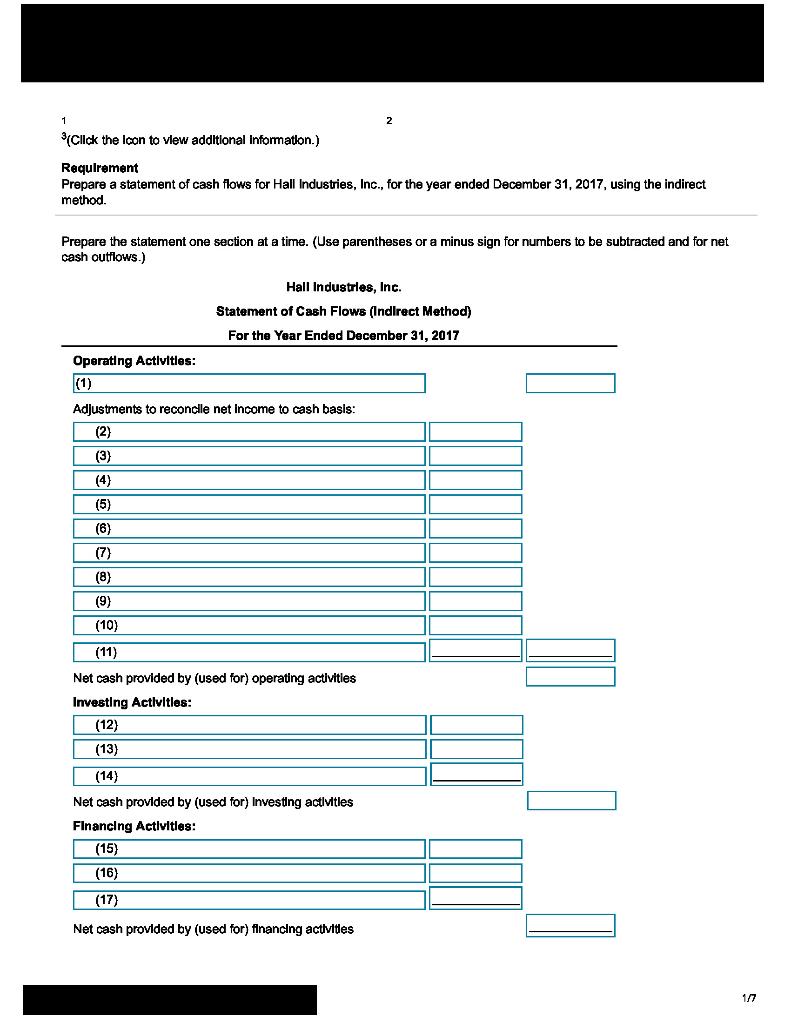

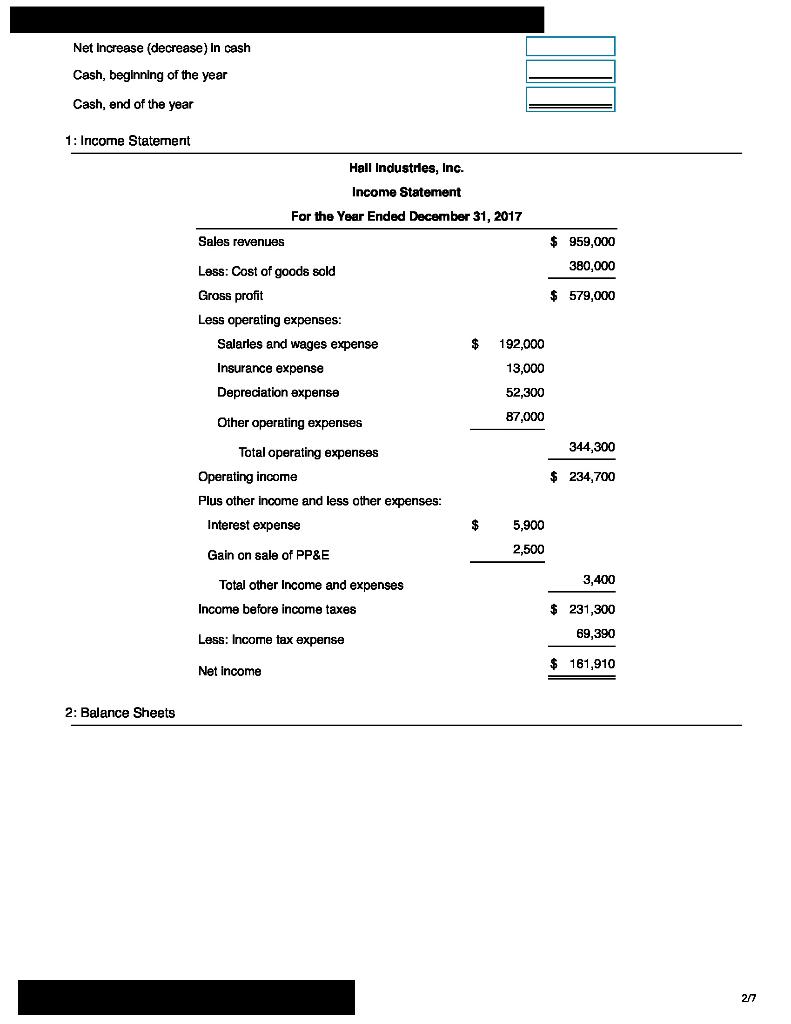

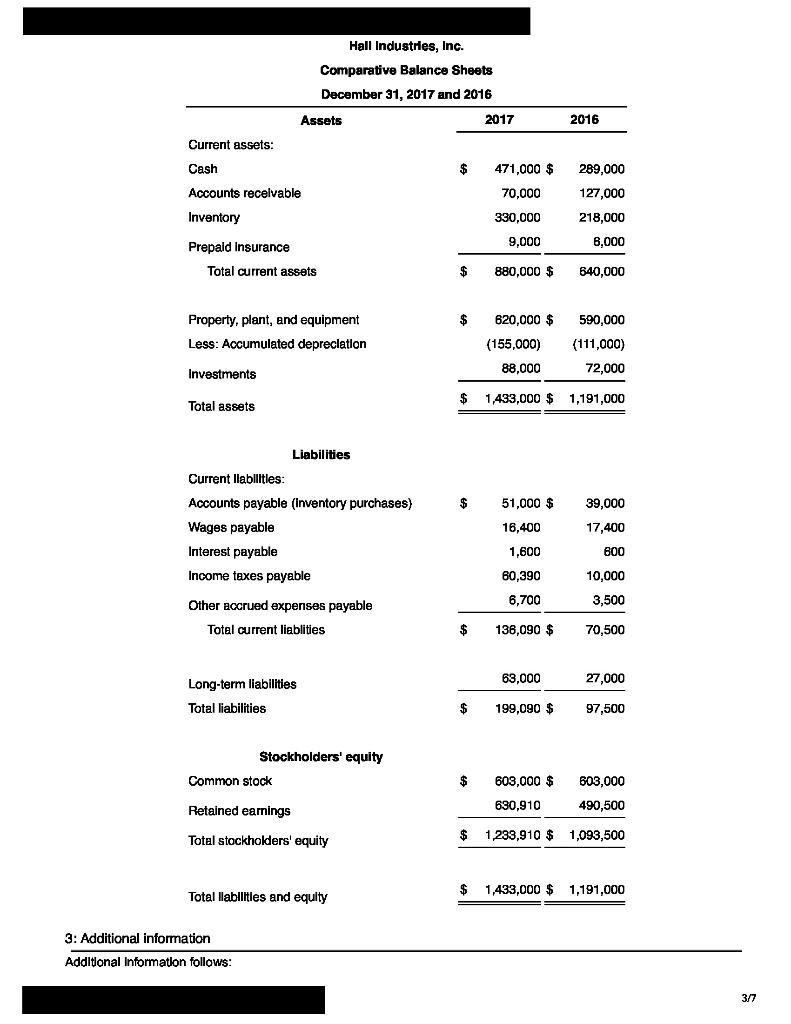

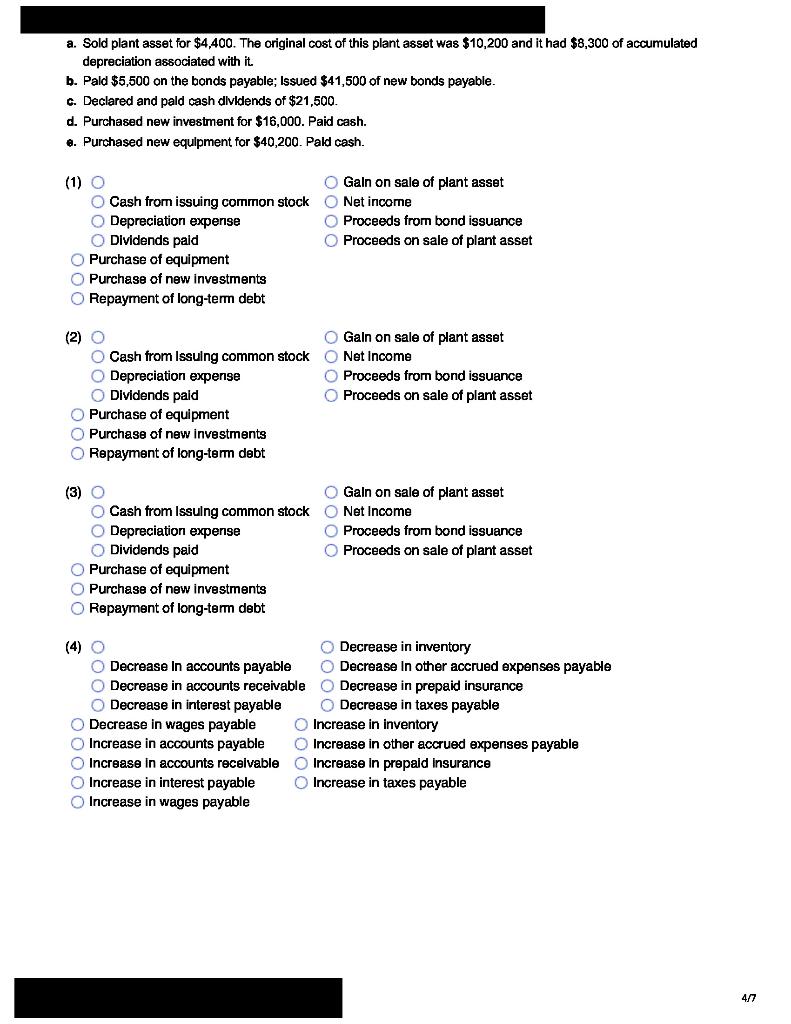

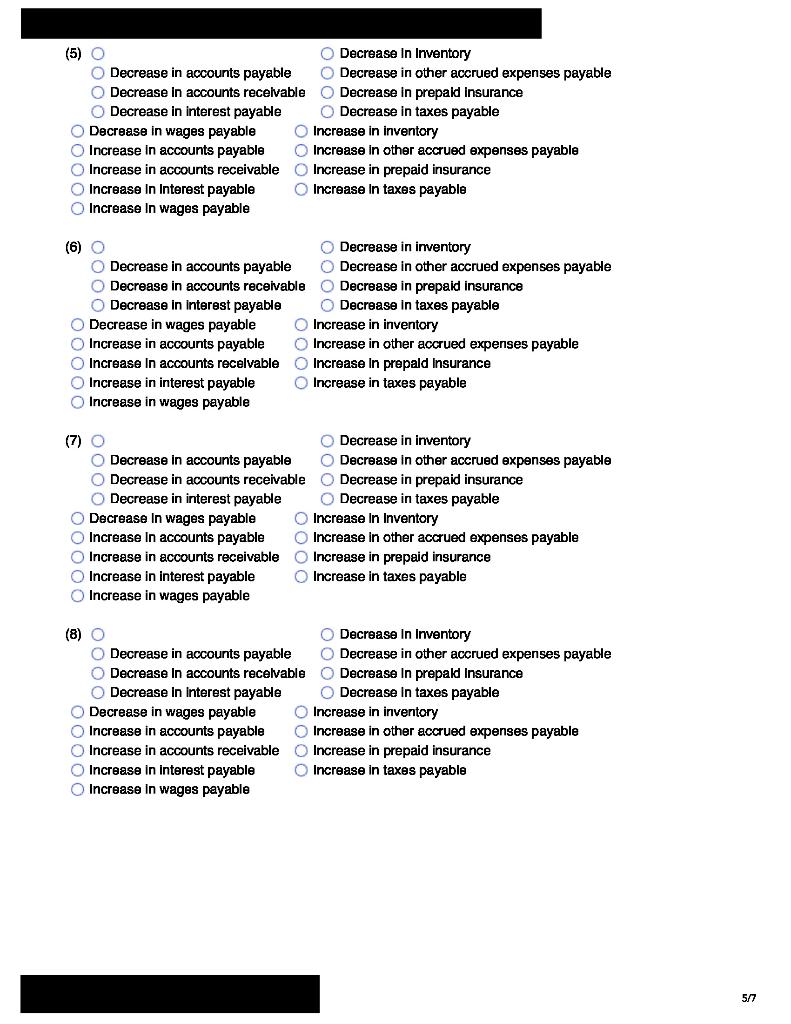

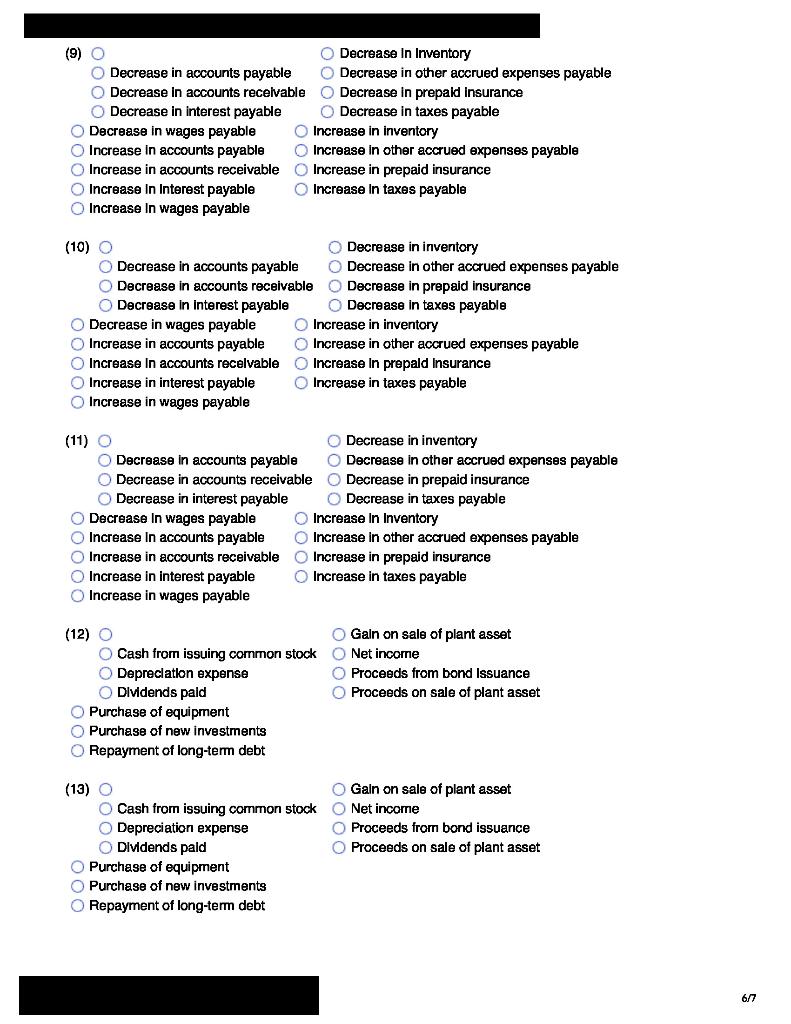

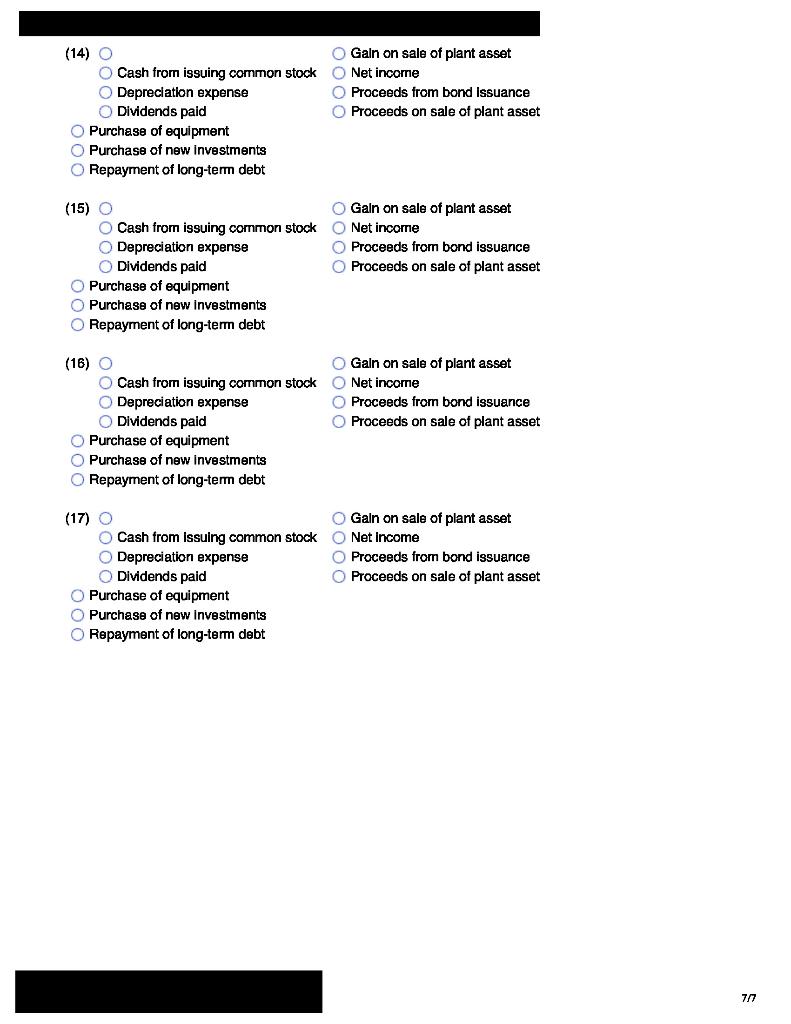

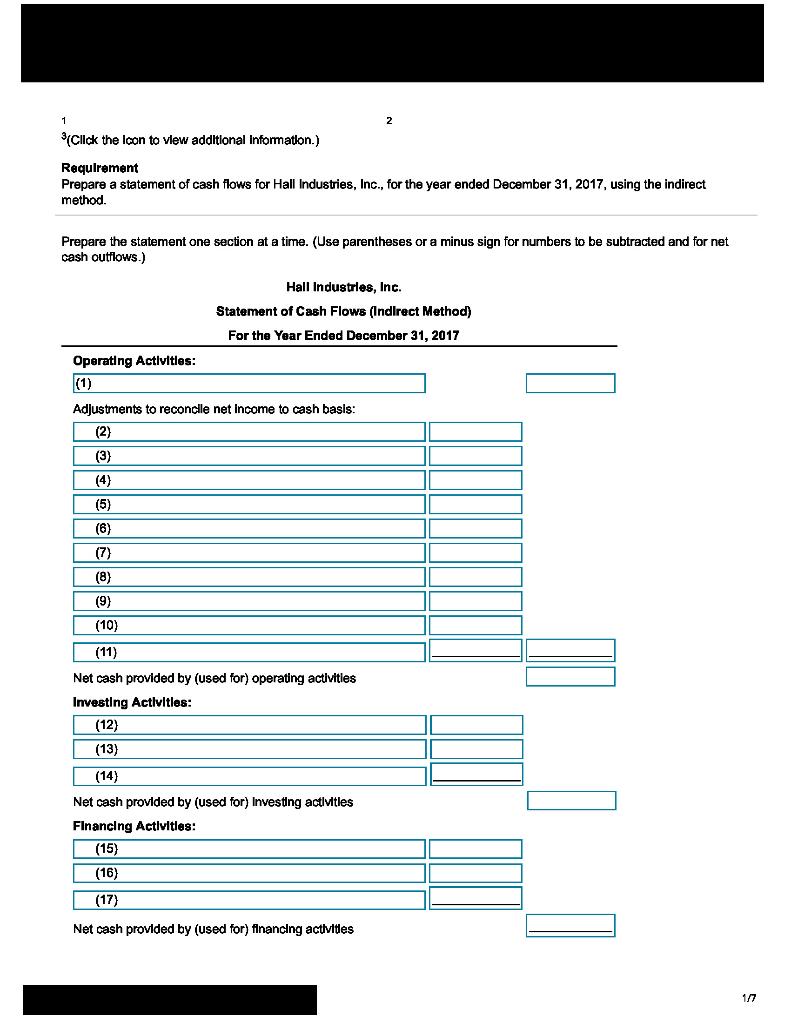

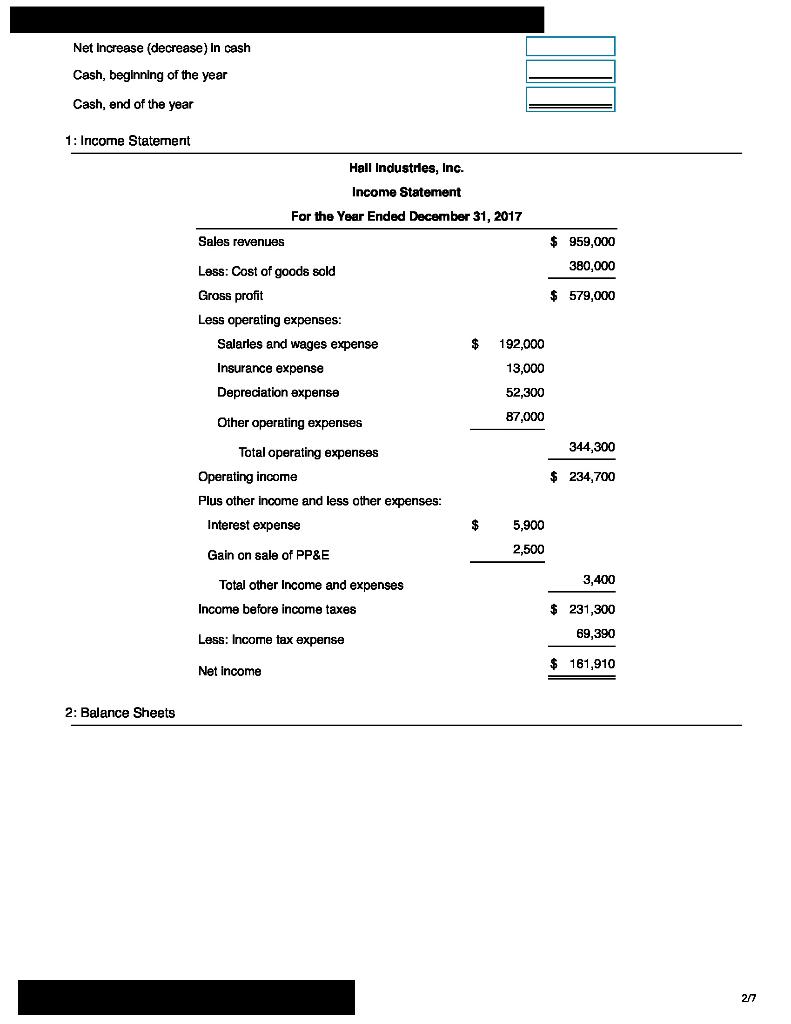

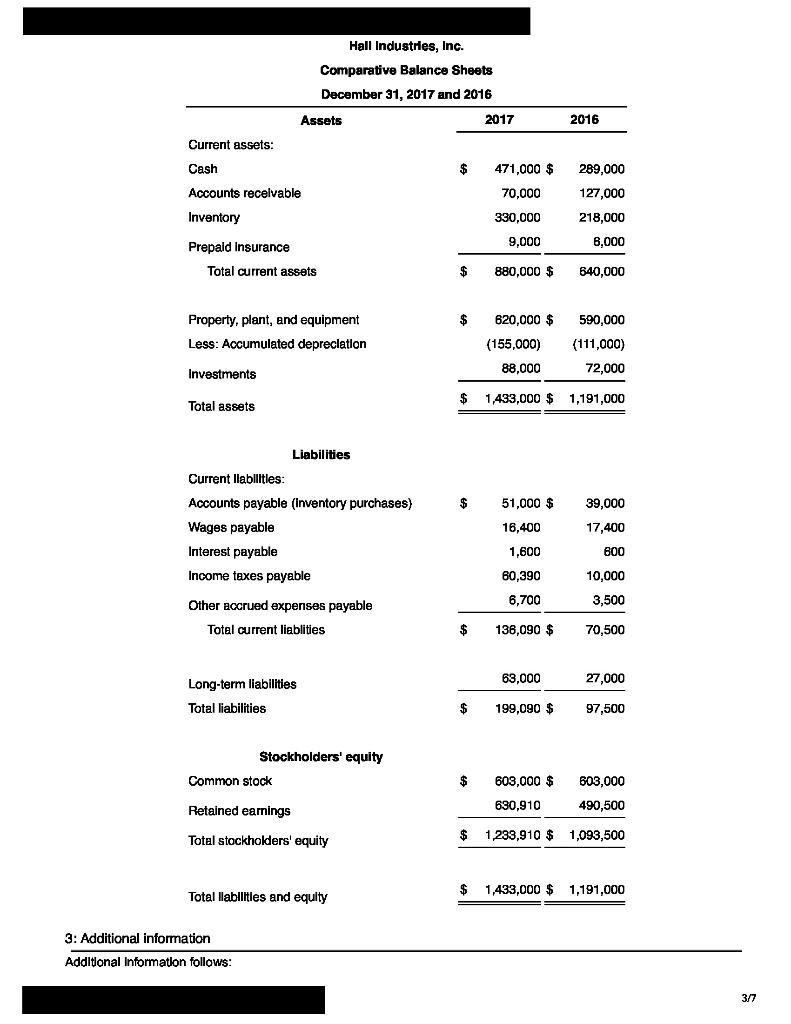

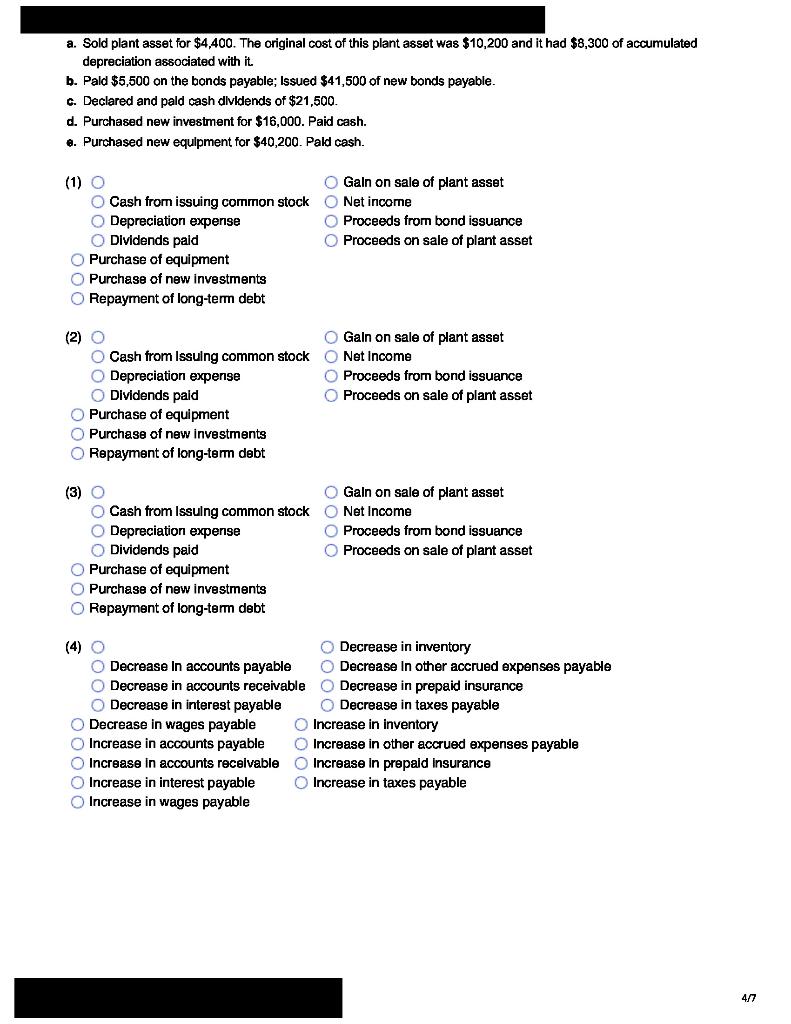

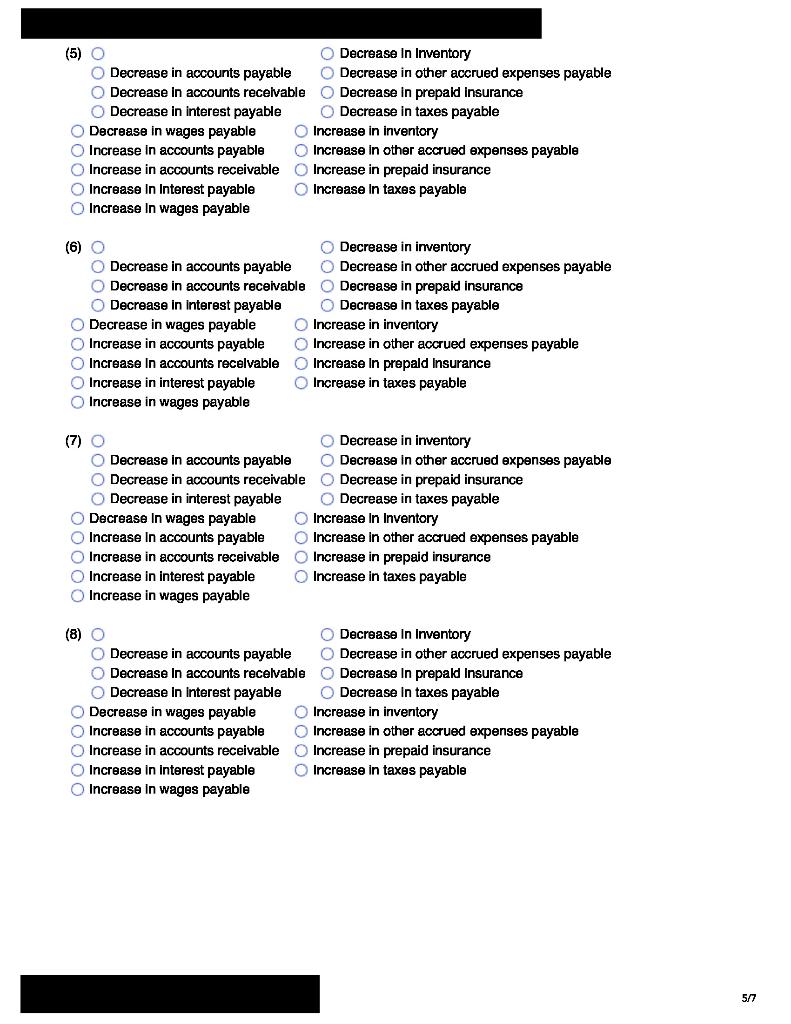

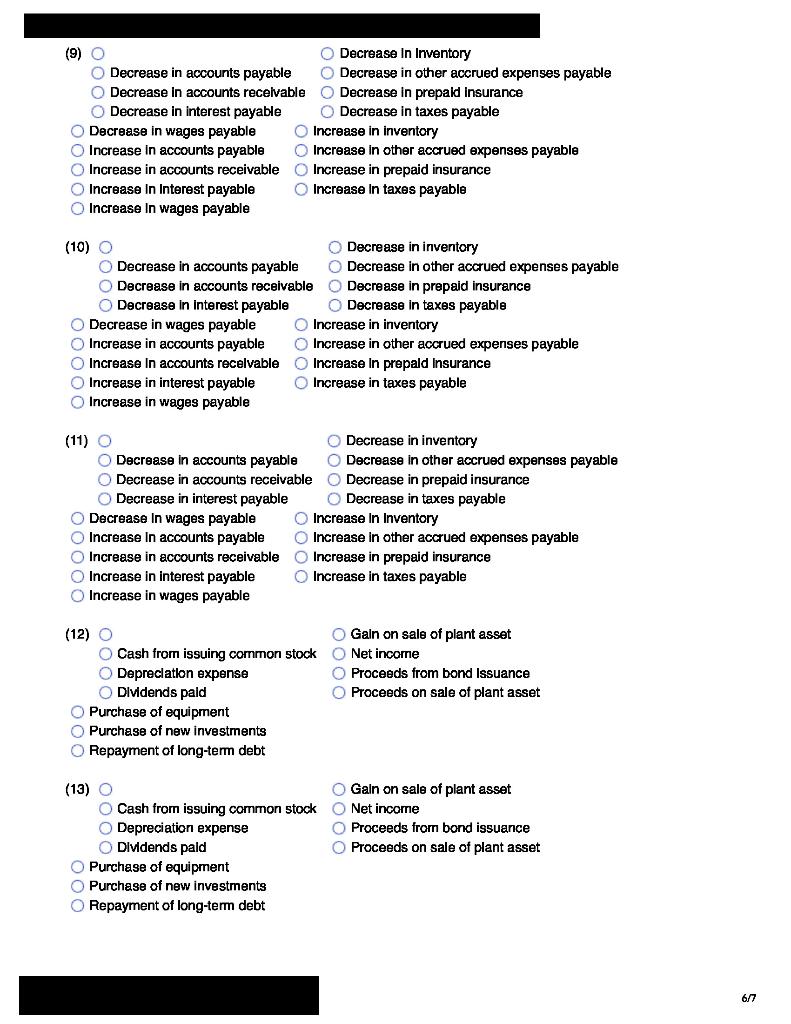

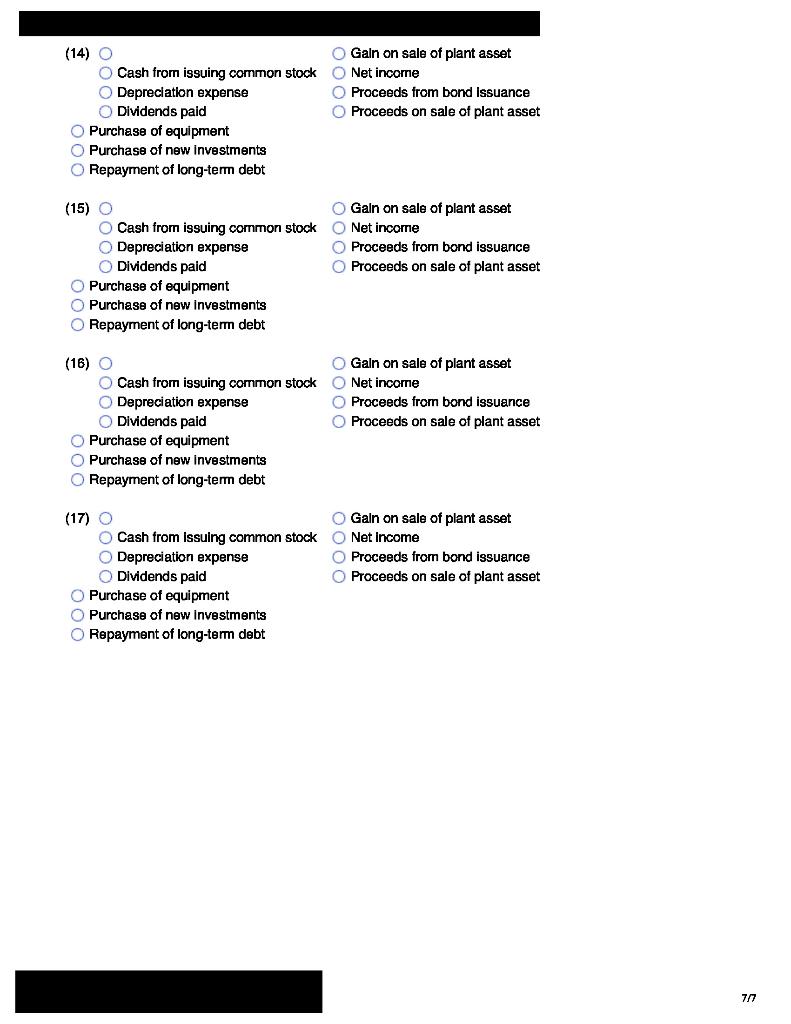

(Click the Icon to view additional Information.) Requirement Prepare a statement of cash flows for Hall Industries, Inc., for the year ended December 31, 2017, using the indirect method. Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflows.) Hall Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2017 Operating Activities: (1) Adjustments to reconcile net Income to cash basis: (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) Net cash provided by (used for) operating activities Investing Activities: (12) (13) (14) Net cash provided by (used for) Investing activities Financing Activities: (15) (16) (17) Net cash provided by (used for) financing activides 177 Net Increase (decrease) In cash Cash, beginning of the year Cash, end of the year 1: Income Statement Hall Industries, Inc. Income Statement For the Year Ended December 31, 2017 Sales revenues $ 959,000 380,000 $ 579,000 Less: Cost of goods sold Gross profit Less operating expenses: Salarles and wages expense $ Insurance expense 192,000 13,000 52,300 87,000 Depreciation expense Other operating expenses 344,300 Total operating expenses Operating income Plus other Income and less other expenses: $ 234,700 Interest expense $ 5,900 Gain on sale of PP&E 2,500 3,400 Total other Income and expenses Income before income taxes $ 231,300 Less: Income tax expense 69,390 $ 161,910 Net Income 2: Balance Sheets 207 Hall Industries, Inc. Comparative Balance Sheets December 31, 2017 and 2016 Assets 2017 2016 Current assets: Cash $ 471,000 $ 70,000 289,000 127,000 Accounts receivable Inventory 330,000 218,000 9,000 8,000 Prepaid Insurance Total current assets $ 880,000 $ 640,000 $ 590,000 Property, plant, and equipment Less: Accumulated depreclatlon 620,000 $ (155,000) 88,000 (111,000) 72,000 Investments Total assets $ 1,433,000 $ 1,191,000 Liabilities Current liabilitles: $ 51,000 $ 39,000 Accounts payable (Inventory purchases) Wages payable Interest payable 16,400 17,400 600 1,600 60,390 Income taxes payable 10,000 6,700 3,500 Other accrued expenses payable Total current liablities $ 138,090 $ 70,500 63,000 27,000 Long-term liabilities Total liabilities $ 199,090 $ 97,500 Stockholders' equity Common stock $ 603,000 603,000 $ 630,910 Retained earnings 490,500 Total stockholders' equity $ 1,233,910 $ 1,093,500 Total llabilities and equity $ 1,433,000 $ 1,191,000 3: Additional information Additional Information follows: 3/7 a. Sold plant asset for $4,400. The original cost of this plant asset was $10,200 and it had $8,300 of accumulated depreciation associated with it b. Pald $5,500 on the bonds payable; Issued $41,500 of new bonds payable. c. Declared and pald cash dividends of $21,500. d. Purchased new investment for $16,000. Paid cash. 0. Purchased new equipment for $40,200. Pald cash. (1) O O Cash from issuing common stock Depreciation expense O Dividends pald Purchase of equipment Purchase of new investments Repayment of long-term debt Galn on sale of plant asset Net income Proceeds from bond issuance Proceeds on sale of plant asset (2) Cash from Issuing common stock Depreciation expense Dividends pald Purchase of equipment O Purchase of new investments O Repayment of long-term debt O Galn on sale of plant asset Net Income Proceeds from bond issuance O Proceeds on sale of plant asset (3) O Cash from Issuing common stock Depreciation expense Dividends paid Purchase of equipment O Purchase of new investments O Repayment of long-term debt O Gain on sale of plant asset Net Income O Proceeds from bond issuance Proceeds on sale of plant asset (4) O Decrease in inventory Decrease in accounts payable Decrease in other accrued expenses payable Decrease in accounts receivable Decrease in prepaid insurance Decrease in interest payable Decrease in taxes payable Decrease in wages payable Increase in inventory Increase in accounts payable Increase in other accrued expenses payable Increase in accounts receivable Increase in prepaid insurance Increase in interest payable Increase in taxes payable Increase in wages payable 40 477 (5) O Decrease in Inventory Decrease in accounts payable Decrease in other accrued expenses payable O Decrease in accounts receivable Decrease in prepaid insurance Decrease in interest payable O Decrease in taxes payable Decrease in wages payable Increase in Inventory Increase in accounts payable Increase in other accrued expenses payable Increase in accounts receivable Increase in prepaid insurance O Increase in Interest payable Increase in taxes payable O Increase in wages payable (6) O Decrease in inventory Decrease in accounts payable Decrease in other accrued expenses payable O Decrease in accounts receivable Decrease in prepaid insurance Decrease in interest payable Decrease in taxes payable O Decrease in wages payable Increase in inventory Increase in accounts payable Increase in other accrued expenses payable Increase in accounts recelvable Increase in prepald Insurance Increase in interest payable Increase in taxes payable O Increase in wages payable (7) O O Decrease in inventory O Decrease in accounts payable Decrease in other accrued expenses payable Decrease in accounts receivable Decrease in prepaid insurance O Decrease in interest payable O Decrease in taxes payable O Decrease in wages payable Increase in Inventory Increase in accounts payable Increase in other accrued expenses payable Increase in accounts receivable Increase in prepaid insurance Increase in interest payable Increase in taxes payable O Increase in wages payable (8) Decrease in Inventory Decrease in accounts payable O Decrease in other accrued expenses payable Decrease in accounts receivable Decrease in prepaid Insurance Decrease in Interest payable Decrease in taxes payable Decrease in wages payable Increase in inventory Increase in accounts payable Increase in other accrued expenses payable O Increase in accounts receivable Increase in prepaid insurance O Increase in interest payable Increase in taxes payable Increase in wages payable 577 (9) O Decrease in Inventory Decrease in accounts payable Decrease in other accrued expenses payable O Decrease in accounts receivable Decrease in prepaid Insurance Decrease in interest payable O Decrease in taxes payable Decrease in wages payable Increase in inventory O Increase in accounts payable Increase in other accrued expenses payable Increase in accounts receivable Increase in prepaid insurance O Increase in Interest payable Increase in taxes payable O Increase in wages payable (10) O Decrease in inventory Decrease in accounts payable Decrease in other accrued expenses payable O Decrease in accounts receivable Decrease in prepaid insurance Decrease in interest payable O Decrease in taxes payable O Decrease in wages payable Increase in inventory Increase in accounts payable Increase in other accrued expenses payable Increase in accounts recelvable Increase in prepald Insurance Increase in interest payable Increase in taxes payable O Increase in wages payable (11) O Decrease in inventory Decrease in accounts payable O Decrease in other accrued expenses payable Decrease in accounts receivable Decrease in prepaid insurance Decrease in interest payable Decrease in taxes payable Decrease in wages payable Increase in Inventory Increase in accounts payable Increase in other accrued expenses payable Increase in accounts receivable Increase in prepaid insurance Increase in interest payable Increase in taxes payable O Increase in wages payable (12) O O Cash from issuing common stock Depreciation expense Dividends pald Purchase of equipment Purchase of new investments O Repayment of long-term debt Gain on sale of plant asset O Net income Proceeds from bond Issuance O Proceeds on sale of plant asset (13) O O Cash from issuing common stock Depreciation expense Dividends pald O Purchase of equipment Purchase of new investments Repayment of long-term debt Galn on sale of plant asset Net income O Proceeds from bond issuance Proceeds on sale of plant asset 617 (14) O O Cash from issuing common stock Depreciation expense Dividends paid O Purchase of equipment O Purchase of new investments O Repayment of long-term debt Galn on sale of plant asset O Net income O Proceeds from bond Issuance Proceeds on sale of plant asset (15) O Cash from issuing common stock Depreciation expense Dividends paid O Purchase of equipment O Purchase of new investments Repayment of long-term debt Gain on sale of plant asset O Net income Proceeds from bond issuance O Proceeds on sale of plant asset (16) O O Cash from issuing common stock Depreciation expense O Dividends pald Purchase of equipment O Purchase of new Investments O Repayment of long-term debt O Galn on sale of plant asset Net income O Proceeds from bond issuance O Proceeds on sale of plant asset (17) O Cash from issuing common stock Depreciation expense Dividends paid O Purchase of equipment Purchase of new investments Repayment of long-term debt Gain on sale of plant asset Net Income O Proceeds from bond issuance O Proceeds on sale of plant asset 777