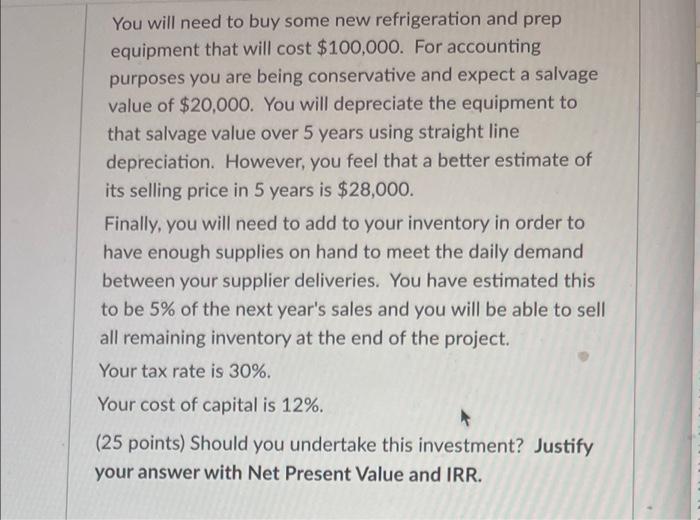

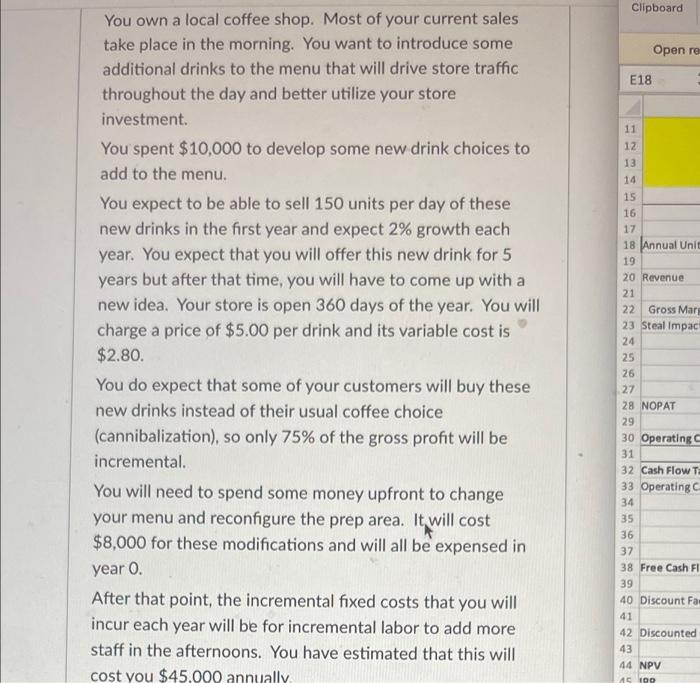

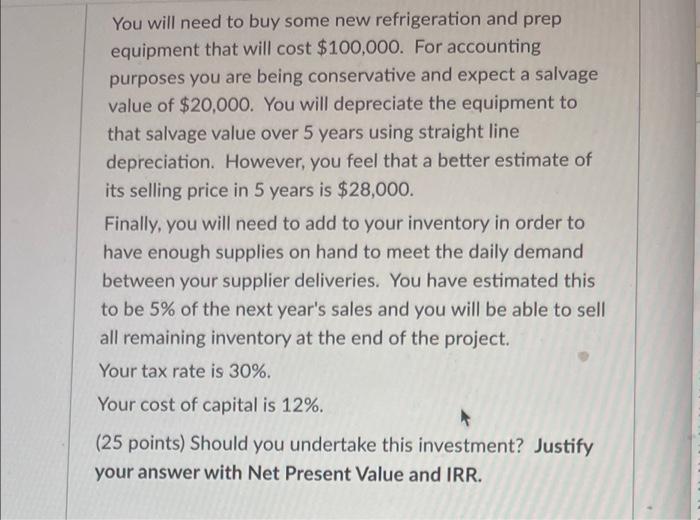

Clipboard Open ro E18 Ne You own a local coffee shop. Most of your current sales take place in the morning. You want to introduce some additional drinks to the menu that will drive store traffic throughout the day and better utilize your store investment. You spent $10,000 to develop some new drink choices to add to the menu. You expect to be able to sell 150 units per day of these new drinks in the first year and expect 2% growth each year. You expect that you will offer this new drink for 5 years but after that time, you will have to come up with a new idea. Your store is open 360 days of the year. You will charge a price of $5.00 per drink and its variable cost is $2.80. You do expect that some of your customers will buy these new drinks instead of their usual coffee choice (cannibalization), so only 75% of the gross profit will be incremental. You will need to spend some money upfront to change your menu and reconfigure the prep area. It will cost $8,000 for these modifications and will all be expensed in 11 12 13 14 15 16 17 18 Annual Unit 19 20 Revenue 21 22 Gross Mar 23 Steal Impac 24 25 26 27 28 NOPAT 29 30 Operating 31 32 Cash Flow T 33 Operating 34 35 36 37 38 Free Cash Fl 39 40 Discount Fa year 0. 41 After that point, the incremental fixed costs that you will incur each year will be for incremental labor to add more staff in the afternoons. You have estimated that this will cost you $45.000 annually 42 Discounted 43 44 NPV ACTO You will need to buy some new refrigeration and prep equipment that will cost $100,000. For accounting purposes you are being conservative and expect a salvage value of $20,000. You will depreciate the equipment to that salvage value over 5 years using straight line depreciation. However, you feel that a better estimate of its selling price in 5 years is $28,000. Finally, you will need to add to your inventory in order to have enough supplies on hand to meet the daily demand between your supplier deliveries. You have estimated this to be 5% of the next year's sales and you will be able to sell all remaining inventory at the end of the project. Your tax rate is 30%. Your cost of capital is 12%. (25 points) Should you undertake this investment? Justify your answer with Net Present Value and IRR. D A E F G H Year o 1 54,000 3 56,181.60 55,080 57,305.23 58,451.34 16 17 1 Annual Units 19 20 Revenue 21 22 Gross Margin 23 Steal Impact 24 25 36 27 28 NOPAT 19 10 Operating Cash Flow 11 2 Cash Flow Table a Operating Cash Flow (from above) 4 5 6 2 Free Cash Flow 9 D Discount Factor 1 2 Discounted Cash Flow 3 3 NPV IRR S $ $ Investment Beginning Book Value Year 3 5 Exam Tamnista