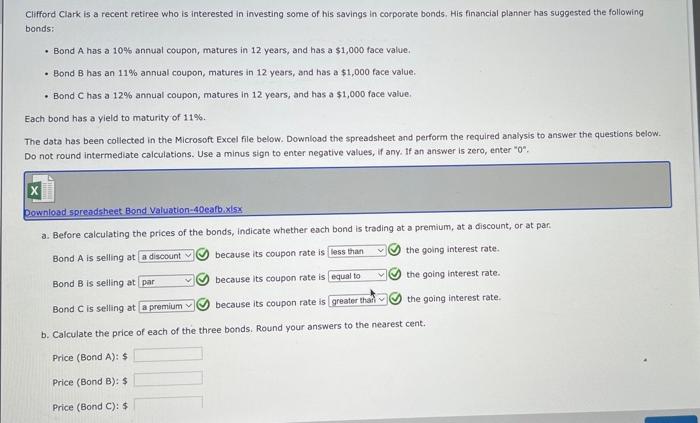

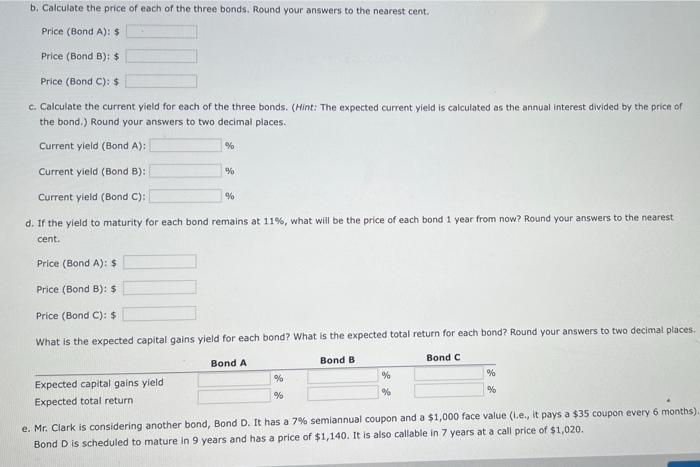

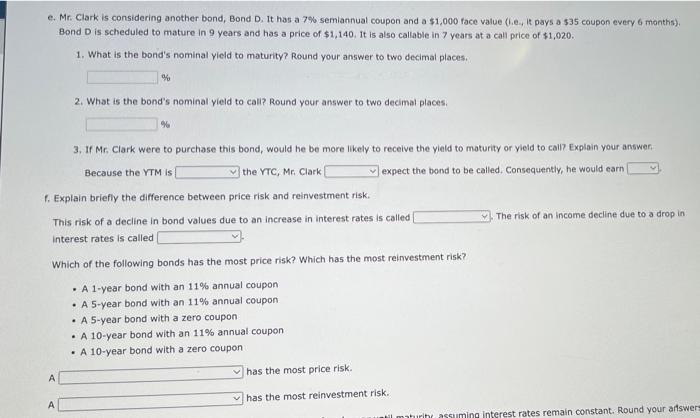

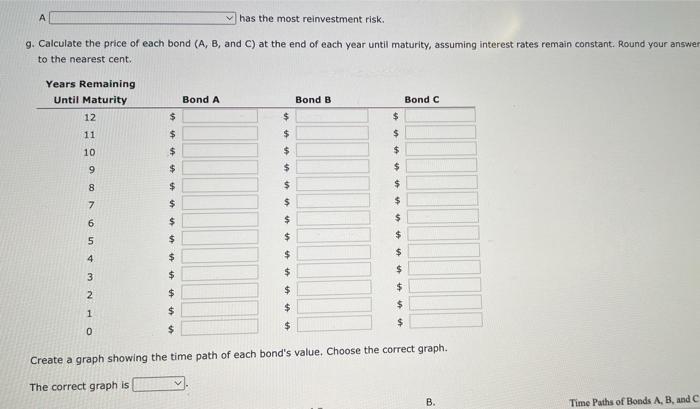

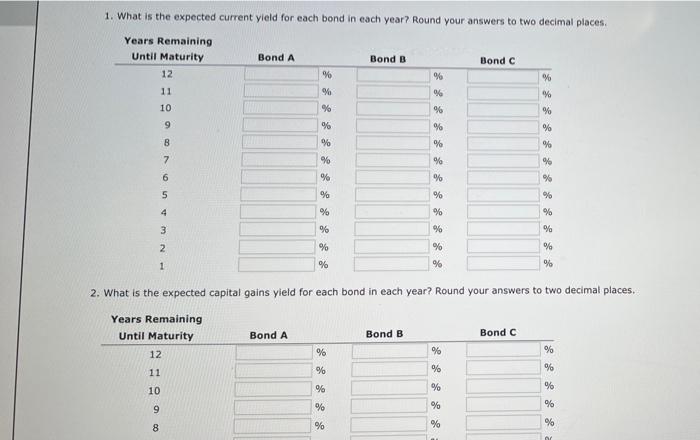

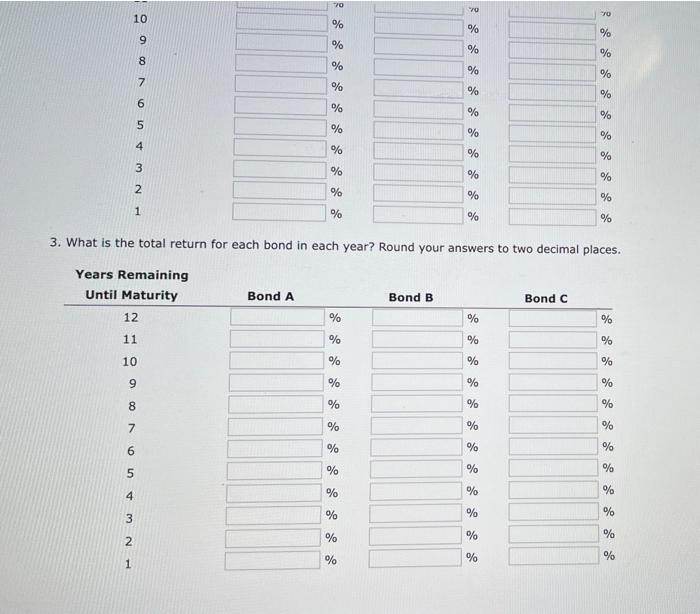

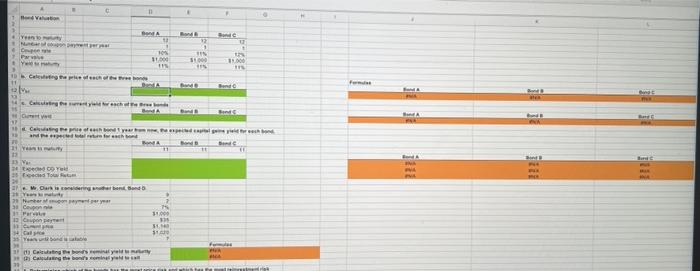

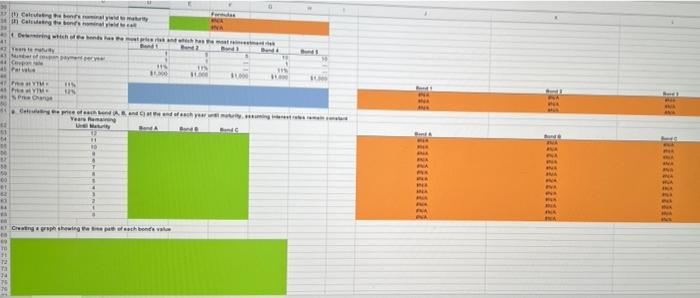

Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: a Bond A has a 10% annual coupon, matures in 12 years, and has a $1,000 face value Bond B has an 11% annual coupon, matures in 12 years, and has a $1,000 face value Bond C has a 12% annual coupon, matures in 12 years, and has a $1,000 face value Each bond has a yield to maturity of 11%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter "O", Download spreadsheet Bond Valuation 4Deafb.xlsx a. Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par. Bond A is selling at a discount because its coupon rate is less than the going interest rate. Bond Bis selling at par because its coupon rate is equal to the going interest rate. Bond C is selling at a premium because its coupon rate is greater than the going interest rate b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): $ Price (Bond B): 5 Price (Bond C): $ b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): $ Price (Bond B): $ Price (Bond C): $ c. Calculate the current yield for each of the three bonds. (Hint: The expected current yield is calculated as the annual interest divided by the price of the bond.) Round your answers to two decimal places. Current yield (Bond A): % Current yield (Bond B): % Current yield (Bond C): % d. If the yield to maturity for each bond remains at 11%, what will be the price of each bond 1 year from now? Round your answers to the nearest cent. Price (Bond A): $ Price (Bond B): 5 Price (Bond C): $ What is the expected capital gains yleld for each bond? What is the expected total return for each bond? Round your answers to two decimal places. Bond A Bond B Bond C Expected capital gains yield % % Expected total return % % % e. Mr. Clark is considering another bond, Bond D. It has a 7% semiannual coupon and a $1,000 face value (l.e., it pays a $35 coupon every 6 months). Bond D is scheduled to mature in 9 years and has a price of $1,140. It is also callable in 7 years at a call price of $1,020. e. Mr. Clark is considering another bond, Bond D. It has a 7% semiannual coupon and a $1,000 face value (... It pays a 535 coupon every 6 months) Bond D is scheduled to mature in 9 years and has a price of $1,140. It is also callable in 7 years at a call price of $1,020. 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. % 2. What is the bond's nominal yield to call? Round your answer to two decimal places % 3. If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain your answer Because the YTM IS the VTC, Mr. Clark expect the bond to be called. Consequently, he would earn 1. Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond values due to an increase in interest rates is called The risk of an income decline due to a drop in Interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? A 1-year bond with an 11% annual coupon A 5-year bond with an 11% annual coupon A 5-year bond with a zero coupon A 10-year bond with an 11% annual coupon A 10-year bond with a zero coupon has the most price risk. A has the most reinvestment risk. A il maturit assuming interest rates remain constant. Round your artswers A has the most reinvestment risk. 9. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Round your answer to the nearest cent. Years Remaining Until Maturity 12 Bond A Bond B Bond C $ $ $ $ 11 10 $ $ $ $ $ $ $ 9 $ 8 $ $ 7 $ $ $ $ $ $ 6 $ $ 5 $ $ $ $ $ 4 $ 3 $ 2 $ $ $ $ $ M N O $ 1 $ $ $ $ Create a graph showing the time path of each bond's value. Choose the correct graph. The correct graph is B. Time Paths of Bonds A, B, and C 1. What is the expected current yield for each bond in each year? Round your answers to two decimal places Years Remaining Until Maturity 12 Bond A Bond B Bond C % 11 % %% % % yo 10 9 % 9 % % % % % % 7 % % % % 6 % % 5 % % % 4 % % % 3 % % % 2 % % % % 1 % % 2. What is the expected capital gains yield for each bond in each year? Round your answers to two decimal places. Years Remaining Until Maturity 12 Bond A Bond B Bond C % % % 11 % % % 10 9% % % % 9 % % 8 % % % 70 70 70 10 % % % 9 % % % 8 % No o o % % % % % 6 % % % 5 % % % 4 % % % 3 % NW % % 2 % % % 1 % % % 3. What is the total return for each bond in each year? Round your answers to two decimal places. Years Remaining Until Maturity 12 Bond A Bond B Bond C % % % 11 % % % 10 % % % 9 % % % 8 % % % 7 % % % % % % % % % % % % % % % % % 2 % % % 1 % 11 AP OLA BA Rand 11 1 10% 11.00 51000 19.000 . Calgar 11 Calengerechter 7 Congo year dure for each 11 13 EV BOY 35 cd Tom BEM Clarks andering en ondb 7 pery 3 Coupon Farm 13 Cup al m! INTE 11.000 3 11 ) Casting abiye Cong the body + Cathy m Calathe bonds NE w IN 11 VIN 4 M SPO 13! w And and of Years 1 14 H 10 NA 3 T BA 00 1 F NE Creating graph showing of each bondaval T2 FE 79 Ver 100 00 NA CA MA 194 OF C Hea F 1 WA 123 133 Year wy 124 134 Shoot HE -1111 Cheap You tam 123 Bunda - jam B donde 18 . HER 12 10 0 1 2 Ski AP 141 DE 14 A *