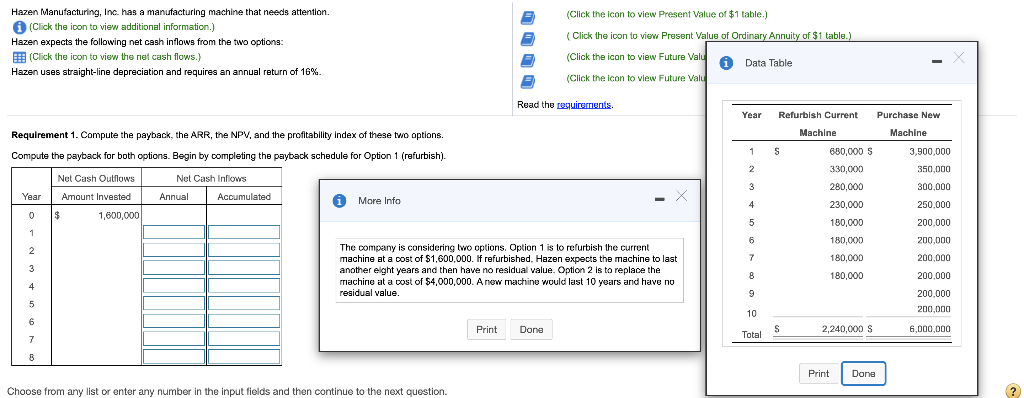

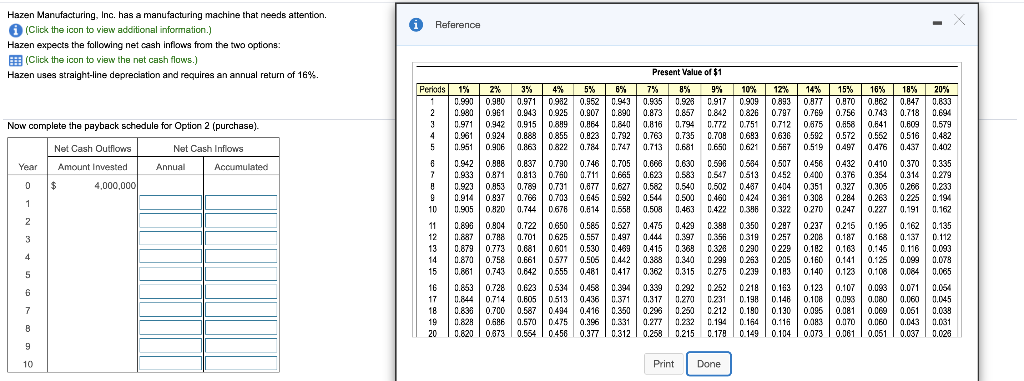

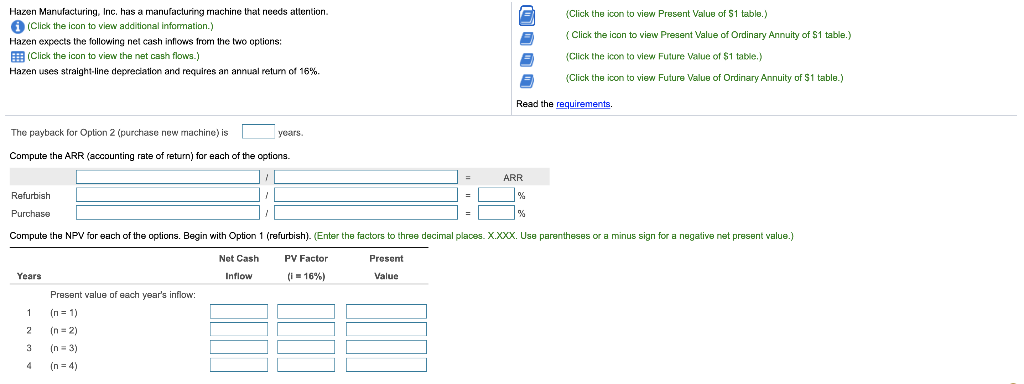

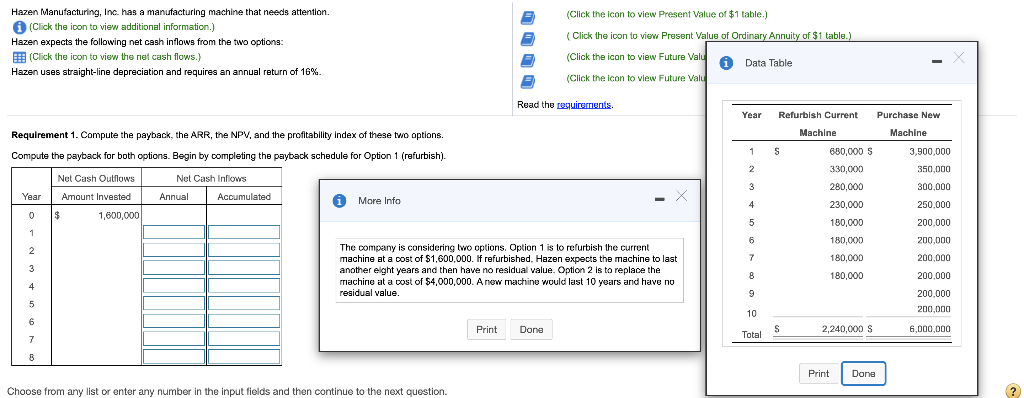

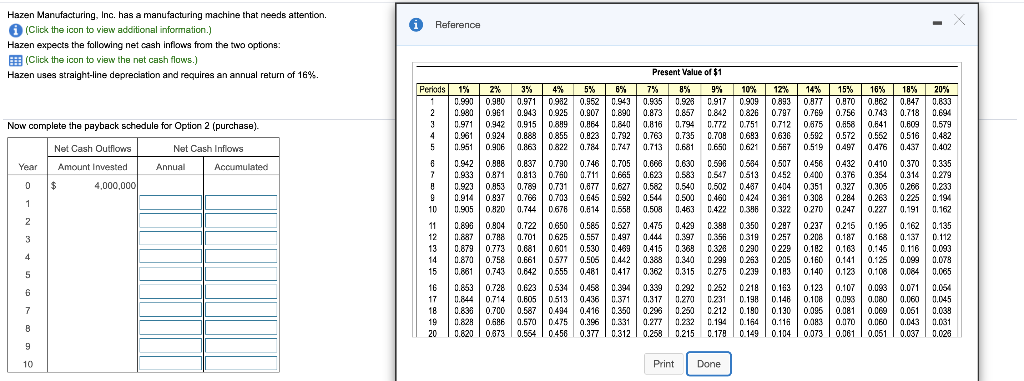

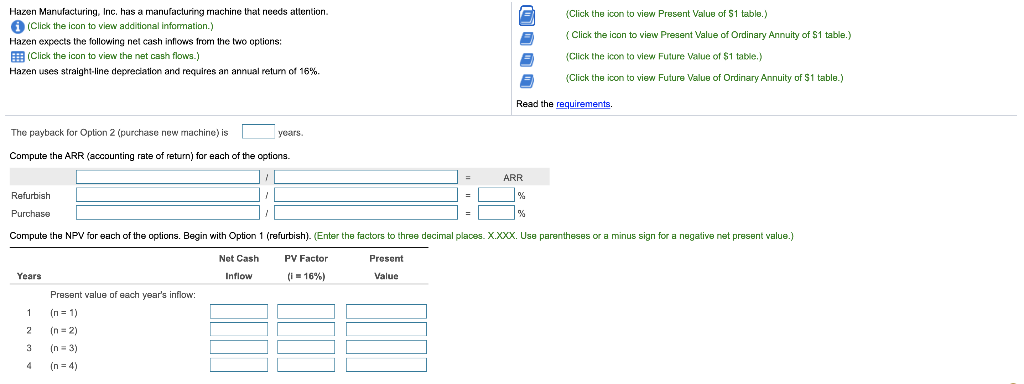

(Click the icon to view Present Value of $1 table.) Hazen Manufacturing, Inc. has a manufacturing machine that needs attention (Click the icon to view additional information.) Hazen expects the following net cash inflows from the two options: (Click the icon to view the nei cash flows.) Hazen uses straight-line depreciation and requires an annual return of 16%. (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Valu i Data Table (Click the icon to view Future Valu Read the requirements. Year Purchase New Refurbish Current Machine Machine Requirement 1. Compute the payback, the ARR, the NPV, and the profitability Index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). 1 S S 3,900,000 2 680,000 S 330,000 280,000 Net Cash Outflows Amount Invested Net Cash Inflows Annual Accumulated 3 350,000 300.000 250.000 Year More Info 4 0 GA 1,600,000 5 200.000 1 230,000 180,000 180,000 180,000 6 200,000 2 7 200,000 3 The company is considering two options. Option 1 is to refurbish the current machine at a cost of $1,600,000. If refurbished. Hazen expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,000,000. A new machine would last 10 years and have no residual value 8 180,000 200.000 4 5 200.000 200.000 10 6 Print Done S Total 2,240,000 S 6,000,000 7 8 Print Done Choose from any list or enter any number in the input fields and then continue to the next question. ? Reference Hazen Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information.) Hazen expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Hazen uses straight-line depreciation and requires an annual return of 16% Periods 1 2 3 4 5 Now complete the payback schedule for Option 2 (purchase). 15% 0.370 0.756 0.558 0.572 0.497 Net Cash Outflows Net Cash Inflows Annual Accumulated 14% 0.377 0.760 0.575 0.592 0.519 0.456 0.400 0.351 0.308 0.270 Year Amount Invested 8 7 0 $ 4,000,000 Present Value of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 0.990 0.900 0.971 0.932 0.952 0.943 0.935 0.923 0.917 0.999 0.893 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.971 0.942 0.915 0.889 0.864 0.840 0.794 0.751 0.712 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.709 0.693 0.636 11.951 0.906 (1.863 D822 0.784 0.747 01.713 11.681 0.650 0.621 0.567 0.888 0.837 0.790 0.746 0.705 0.668 0.630 0.598 0.534 0.507 0.933 0.871 0.871 0.813 0.760 0.711 0.685 0.623 0.583 0.547 0.513 0.452 0.923 0.858 0.789 0.731 0.877 0.627 0.582 0.540 0.502 0.437 0.404 0.914 0.837 0.7680.703 0.645 0.592 0.544 0.500 0.460 0.424 0.361 1.905 0.820 01.744 0.676 0.614 0.558 0.508 01.463 0.422 0.356 0.322 0.898 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.389 0.350 0287 0.887 0.788 0.788 0.701 0.625 0.557 0.497 01.444 0.397 0.356 D.319 0257 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.369 0.328 0.290 0229 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.253 0 205 0.881 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.103 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.844 0.714 0.605 0 513 0.436 11.371 0.317 01.270 0.231 D.198 0.146 0.838 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.190 0.130 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.194 0.164 0.116 0.820 0.373 0.564 1 0.458 0.377 0.377 | 0.312 0.312 0.258 0.215 0.178 0.149 1 0.104 0.432 0.376 0.327 0.284 0.247 1 9 10 16% 18% 20% 0.062 0.047 0.633 0.743 0.718 0.694 0.841 0.609 0.579 0.552 0.516 0.482 0.476 (1.437 0.402 0.410 0.370 0.335 0.354 0.314 0.279 0.305 0.263 0.233 0.263 0.225 0.194 0.227 01.191 01.162 0.195 0.162 0.135 0.168 (1.137 0.112 0.145 0.116 0.083 0.125 0.099 0.078 0.108 0.084 0.065 0.096 0.071 0.054 0.080 01.060 01.045 0.069 0.051 0.039 0.060 0.043 0.031 0.051 0.037 0.023 2 3 11 12 13 14 15 0.237 0.208 0.102 0.160 0.140 0.215 0.187 0.163 0.141 0.123 4 5 6 7 16 17 18 19 20 0.123 0.108 0.096 0.083 0.073 0.107 0.093 0.081 0.070 0.061 9 10 Print Done (Click the icon to view Present Value of $1 table.) Hazen Manufacturing, Inc. has a manufacturing machine that needs attention (Click the icon to view additional information.) Hazen expects the following nel cash inflows from the two options: (Click the icon to view the net cash flows.) Hazen uses straight-line depreciation and requires an annual retum of 16%. (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements The payback for Option 2 (purchase new machine) is years Compute the ARR (accounting rate of return) for each of the options ARR 9 Refurbish Purchase % Compute the NPV for each of the options. Begin with Option 1 (refurbish). (Enter the factors to three decimal places. X.XXX. Use parentheses or a minus sign for a negative net present value.) Net Cash PV Factor Present Value Years Inflow (i = 16%) Present value each year's inflow: 1 (n = 1) 2 in = 2) (n = 3) 3 (Click the icon to view Present Value of $1 table.) Hazen Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information.) Hazen expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Hazen uses straight-line depreciation and requires an annual return of 16%. Reference 5 0.893 (n = 5) in = 6) 6 7 in = 7) 8 in = 8) Total PV of cash inflows 0 Initial investment Present Value of Ordinary Annulty of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.990 0.900 0.971 0.952 0.952 0.943 0.935 0.923 0917 0.909 2 1.970 1.942 1.913 1.896 1.859 1.833 1.808 1.783 1.759 1.738 3 2.941 2.884 2.829 2.775 2.723 2.673 2.524 2.577 2.531 2.487 4 3.902 3.908 3.717 3.630 3.546 3.455 3.387 3.312 3240 3.170 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 6 5.795 5.301 5.417 5242 5.076 4.917 4.767 4.767 4.623 4.406 4.356 7 6.728 6.472 6.230 6.002 5.786 5.592 5.389 5.203 5.033 4.868 8 7.652 7.325 7,020 6.733 6.463 6210 5.971 5.747 5.535 5.335 0.506 8.162 7.783 7.435 7.108 6.802 6.515 6.247 5.995 5.750 10 9.471 8.9838.530 8.111 7.722 7.380 7.024 6.710 6.418 6.145 11 10.358 9.707 9.253 8.780 3.306 7.897 7.499 7.499 7.139 6.805 6.495 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.538 7.161 6.814 13 12 134 11 348 10.635 | 9.986 9.394 8.853 8.358 7.904 7487 7.100 14 13.094 12.106 11.296 10.563 9.890 9.295 8.745 9.244 7.796 7.267 15 13.865 12.849 11.638 11.118 10.380 9.712 9.108 8.569 8,081 7.606 16 14.718 13.578 12.561 11.652 10.838 10.108| 9.447 9.861 8.313 7.824 17 15.582 14.292 13.168 12.166 11.274 10.477 9.763 9.122 8.544 8.022 18 16.390 14.992 19.754 12.559 11.590 10.82 10.059 9.372 8.756 3.201 19 17.226 15.678 14.324 13.134 12.065 11.159 10.336 9.604 8.950 8.365 12% 14% 0.877 1.690 1.647 2.4.12 2.322 3.037 2.914 3.635 3.433 4.111 3.089 4.564 4.288 4.958 4.839 5.328 4.946 5.650 5.216 5.938 5.453 6.194 5.660 6.424 5.542 6.628 6.002 6.811 6.142 6.9746.266 7.120 6.373 7.250 6.467 7356 6.550 Nel present value of the project Now compute the NPV for Option 2 (purchase). (Enter the factors to three decimal places. X.XXX. Use parentheses or a mi Net Cash Present PV Factor (1 = 16%) Years Inflow Value 1 Present value of each year's inflow: in = 1) (n = 2) 2 Print Done Choose from any list or enter any number in the input fields and then continue to the next question. ? Hazen Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information.) Hazen expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Hazen uses straight-line depreciation and requires an annual retum of 16% (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of S1 table.) Click the icon to view Future Value of $1 table.) O (Click the icon to view Future Value of Ordinary Annuity of $1 table. Read the requirements. 8 in = 8) 9 In -9) 10 (n = 10) Total PV of cash inflows 0 Initial investment Net present value of the project Finally, compute the profitability index for each option. (Round to two decimal places X.XX.) Profitability Index Refurbish Purchase Requirement 2. Which option should Hazen choose? Why? Review your answers in Requirement 1. Hazen should choose because this option has a payback period, an ARR that is the other option, a Y NPV, and its profitability index is Reference A Reference Future Value of $ Future Value of Ordinary Annu 1.000 | 1.00 | 2010 | 2020 | 2030 | 20140 | 20537 | 2017 | 1411_14194 | 4.245 55.11 | 204 | 532 | 3.132 | EP.37 | FAHA | | 2011 3.75 106| 11.88|| 1147 | 3.02 |3.58 | 14.16%]6.79 | 45 | 0.35 | 11 E | 12.01 | 1258 | 13.148 | 9 | 5.19 | 15.94 | 17.5 11.57 | 2017 | 12.81 13.49 | 1421 | 14.37 | 15.78 18 | 78 | 18.53 | 2016 | 23 | 24.32 N a t : need E- : 7. ? ? ? ? ? SNE mus Emm Print Done Print Done