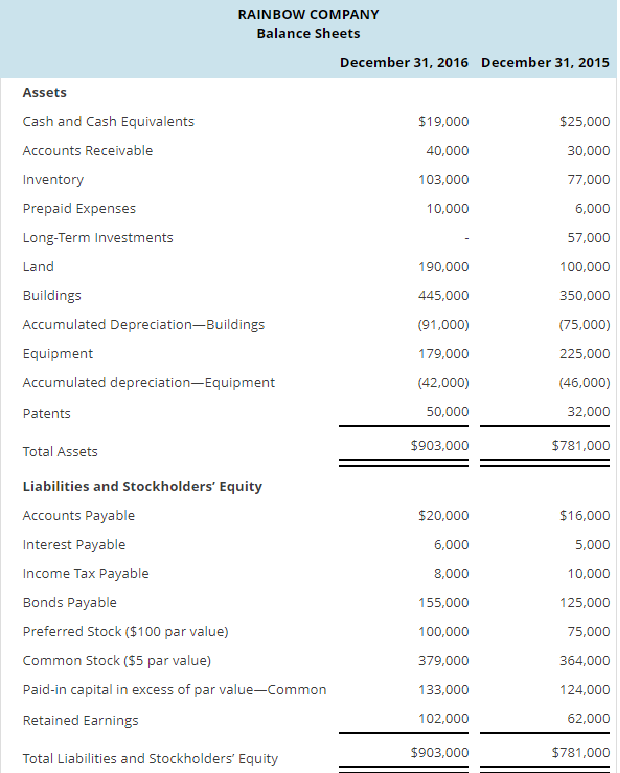

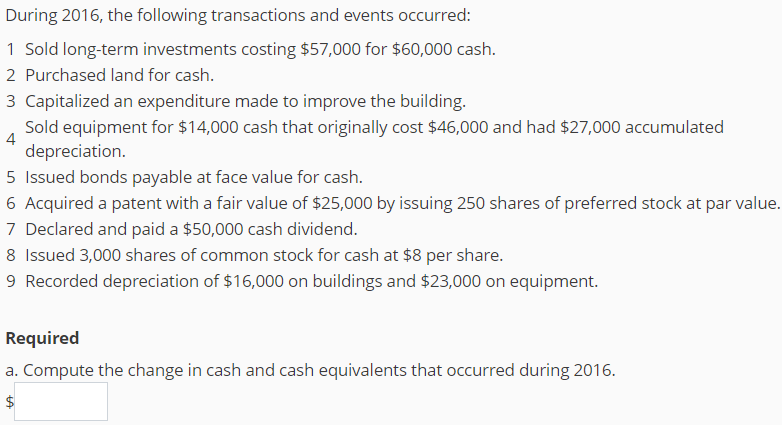

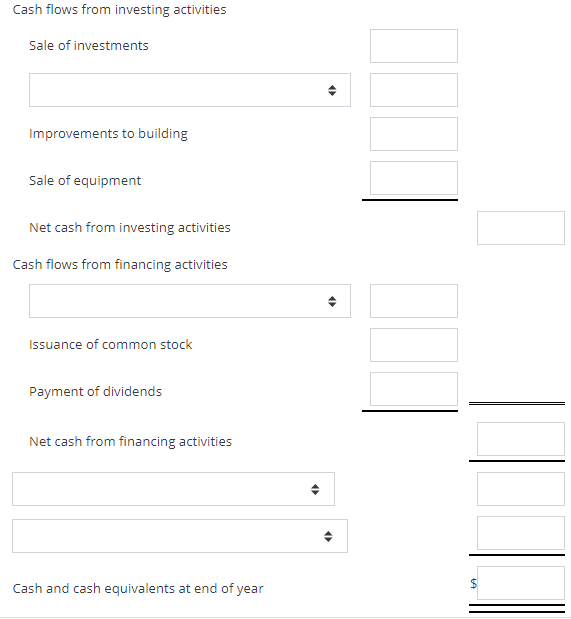

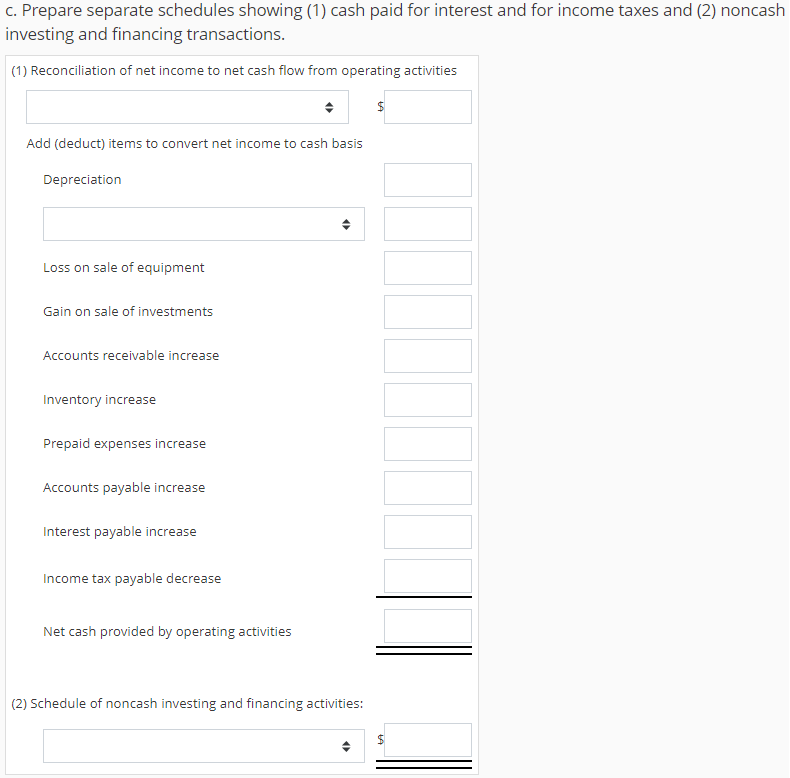

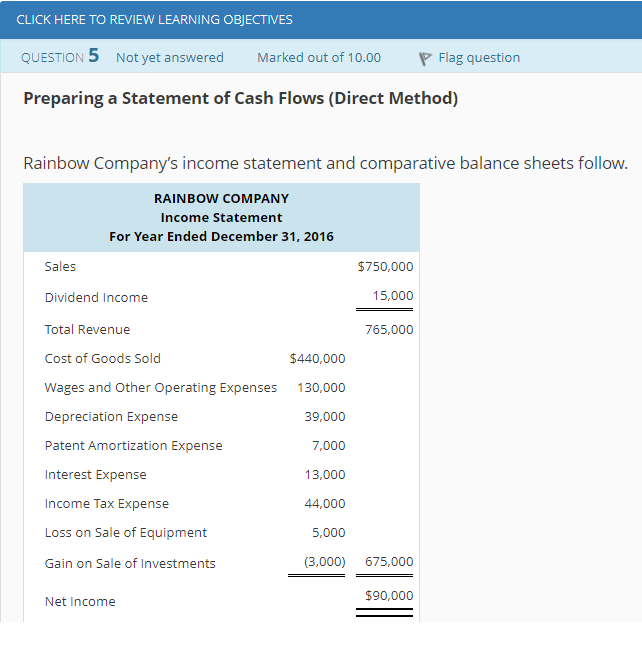

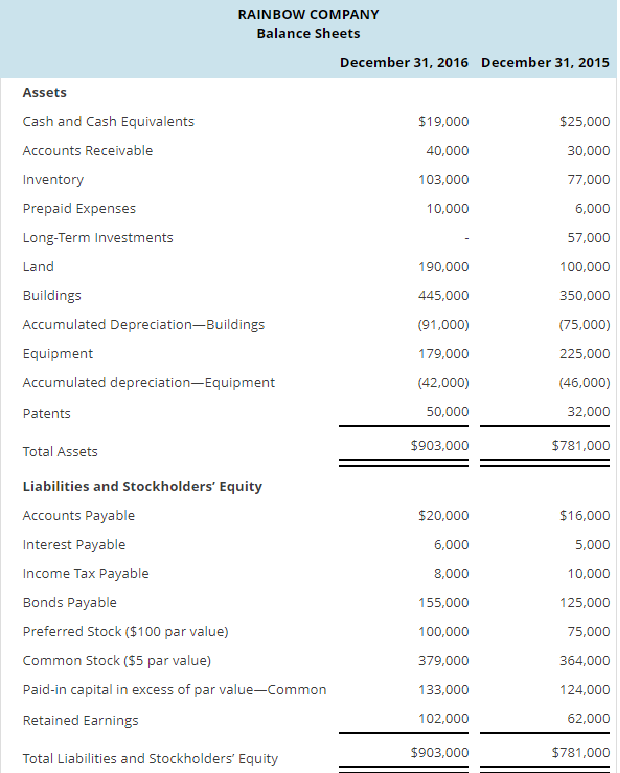

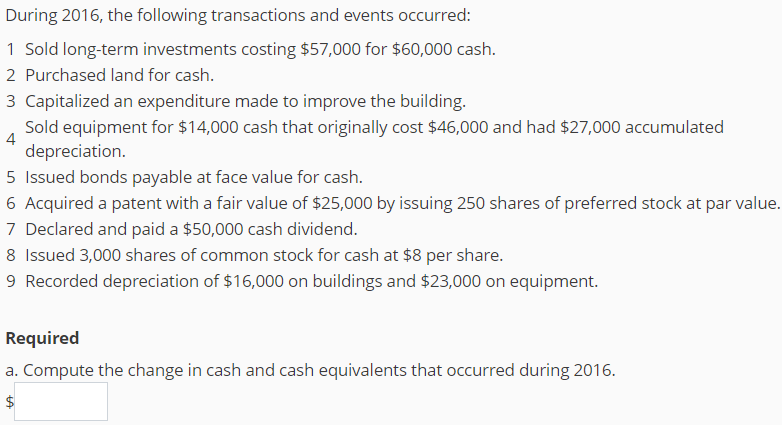

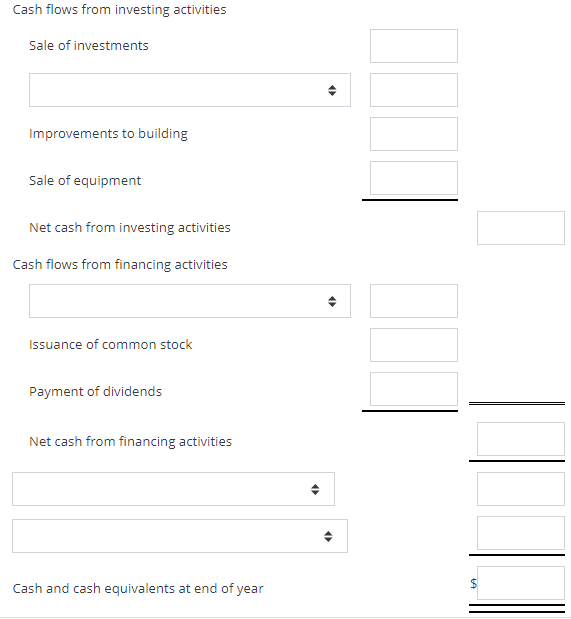

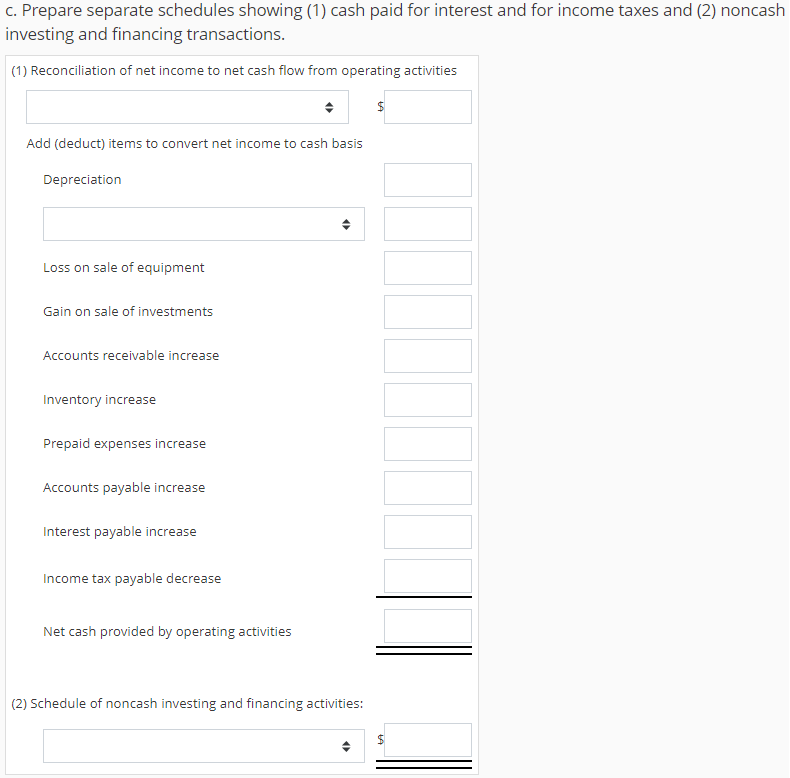

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 5 Not yet answered Marked out of 10.00 P Flag question Preparing a Statement of Cash Flows (Direct Method) Rainbow Company's income statement and comparative balance sheets follow RAINBOW COMPANY Income Statement For Year Ended December 31, 2016 $750,000 15,000 765,000 Sales Dividend Income Total Revenue Cost of Goods Sold Wages and Other Operating Expenses Depreciation Expense Patent Amortization Expense Interest Expense Income Tax Expense Loss on Sale of Equipment Gain on Sale of Investments $440,000 130,000 39,000 7,000 13,000 44,000 5,000 (3,000 675,000 $90,000 Net Income RAINBoW cOMPANY Balance Sheets December 31, 2016 December 31, 2015 Assets Cash and Cash Equivalents Accounts Receivable Inventory Prepaid Expenses Long-Term Investments Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated depreciation-Equipment Patents $25,000 30,000 77,000 6,000 57,000 100,000 350,000 (75,000) 225,000 (46,000) 32,000 $781,000 $19,000 40,000 103,000 10,000 190,000 445,000 (91,000) 179,000 (42,000) 50,000 $903,000 Total Assets Liabilities and Stockholders' Equity Accounts Payable Interest Payable Income Tax Payable Bonds Payable Preferred Stock ($100 par value) Common Stock ($5 par value) Paid-in capital in excess of par value-Common Retained Earnings Total Liabilities and Stockholders' Equity $20,000 6,000 8,000 155,000 100,000 379,000 133,000 102,000 $903,000 $16,000 5,000 10,000 125,000 75,000 364,000 124,000 62,000 $781,000 During 2016, the following transactions and events occurred: 1 Sold long-term investments costing $57,000 for $60,000 cash. 2 Purchased land for cash Capitalized an expenditure made to improve the building Sold equipment for $14,000 cash that originally cost $46,000 and had $27,000 accumulated 4 depreciation 5 Issued bonds payable at face value for cash. 6 Acquired a patent with a fair value of $25,000 by issuing 250 shares of preferred stock at par value. 7 Declared and paid a $50,000 cash dividend. 8 Issued 3,000 shares of common stock for cash at $8 per share. 9 Recorded depreciation of $16,000 on buildings and $23,000 on equipment. Required a. Compute the change in cash and cash equivalents that occurred during 2016. Cash flows from investing activities Sale of investments Improvements to building Sale of equipment Nei: GIsti rorn invesiin.xiiviiimi Cash flows from financing activities Issuance of common stock Payment of d from financing activities Cash and cash equivalents at end of year c. Prepare separate schedules showing (1) cash paid for interest and for income taxes and (2) noncaslh investing and financing transactions (1) Reconciliation of net income to net cash flow from operating activities Add (deduct) items to convert net income to cash basis Depreciation Loss on sale of equipment Gain on sale of investments Accounts receivable increase Inventory increase Prepaid expenses increase Accounts payable increase Interest payable increase Income tax payable decrease Net cash provided by operating activities (2) Schedule of noncash investing and financing activities