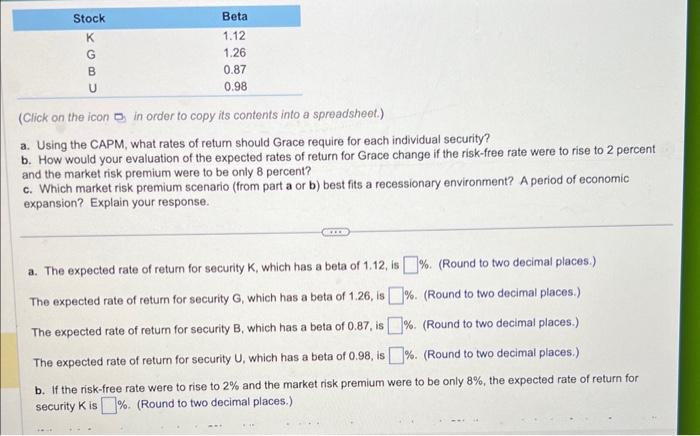

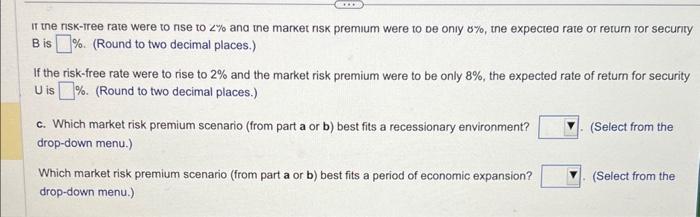

(Click on the icon p in order to copy its contents into a spreadsheet.) a. Using the CAPM, what rates of return should Grace require for each individual security? b. How would your evaluation of the expected rates of return for Grace change if the risk-free rate were to rise to 2 percent and the market risk premium were to be only 8 percent? c. Which market risk premium scenario (from part a or b) best fits a recessionary environment? A period of economic expansion? Explain your response. a. The expected rate of return for security K, which has a beta of 1.12 , is \%. (Round to two decimal places.) The expected rate of return for security G, which has a beta of 1.26, is \%. (Round to two decimal places.) The expected rate of retum for security B, which has a beta of 0.87 , is \%. (Round to two decimal places.) The expected rate of retum for security U, which has a beta of 0.98 , is \%. (Round to two decimal places.) b. If the risk-free rate were to rise to 2% and the market risk premium were to be only 8%, the expected rate of return for security K is %. (Round to two decimal places.) If the nsk-tree rate were to nse to % and the market nsk premium were to ve oniy %, the expected rate or return ror security B is %. (Round to two decimal places.) If the risk-free rate were to rise to 2% and the market risk premium were to be only 8%, the expected rate of retum for security U is \%. (Round to two decimal places.) c. Which market risk premium scenario (from part a or b) best fits a recessionary environment? (Select from the drop-down menu.) Which market risk premium scenario (from part a or b) best fits a period of economic expansion? (Select from the drop-down menu.) (Click on the icon p in order to copy its contents into a spreadsheet.) a. Using the CAPM, what rates of return should Grace require for each individual security? b. How would your evaluation of the expected rates of return for Grace change if the risk-free rate were to rise to 2 percent and the market risk premium were to be only 8 percent? c. Which market risk premium scenario (from part a or b) best fits a recessionary environment? A period of economic expansion? Explain your response. a. The expected rate of return for security K, which has a beta of 1.12 , is \%. (Round to two decimal places.) The expected rate of return for security G, which has a beta of 1.26, is \%. (Round to two decimal places.) The expected rate of retum for security B, which has a beta of 0.87 , is \%. (Round to two decimal places.) The expected rate of retum for security U, which has a beta of 0.98 , is \%. (Round to two decimal places.) b. If the risk-free rate were to rise to 2% and the market risk premium were to be only 8%, the expected rate of return for security K is %. (Round to two decimal places.) If the nsk-tree rate were to nse to % and the market nsk premium were to ve oniy %, the expected rate or return ror security B is %. (Round to two decimal places.) If the risk-free rate were to rise to 2% and the market risk premium were to be only 8%, the expected rate of retum for security U is \%. (Round to two decimal places.) c. Which market risk premium scenario (from part a or b) best fits a recessionary environment? (Select from the drop-down menu.) Which market risk premium scenario (from part a or b) best fits a period of economic expansion? (Select from the drop-down menu.)