Assume that the Special Contract Division of Smith experienced the following transactions during the year ended December 31, 2020. i (Click the icon to

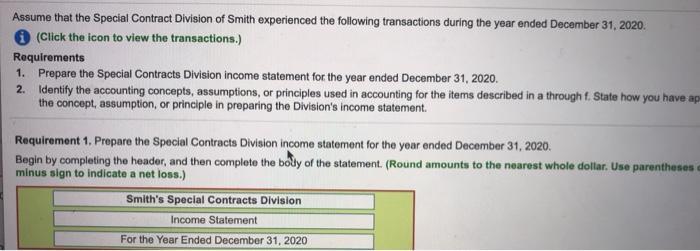

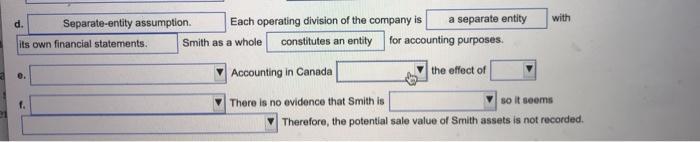

Assume that the Special Contract Division of Smith experienced the following transactions during the year ended December 31, 2020. i (Click the icon to view the transactions.) Requirements 1. Prepare the Special Contracts Division income statement for the year ended December 31, 2020. 2. Identify the accounting concepts, assumptions, or principles used in accounting for the items described in a through f. State how you have ap the concept, assumption, or principle in preparing the Division s income statement. Requirement 1. Prepare the Special Contracts Division income statement for the year ended December 31, 2020. Begin by completing the header, and then complete the body of the statement. (Round amounts to the nearest whole dollar. Use parentheses a minus sign to indicate a net loss.) Smith s Special Contracts Division Income Statement For the Year Ended December 31, 2020 d. its own financial statements. 0. Separate-entity assumption. Each operating division of the company is a separate entity Smith as a whole constitutes an entity for accounting purposes. Accounting in Canada There is no evidence that Smith is the effect of with so it seems Therefore, the potential sale value of Smith assets is not recorded. Requirement 2. Identify the accounting concepts, assumptions, or principles used in accounting for the items described in a through f. State how you have applied the concept, assumption, or principle in preparing the Division s income statement. Identify the accounting assumption or characteristic that provides guidance in accounting for the item described. How have you applied the assumption or characteristics in preparing the special contracts division income statement? Begin with transaction a.

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started