Question

CLIENT ACCEPTANCE: The Winery at Chateau Americana LEARNING OBJECTIVES After completing and discussing this case, you should be able to: Understand types of information used

CLIENT ACCEPTANCE:

The Winery at Chateau Americana

LEARNING OBJECTIVES

After completing and discussing this case, you should be able to:

- Understand types of information used to evaluate a prospective audit client.

- Evaluate background information about an entity and key members of management.

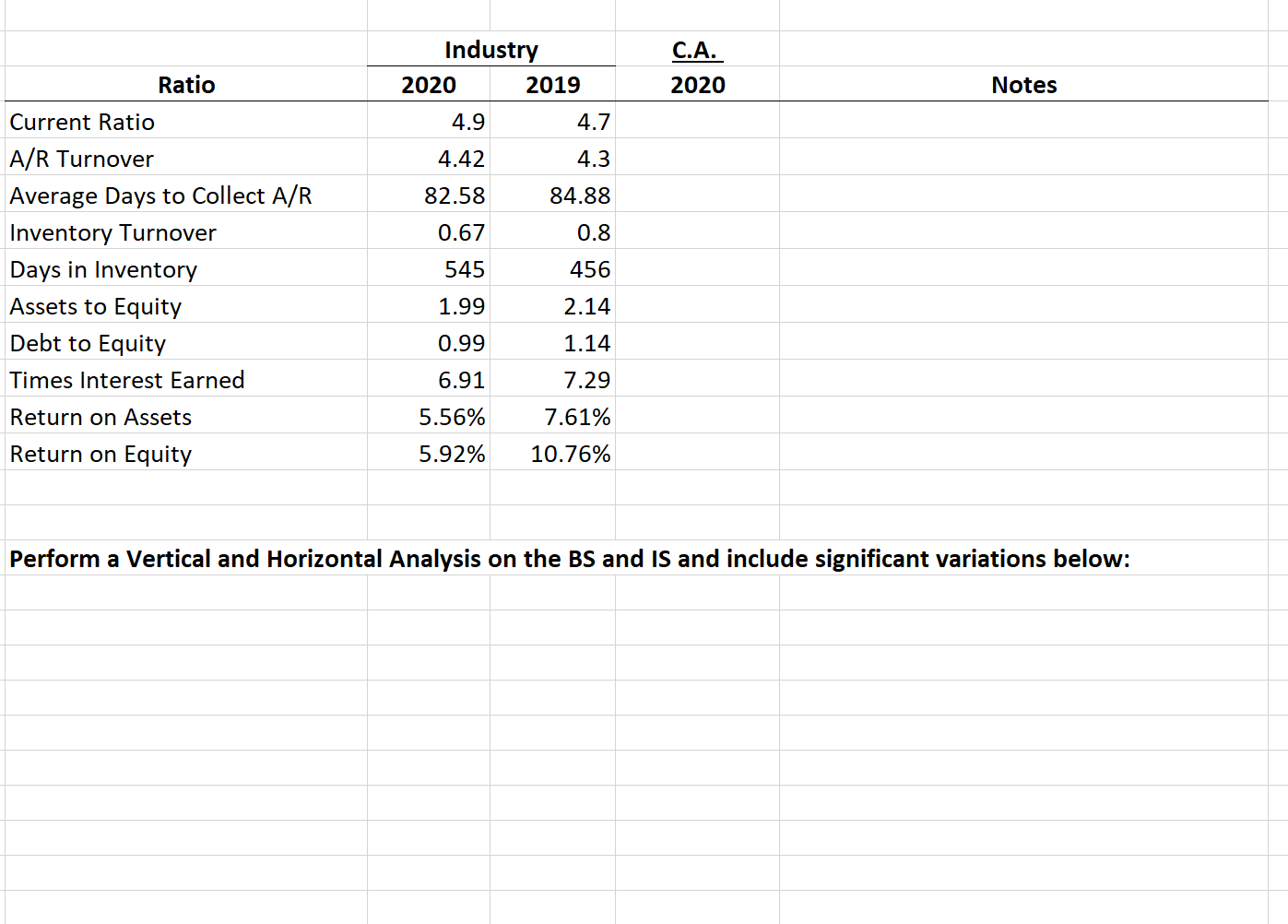

- Perform and evaluate preliminary analytical procedures.

- Make and justify a client acceptance decision.

- Describe matters that should be included in an engagement letter.

INTRODUCTION

Since its founding in 1980, Chateau Americana (CA) has cultivated a reputation as one of America's finest wineries. The small, family-owned winery has an impressive vineyard whose 125 acres yields a variety of grapes including Cabernet Sauvignon, Cabernet Franc, Chardonnay and Riesling. In the last several years, CA's wines have received accolades at several highly regarded wine competitions which have dramatically increased the demand for its wines. This recent growth, along with the accompanying challenges and opportunities, has caused the winery's management to have doubts as to whether their current accounting firm is prepared to provide the advice and services required by a growing company.

Claire Helton, a partner with your accounting firm (Boston & Greer, LLP) recently met with the winery's president and chief financial officer (CFO) about the company's present and future needs. After several follow-up meetings, the winery's CFO contacted Claire to notify her that CA would like to have your firm submit a proposal to perform the company's financial statement audit. You have been asked by Claire to assist her in the evaluation of CA as a potential audit client and to assist with the preparation of the engagement proposal.

BACKGROUND INFORMATION

CA, owned by the Summerfield family, is a relatively modest winery with an annual production of approximately 385,000 cases of wine. Several years of sales growth have enabled the company to reinvest in its operations while simultaneously reducing its debts. Encouraged by its success and growing acclaim, management is contemplating an initial public offering within the next several years.

Overview of the Wine Industry

The domestic wine industry has experienced tremendous growth in the last decade and is now comprised of more than 8,000 wineries. California is home to more than 2,000 of these wineries, almost one out of every four of the nation's wineries, and is the leading producer of wine in the U.S. More impressive still, California wineries account for more than 90 percent of the annual domestic wine production. Much of the remaining domestic wine production comes from wineries located in Washington, Oregon, New York and Virginia. An understanding of California's wineries is instructive because it is a "snapshot" of the domestic wine industry. The wine industry is highly concentrated with the five largest US winemakers accounting for the majority of domestic wine sales.

Several of the world's largest winemakers are located in California. Ernest & Julio Gallo, one of the largest winemakers in the world, is privately owned and is estimated to have annual sales approaching $5 billion. Another large winemaker, one that is publicly owned, is Constellation Brands. The company's annual wine revenue has varied in recent years between $2.5 and $2.7 billion. Although there are several other large California wineries, they are much smaller than Gallo and Constellation with annual sales that are generally less than $250 million. In addition, many small California wineries specialize in the production of particular varieties of grapes and generate much lower sales. Consolidation within the industry is relatively common and is likely to continue as wineries search for economies of scale in production and advertising and interest in product expansion broadens.

Wine reaches the consumer through a variety of distribution channels. Much of the domestic wine sales occur through supermarket chains. Wine specialty shops and mass merchandisers account for much of the remaining sales. A much smaller proportion of overall domestic wine sales is accounted for by restaurants, small convenience stores, and other outlets. Internet sales and distribution are relatively small primarily because of financial security concerns and interstate alcohol shipping regulations.

The wine industry appears to have a bright future. Wine consumption is directly related to household income, with higher income families consuming more wine than lower income families. Consumption is highest among adults between the ages of 51 - 69 (i.e., Baby Boomers) and those between 21 and 38 years of age (i.e., Millennials).

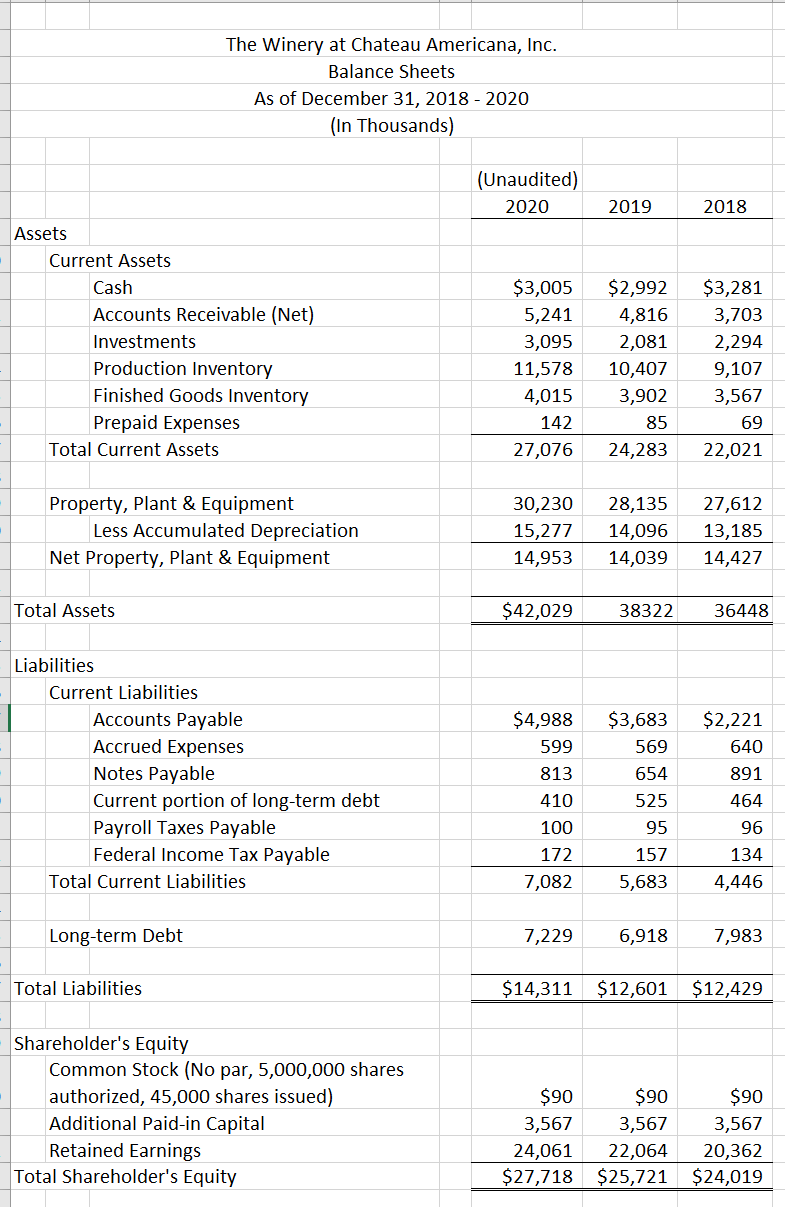

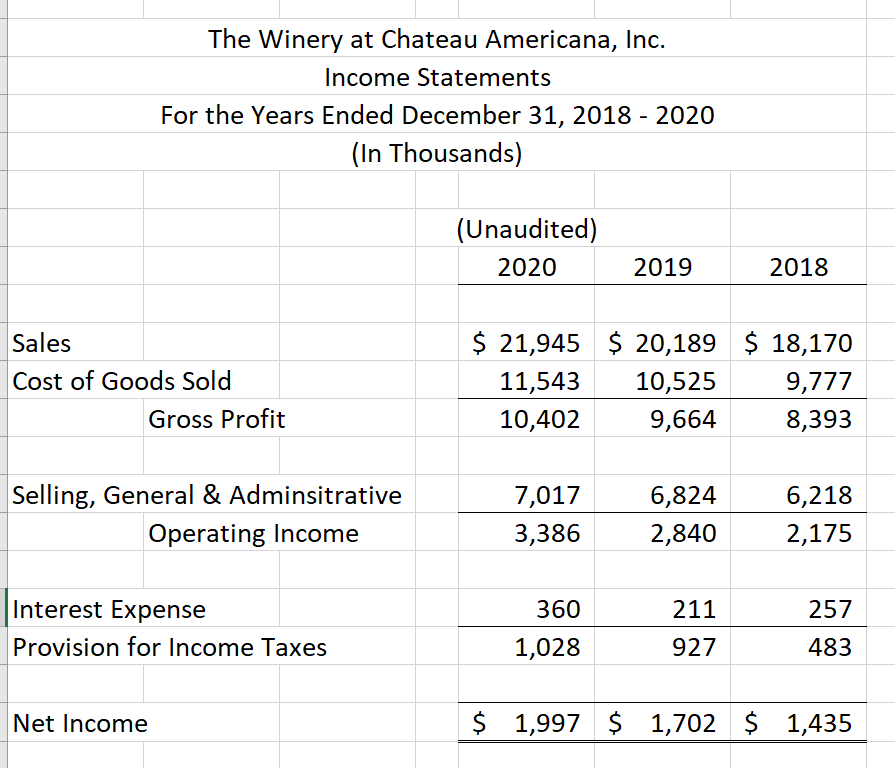

Overview of Chateau Americana

CA has experienced significant sales growth in recent years and expects to report record sales of almost $22 million for the year ending December 31, 2019. Audited sales for the two prior years totaled $20.2 and $18.2 million, respectively. Over the same three-year period, the company's asset base has also grown, increasing by more than 15 percent from $36.4 to $42 million. CA has been a profitable winery for a number of years and expects to report profits of approximately $2 million for the current year. Much of CA's growth has been fueled through the company's policy of reinvestment. To this end, retained earnings have increased approximately $3.7 million over the last three years, while total liabilities have increased $1.9 million. The winery's CFO provided the balance sheets and income statements for the current and two preceding years.

The winery's crown jewel is its 125-acre vineyard which yields a harvest of some fifteen varieties of grapes. Each year the vineyard provides approximately 800 tons of grapes, or one-fourth of the winery's production requirement. The remaining grapes are purchased from other vineyards, most of which are in California. CA is particularly proud of its production process - a blend of traditional techniques and state-of-the-art technology - which produces widely acclaimed red and white wines.

The company primarily sells its wines to distributors and retail shops. CA has developed several exclusive distribution agreements which have significantly increased its presence in several large metropolitan areas. The company is seeking similar opportunities in other areas.

The Company's Management

CA has a management team that is widely respected in the industry. The winery's owners have invested considerable time and energies in hiring individuals whom they believe are competent and trustworthy. Several members of the Summerfield family occupy key management positions.

- Edward Summerfield is the family's patriarch and president of the company. He has received several entrepreneurship awards and is generally perceived as an astute businessperson.

- Taylor Summerfield is vice president of marketing for the company. Prior to assuming this position, she had a successful career in sales and marketing. Taylor is well-educated and earned an MBA from an Ivy League school.

- Jacques Dupuis, Edward's son-in-law, is vice-president of winery operations. He has an extensive background in viticulture (i.e., grape growing) and vinification (i.e., wine making).

- Rob Breeden, the company's CFO, is the sole individual to hold a key management position who is not a member of the Summerfield family. He has substantial financial experience and was previously employed in public accounting for nine years and served as controller and CFO for another winery in California. Rob holds undergraduate and graduate degrees in accounting and is a CPA.

Edward and other members of management have taken considerable steps to ensure the stability of the winery's management team. To this end, management members have an open-door policy that encourages a free exchange of ideas and concerns. In addition, Edward has instituted a compensation plan that provides substantial bonuses to all employees, including members of management, who meet performance goals. He believes that his policies and approach to business are the reasons that CA has had very low employee turnover. In fact, Rob is the newest member of management with just over two years of service to the company. He replaced the former CFO who resigned from the company after more than 15 years. According to Edward, the former CFO resigned because he wanted to spend more time with his wife who was suffering from a serious illness.

Client Background Investigation

Your firm customarily has a background investigation conducted prior to accepting a new audit client. The investigation of CA included the winery's corporate history and, the background of each member of management. Two issues arose during the investigation. First, the company's credit history indicates that the company was delinquent on several obligations that were referred to collection agencies six years ago. Recent credit history is much more favorable, and no problems of ongoing significance were found. The second issue relates to criminal charges filed against Jacques Dupuis while living in France. According to public records and news sources, Jacques and several other employees were accused of stealing trade secrets from a former employer - a French winery. Although charges were eventually dropped because of insufficient evidence, many in France still believe Jacques was guilty of stealing trade secrets.

The Company's Information System

The winery employs a fully integrated information system (IS) to collect, store and share data among its employees. The present system has been operational for approximately 14 months. Although employees are generally satisfied with the system, some complain that the transition from the previous system occurred too quickly and without adequate planning and training. Although the company has been computerized for more than 10 years, its former system was a combination of manual and computerized processes. Consequently, the new system represents a significant change in the company's IS.

Management believes the new system is the best on the market. After having been through a similar IS conversion process at his former employer, Rob Breeden insisted that the company investigate the prospects of developing an integrated IS using database technology. Following his detailed evaluation of the potential for in-house development of the system, Rob advised Edward that the system could be developed by the company's employees. Internal memos obtained from the company indicate that Edward deferred to Rob's judgment in making the decision to proceed with the in-house development process.

The current system is based on a relational database. The IS modules include purchasing and accounts payable, sales and accounts receivable, production and inventory, payroll, and the general ledger. Each of these modules provides data that are critical to the company's continued growth and success. Internal memos indicate that the company has experienced some employee turnover because of continuing problems with the accounts payable and accounts receivable modules. In fact, there are rumors that the former CFO resigned over disagreements with Edward about the need for a new IS.

Discussions with the Predecessor Auditor

As required by auditing standards, your firm asked for and received permission from management to contact the company's former auditor. Several phone calls were required before you were able to speak with the former partner-in-charge of the CA audit, William Lawson. At first, William was hesitant to talk with you about his firm's past relationship with CA. He said he needed to speak with Rob Breeden before you and he could have any substantive conversation.

You met with William at his office a few days later to learn more about his firm's relationship with the winery's management and recent audits. William was very complementary of the Summerfield family, describing Edward as a man of great integrity and business savvy. He stated that he was very impressed by the company's strong professional environment and complete lack of nepotism. William did express concerns about the winery's new CFO. He felt that Rob was too eager to "make his mark on the company as evidenced by the implementation of the companys new IS. According to William, Rob believed the winerys old IS was limiting CAs future because of the inability to provide accurate data in a timely manner and was insistent that a new system be implemented. Several of the winerys internal memos reviewed by you indicated that Rob was the real force behind the new system.

You asked William if there were any disagreements with management about either accounting principles or his firm's audit procedures. He quickly mentioned that his firm had always enjoyed a very good relationship with CA until Rob became CFO. When you asked him to explain further, William said that Rob is very knowledgeable, but also more aggressive than CAs former CFO. He specifically mentioned that last year's audit team noted policy changes related to Accounts Receivable and Accounts Payable. With respect to receivables, the company instituted more aggressive collection procedures and reduced the Allowance for Bad Debts by more than $100,000 from the previous year. The company also implemented a practice of paying vendors who offer discounts within that discount period, but simultaneously delayed payments to vendors who offer no discounts by 10 to 15 days beyond the indicated terms. Notwithstanding these changes, William said that he was unaware of any significant negative reaction by customers or vendors.

Finally, you asked William to explain his understanding of why CA had decided to change audit firms. After a brief silence, he said that Edward and Rob had told him that they believed the company needed a "fresh perspective" and was concerned that his firm would not be able to provide the services required as their company continued its growth.

Financial Statements

Financial statements for the current and preceding two years were provided by Rob Breeden and are included. William Lawson's firm issued an unqualified audit opinion on the company's financial statements for each of the preceding two years.

REQUIREMENTS

Client acceptance is a challenging process that requires considerable professional judgment. Although such decisions are typically made by highly experienced auditors, you have so impressed the managers and partners in your office that you have been asked to assist with the client acceptance procedures for Chateau Americana.

Now you are ready to assist the engagement partner, Claire Helton, by completing all open audit procedures on the audit plan. Document your work on the provided audit schedules that follow Chateau Americana's financial statements. You should assume that audit schedules CA-104 and CA-105 were properly prepared and have already been included with other relevant audit documentation. These pieces of documentation are not included.

What are the financial factors for client acceptance?

What are the nonfinancial factors for client acceptance?

Calculate the following ratios based off the income statement and balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started