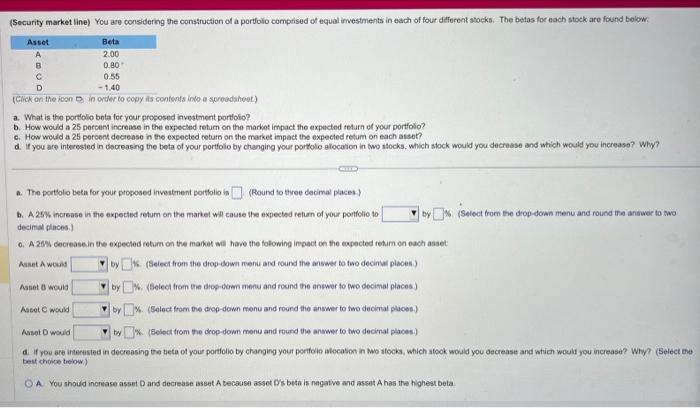

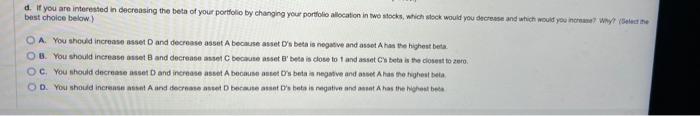

(Click on the icon D in order to copy is contonts info a spreadaheot.) a. What is the portiolo bota for your proposed investment portoloio? b. How would a 25 percunt increase in the expected retum on the market impact the expected teturn of your portfolo? c. How would a 25 percont decrease in the expected return on the market impact the expected retum on each assot? d. If you are interested in decreasing the beta of your portfolo by changing your portolio alocaion in two stocks, which stock would you decrase and which would you increase? Why? a. The portiolo beta for your proposed investment porthitio is (Round to three decimal paces) decinal places.) 0. A 256 decreasein the expected return on the market wil hare the folowing ingact on the expected retum on each asset: Asset A woul by 5. (Seicot from the drop-down menu and round the answer to two decimat places.) Asset B wevla by 5. (Select from the diop-dows menu and round the answor to two decisial places) Aaset C mould by 4. (Select from the drep-down menu and rourd the answer to two decimal places) Asset D would by . (Select from the drop-down menu and round the anwwer to the decimal places) d. If you are interested in decreasing the beta of your portfolio by changing yout portolo atocasion in wo stocks, which stook would you decrease and which would you increase? Why? (Se test chickice theiow.) A. You shoud increase asset D and decrease asset A because asset D s beta is negatie and asset A has the highert beta 1. If you are interested in decreasing the beta of your portfolio by changing your portfolo allocation in two alocks, wtich slock would you ancresse and which mould yey inchane? Whyt velec me gest choice below ) A. You sheuld increase asset D and decrease asset A beckuse asset D s beta is negasive and assot A has the highent beta. 3. You should increase asset B and decrease asset C becasue asset B bete is close to 1 and asset CC beta is the closest to zero. C. You should decrease asset D and incrnase asset A becanse anet D s beta is negatve and asee A has the highest beta