Answered step by step

Verified Expert Solution

Question

1 Approved Answer

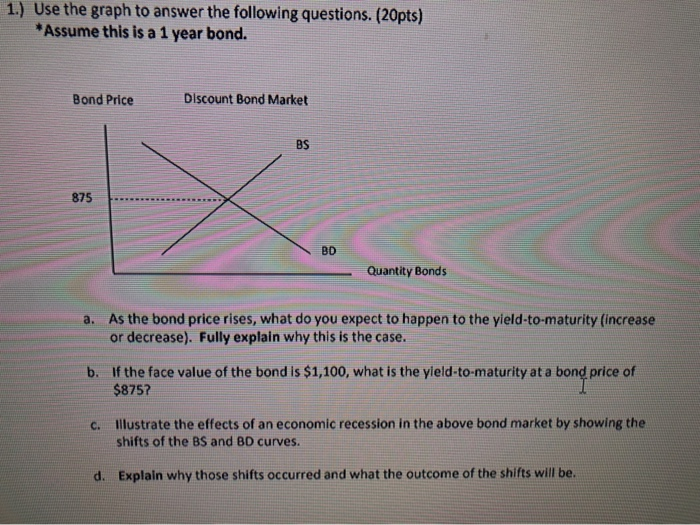

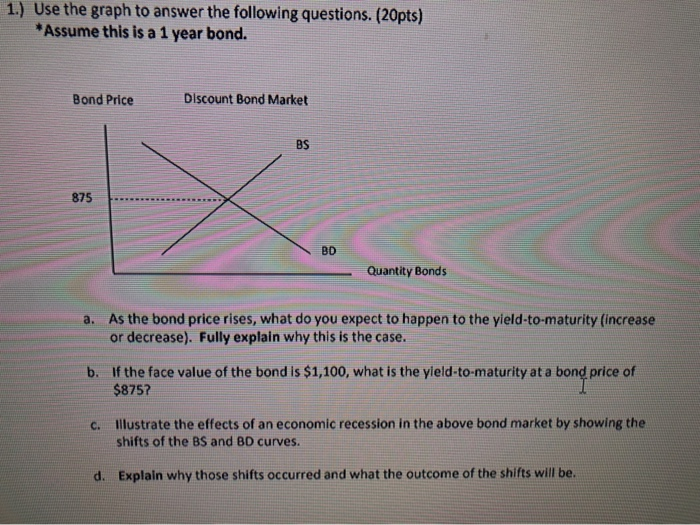

click the image 1.) Use the graph to answer the following questions. (20pts) *Assume this is a 1 year bond. Bond Price Discount Bond Market

click the image

1.) Use the graph to answer the following questions. (20pts) *Assume this is a 1 year bond. Bond Price Discount Bond Market BS 875 BD Quantity Bonds a. As the bond price rises, what do you expect to happen to the yield-to-maturity (increase or decrease). Fully explain why this is the case. b. If the face value of the bond is $1,100, what is the yield-to-maturity at a bond price of $8757 abond pri c. Illustrate the effects of an economic recession in the above bond market by showing the shifts of the BS and BD curves. d. Explain why those shifts occurred and what the outcome of the shifts will be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started