Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Client Scenarios One of the most important aspects of this role is being able to communicate financial and accounting concepts to our clients, who usually

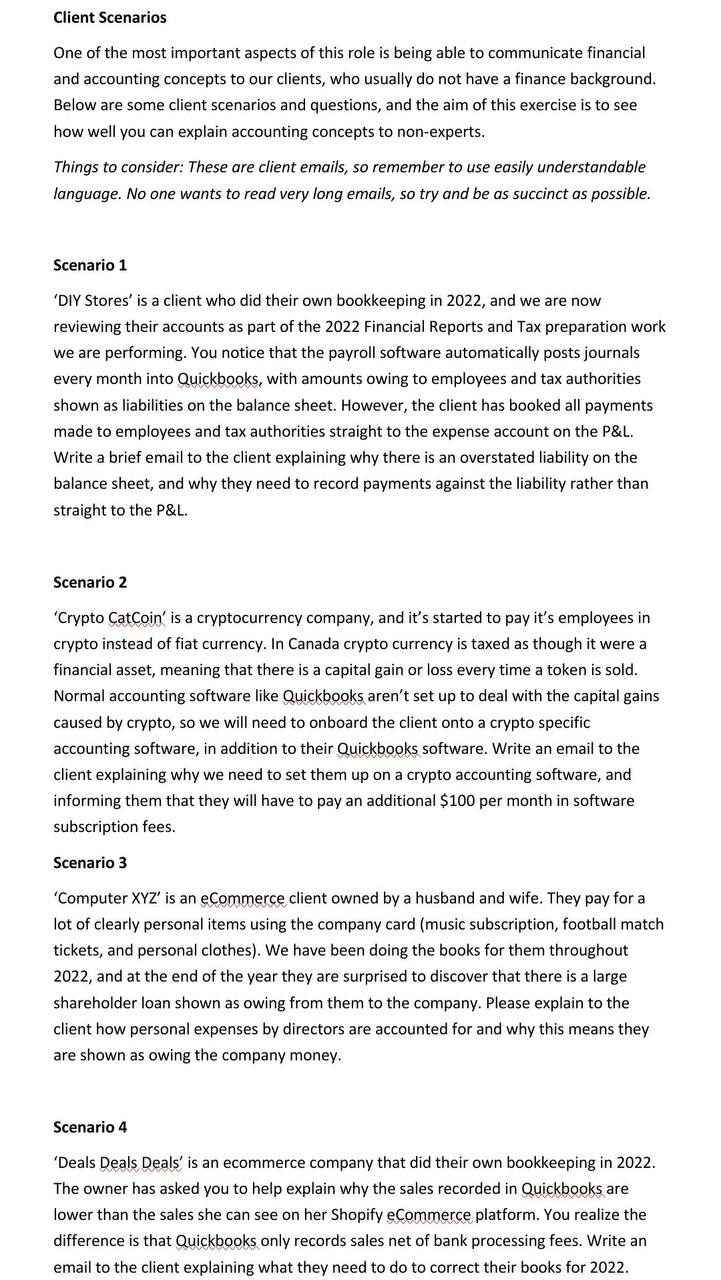

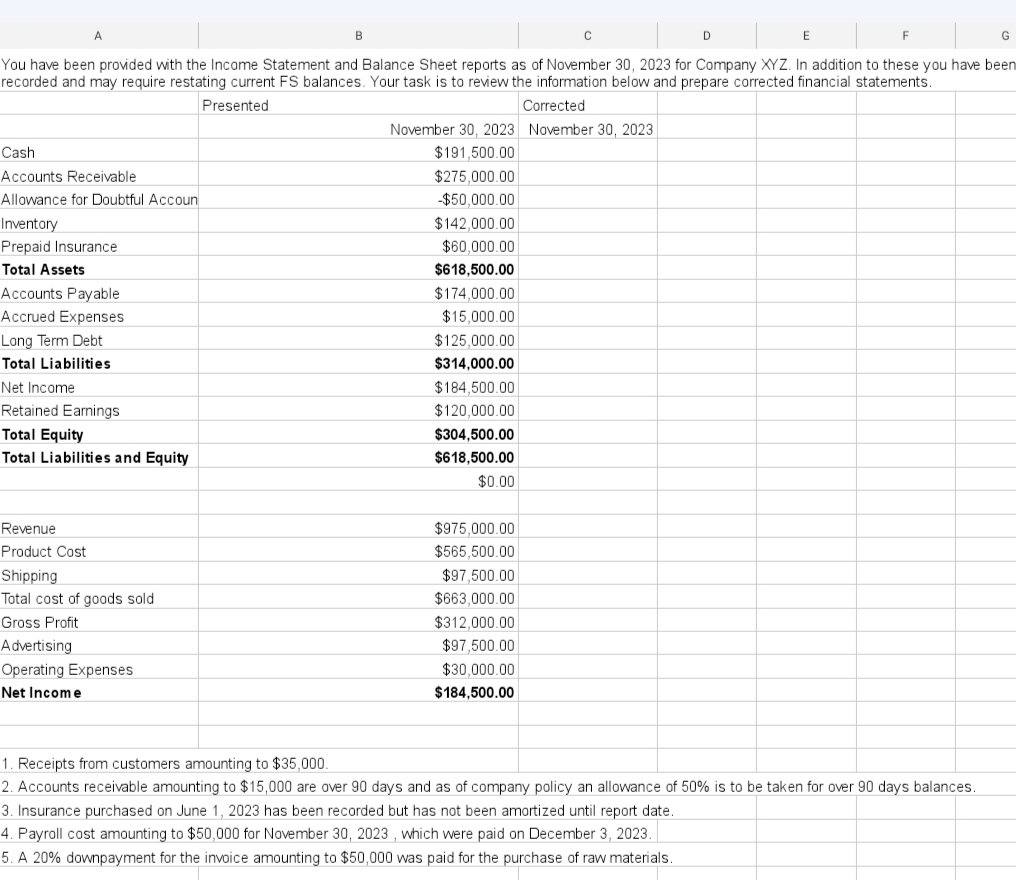

Client Scenarios One of the most important aspects of this role is being able to communicate financial and accounting concepts to our clients, who usually do not have a finance background. Below are some client scenarios and questions, and the aim of this exercise is to see how well you can explain accounting concepts to non-experts. Things to consider: These are client emails, so remember to use easily understandable language. No one wants to read very long emails, so try and be as succinct as possible. Scenario 1 'DIY Stores' is a client who did their own bookkeeping in 2022, and we are now reviewing their accounts as part of the 2022 Financial Reports and Tax preparation work we are performing. You notice that the payroll software automatically posts journals every month into Quickbooks, with amounts owing to employees and tax authorities shown as liabilities on the balance sheet. However, the client has booked all payments made to employees and tax authorities straight to the expense account on the P\&L. Write a brief email to the client explaining why there is an overstated liability on the balance sheet, and why they need to record payments against the liability rather than straight to the P\&L. Scenario 2 'Crypto CatCoin' is a cryptocurrency company, and it's started to pay it's employees in crypto instead of fiat currency. In Canada crypto currency is taxed as though it were a financial asset, meaning that there is a capital gain or loss every time a token is sold. Normal accounting software like Quickbooks aren't set up to deal with the capital gains caused by crypto, so we will need to onboard the client onto a crypto specific accounting software, in addition to their Quickbooks software. Write an email to the client explaining why we need to set them up on a crypto accounting software, and informing them that they will have to pay an additional $100 per month in software subscription fees. Scenario 3 'Computer XYZ' is an eCommerce client owned by a husband and wife. They pay for a lot of clearly personal items using the company card (music subscription, football match tickets, and personal clothes). We have been doing the books for them throughout 2022 , and at the end of the year they are surprised to discover that there is a large shareholder loan shown as owing from them to the company. Please explain to the client how personal expenses by directors are accounted for and why this means they are shown as owing the company money. Scenario 4 'Deals Deals Deals' is an ecommerce company that did their own bookkeeping in 2022. The owner has asked you to help explain why the sales recorded in Quickbooks are lower than the sales she can see on her Shopify eCommerce platform. You realize the difference is that Quickbooks only records sales net of bank processing fees. Write an email to the client explaining what they need to do to correct their books for 2022 . A 20% downpayment for the invoice amounting to $50,000 was paid for the purchase of raw materials. Client Scenarios One of the most important aspects of this role is being able to communicate financial and accounting concepts to our clients, who usually do not have a finance background. Below are some client scenarios and questions, and the aim of this exercise is to see how well you can explain accounting concepts to non-experts. Things to consider: These are client emails, so remember to use easily understandable language. No one wants to read very long emails, so try and be as succinct as possible. Scenario 1 'DIY Stores' is a client who did their own bookkeeping in 2022, and we are now reviewing their accounts as part of the 2022 Financial Reports and Tax preparation work we are performing. You notice that the payroll software automatically posts journals every month into Quickbooks, with amounts owing to employees and tax authorities shown as liabilities on the balance sheet. However, the client has booked all payments made to employees and tax authorities straight to the expense account on the P\&L. Write a brief email to the client explaining why there is an overstated liability on the balance sheet, and why they need to record payments against the liability rather than straight to the P\&L. Scenario 2 'Crypto CatCoin' is a cryptocurrency company, and it's started to pay it's employees in crypto instead of fiat currency. In Canada crypto currency is taxed as though it were a financial asset, meaning that there is a capital gain or loss every time a token is sold. Normal accounting software like Quickbooks aren't set up to deal with the capital gains caused by crypto, so we will need to onboard the client onto a crypto specific accounting software, in addition to their Quickbooks software. Write an email to the client explaining why we need to set them up on a crypto accounting software, and informing them that they will have to pay an additional $100 per month in software subscription fees. Scenario 3 'Computer XYZ' is an eCommerce client owned by a husband and wife. They pay for a lot of clearly personal items using the company card (music subscription, football match tickets, and personal clothes). We have been doing the books for them throughout 2022 , and at the end of the year they are surprised to discover that there is a large shareholder loan shown as owing from them to the company. Please explain to the client how personal expenses by directors are accounted for and why this means they are shown as owing the company money. Scenario 4 'Deals Deals Deals' is an ecommerce company that did their own bookkeeping in 2022. The owner has asked you to help explain why the sales recorded in Quickbooks are lower than the sales she can see on her Shopify eCommerce platform. You realize the difference is that Quickbooks only records sales net of bank processing fees. Write an email to the client explaining what they need to do to correct their books for 2022 . A 20% downpayment for the invoice amounting to $50,000 was paid for the purchase of raw materials

Client Scenarios One of the most important aspects of this role is being able to communicate financial and accounting concepts to our clients, who usually do not have a finance background. Below are some client scenarios and questions, and the aim of this exercise is to see how well you can explain accounting concepts to non-experts. Things to consider: These are client emails, so remember to use easily understandable language. No one wants to read very long emails, so try and be as succinct as possible. Scenario 1 'DIY Stores' is a client who did their own bookkeeping in 2022, and we are now reviewing their accounts as part of the 2022 Financial Reports and Tax preparation work we are performing. You notice that the payroll software automatically posts journals every month into Quickbooks, with amounts owing to employees and tax authorities shown as liabilities on the balance sheet. However, the client has booked all payments made to employees and tax authorities straight to the expense account on the P\&L. Write a brief email to the client explaining why there is an overstated liability on the balance sheet, and why they need to record payments against the liability rather than straight to the P\&L. Scenario 2 'Crypto CatCoin' is a cryptocurrency company, and it's started to pay it's employees in crypto instead of fiat currency. In Canada crypto currency is taxed as though it were a financial asset, meaning that there is a capital gain or loss every time a token is sold. Normal accounting software like Quickbooks aren't set up to deal with the capital gains caused by crypto, so we will need to onboard the client onto a crypto specific accounting software, in addition to their Quickbooks software. Write an email to the client explaining why we need to set them up on a crypto accounting software, and informing them that they will have to pay an additional $100 per month in software subscription fees. Scenario 3 'Computer XYZ' is an eCommerce client owned by a husband and wife. They pay for a lot of clearly personal items using the company card (music subscription, football match tickets, and personal clothes). We have been doing the books for them throughout 2022 , and at the end of the year they are surprised to discover that there is a large shareholder loan shown as owing from them to the company. Please explain to the client how personal expenses by directors are accounted for and why this means they are shown as owing the company money. Scenario 4 'Deals Deals Deals' is an ecommerce company that did their own bookkeeping in 2022. The owner has asked you to help explain why the sales recorded in Quickbooks are lower than the sales she can see on her Shopify eCommerce platform. You realize the difference is that Quickbooks only records sales net of bank processing fees. Write an email to the client explaining what they need to do to correct their books for 2022 . A 20% downpayment for the invoice amounting to $50,000 was paid for the purchase of raw materials. Client Scenarios One of the most important aspects of this role is being able to communicate financial and accounting concepts to our clients, who usually do not have a finance background. Below are some client scenarios and questions, and the aim of this exercise is to see how well you can explain accounting concepts to non-experts. Things to consider: These are client emails, so remember to use easily understandable language. No one wants to read very long emails, so try and be as succinct as possible. Scenario 1 'DIY Stores' is a client who did their own bookkeeping in 2022, and we are now reviewing their accounts as part of the 2022 Financial Reports and Tax preparation work we are performing. You notice that the payroll software automatically posts journals every month into Quickbooks, with amounts owing to employees and tax authorities shown as liabilities on the balance sheet. However, the client has booked all payments made to employees and tax authorities straight to the expense account on the P\&L. Write a brief email to the client explaining why there is an overstated liability on the balance sheet, and why they need to record payments against the liability rather than straight to the P\&L. Scenario 2 'Crypto CatCoin' is a cryptocurrency company, and it's started to pay it's employees in crypto instead of fiat currency. In Canada crypto currency is taxed as though it were a financial asset, meaning that there is a capital gain or loss every time a token is sold. Normal accounting software like Quickbooks aren't set up to deal with the capital gains caused by crypto, so we will need to onboard the client onto a crypto specific accounting software, in addition to their Quickbooks software. Write an email to the client explaining why we need to set them up on a crypto accounting software, and informing them that they will have to pay an additional $100 per month in software subscription fees. Scenario 3 'Computer XYZ' is an eCommerce client owned by a husband and wife. They pay for a lot of clearly personal items using the company card (music subscription, football match tickets, and personal clothes). We have been doing the books for them throughout 2022 , and at the end of the year they are surprised to discover that there is a large shareholder loan shown as owing from them to the company. Please explain to the client how personal expenses by directors are accounted for and why this means they are shown as owing the company money. Scenario 4 'Deals Deals Deals' is an ecommerce company that did their own bookkeeping in 2022. The owner has asked you to help explain why the sales recorded in Quickbooks are lower than the sales she can see on her Shopify eCommerce platform. You realize the difference is that Quickbooks only records sales net of bank processing fees. Write an email to the client explaining what they need to do to correct their books for 2022 . A 20% downpayment for the invoice amounting to $50,000 was paid for the purchase of raw materials Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started