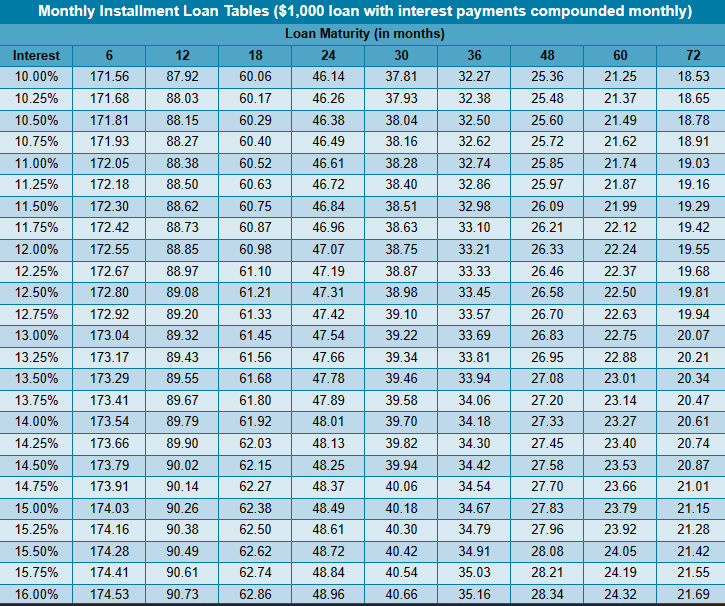

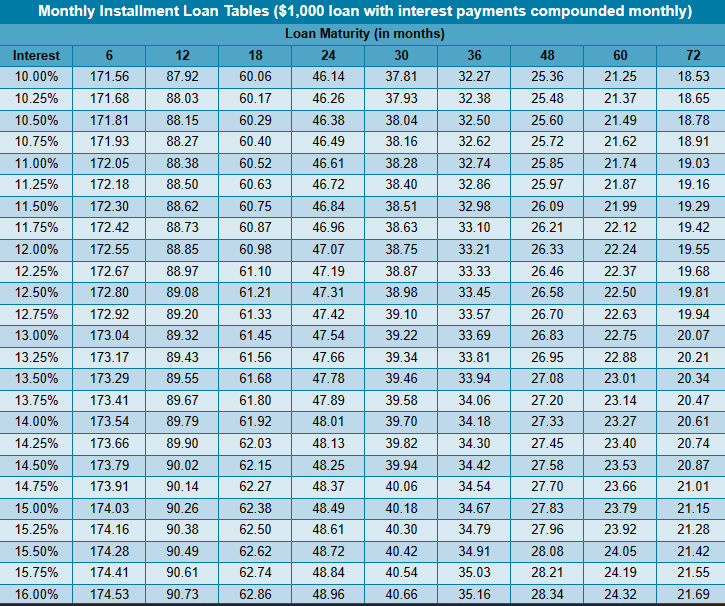

Click on the table icon to view the Monthly Installment Loan Payment Factor (MILPF) table: 1. The monthly payment for a bank loan assuming one-year repayment period and 14.75% interest is $ (Round to the nearest cent.) The total cost for a bank loan assuming one-year repayment period and 14.75% interest is $ (Round to the nearest cent.) f the store uses the add-on method of interest calculation, the monthly payment with a one-year repayment period and 12.75% interest is $ (Round to the nearest cent.) f the store uses the add-on method of interest calculation, the total cost with a one-year repayment period and 12.75% interest is $ (Round to the nearest cent.) Explain why the bank payment and total cost are lower even though the stated interest rate is higher. (Select the best choice below.) expense declines. Therefore, your principal payment amount increases because you're paying interest only on the unpaid balance. because it assumes that you have the entire loan balance outstanding for the entire period; rather than a decreasing balance, as is taken into account by the bank loan. Monthly Installment Loan Tables (\$1,000 loan with interest payments compounded monthly) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline Interest & 6 & 12 & 18 & 24 & 30 & 36 & 48 & 60 & 72 \\ \hline 10.00% & 171.56 & 87.92 & 60.06 & 46.14 & 37.81 & 32.27 & 25.36 & 21.25 & 18.53 \\ \hline 10.25% & 171.68 & 88.03 & 60.17 & 46.26 & 37.93 & 32.38 & 25.48 & 21.37 & 18.65 \\ \hline 10.50% & 171.81 & 88.15 & 60.29 & 46.38 & 38.04 & 32.50 & 25.60 & 21.49 & 18.78 \\ \hline 10.75% & 171.93 & 88.27 & 60.40 & 46.49 & 38.16 & 32.62 & 25.72 & 21.62 & 18.91 \\ \hline 11.00% & 172.05 & 88.38 & 60.52 & 46.61 & 38.28 & 32.74 & 25.85 & 21.74 & 19.03 \\ \hline 11.25% & 172.18 & 88.50 & 60.63 & 46.72 & 38.40 & 32.86 & 25.97 & 21.87 & 19.16 \\ \hline 11.50% & 172.30 & 88.62 & 60.75 & 46.84 & 38.51 & 32.98 & 26.09 & 21.99 & 19.29 \\ \hline 11.75% & 172.42 & 88.73 & 60.87 & 46.96 & 38.63 & 33.10 & 26.21 & 22.12 & 19.42 \\ \hline 12.00% & 172.55 & 88.85 & 60.98 & 47.07 & 38.75 & 33.21 & 26.33 & 22.24 & 19.55 \\ \hline 12.25% & 172.67 & 88.97 & 61.10 & 47.19 & 38.87 & 33.33 & 26.46 & 22.37 & 19.68 \\ \hline 12.50% & 172.80 & 89.08 & 61.21 & 47.31 & 38.98 & 33.45 & 26.58 & 22.50 & 19.81 \\ \hline 12.75% & 172.92 & 89.20 & 61.33 & 47.42 & 39.10 & 33.57 & 26.70 & 22.63 & 19.94 \\ \hline 13.00% & 173.04 & 89.32 & 61.45 & 47.54 & 39.22 & 33.69 & 26.83 & 22.75 & 20.07 \\ \hline 13.25% & 173.17 & 89.43 & 61.56 & 47.66 & 39.34 & 33.81 & 26.95 & 22.88 & 20.21 \\ \hline 13.50% & 173.29 & 89.55 & 61.68 & 47.78 & 39.46 & 33.94 & 27.08 & 23.01 & 20.34 \\ \hline 13.75% & 173.41 & 89.67 & 61.80 & 47.89 & 39.58 & 34.06 & 27.20 & 23.14 & 20.47 \\ \hline 14.00% & 173.54 & 89.79 & 61.92 & 48.01 & 39.70 & 34.18 & 27.33 & 23.27 & 20.61 \\ \hline 14.25% & 173.66 & 89.90 & 62.03 & 48.13 & 39.82 & 34.30 & 27.45 & 23.40 & 20.74 \\ \hline 14.50% & 173.79 & 90.02 & 62.15 & 48.25 & 39.94 & 34.42 & 27.58 & 23.53 & 20.87 \\ \hline 14.75% & 173.91 & 90.14 & 62.27 & 48.37 & 40.06 & 34.54 & 27.70 & 23.66 & 21.01 \\ \hline 15.00% & 174.03 & 90.26 & 62.38 & 48.49 & 40.18 & 34.67 & 27.83 & 23.79 & 21.15 \\ \hline 15.25% & 174.16 & 90.38 & 62.50 & 48.61 & 40.30 & 34.79 & 27.96 & 23.92 & 21.28 \\ \hline 15.50% & 174.28 & 90.49 & 62.62 & 48.72 & 40.42 & 34.91 & 28.08 & 24.05 & 21.42 \\ \hline 15.75% & 174.41 & 90.61 & 62.74 & 48.84 & 40.54 & 35.03 & 28.21 & 24.19 & 21.55 \\ \hline 16.00% & 174.53 & 90.73 & 62.86 & 48.96 & 40.66 & 35.16 & 28.34 & 24.32 & 21.69 \\ \hline \end{tabular}