Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Close this question, please, I don't need it anymore. Thanks!! 1 eBook Worley Company buys surgical supplies from a variety of manufacturers and then resells

Close this question, please, I don't need it anymore. Thanks!!

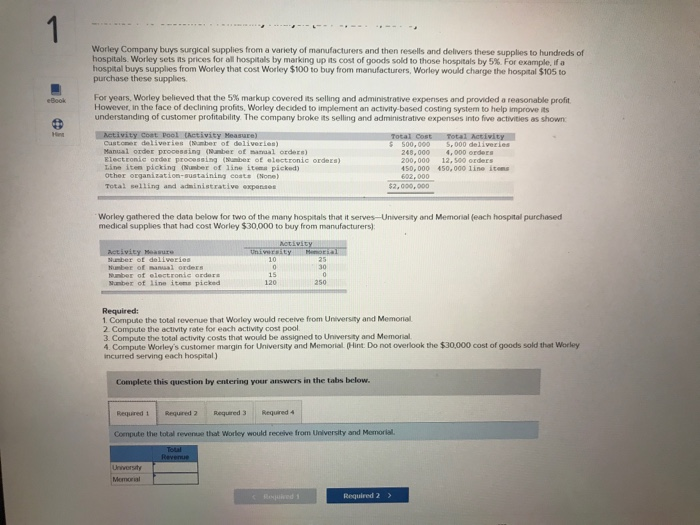

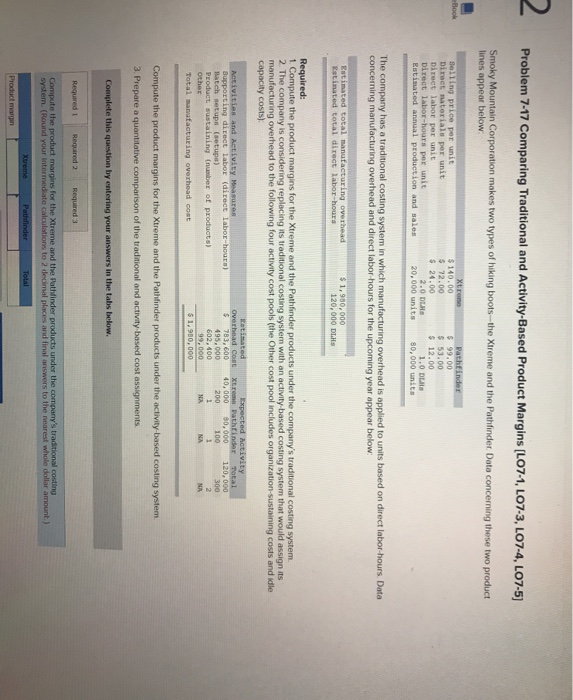

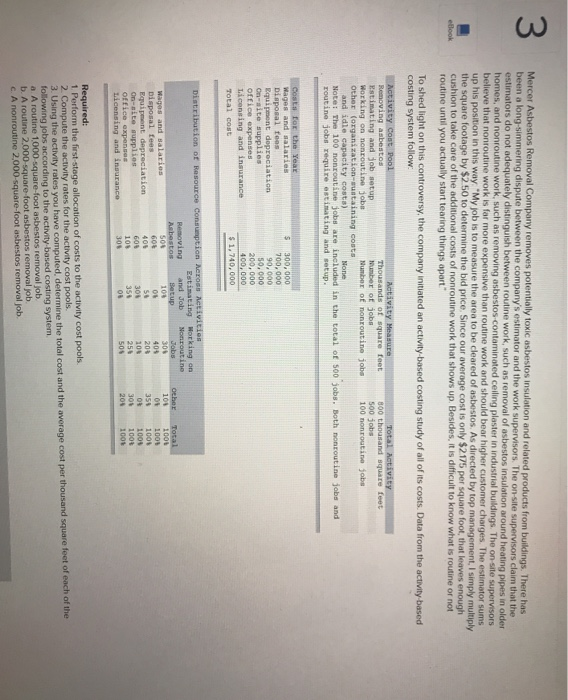

1 eBook Worley Company buys surgical supplies from a variety of manufacturers and then resells and delivers these supplies to hundreds of hospitals. Worley sets its prices for all hospitals by marking up its cost of goods sold to those hospitals by 5%. For example, if a hospital buys supplies from Worley that cost Worley $100 to buy from manufacturers, Worley would charge the hospital $105 to purchase these supplies For years, Worley believed that the 5% markup covered its selling and administrative expenses and provided a reasonable profit However, in the face of declining profits, Worley decided to implement an activity-based costing system to help improve its understanding of customer profitability. The company broke its selling and administrative expenses into five activities as shown Activity Cost Pool (ctivity Measure) Total Cost Total Activity Customer deliveries (amber of deliveries) $ 500,000 5,000 deliveries Manual order processing anber of manual orders) 248,000,000 orders Electronic order processing (amber of electronic orders) 200,000 12.500 orders Line item picking Number of line to picked) 450,000 450.000 line items other organization-sustaining coats None) 602,000 Total selling and administrative expenses $2,000,000 Worley gathered the data below for two of the many hospitals that it serves - University and Memorial (each hospital purchased medical supplies that had cost Worley $30,000 to buy from manufacturers) Mtivity Activity Mar Unity Mia Number of deliveries 25 Number of mansal orders 0 30 Number of electronic orders 15 0 Namber of line items picked 120 250 10 Required: 1. Compute the total revenue that Worley would receive from University and Memorial 2. Compute the activity rate for each activity cost pool 3. Compute the total activity costs that would be assigned to University and Memorial 4. Compute Worley's customer margin for University and Memorial Hint: Do not overlook the $30,000 cost of goods sold that Worley incurred serving each hospital) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required 4 Compute the total revenue that Worley would receive from University and Memorial Total Revenue University Memorial Required 2) Problem 7-17 Comparing Traditional and Activity-Based Product Margins (L07-1, LO7-3, L07-4, LO7-5) Smoky Mountain Corporation makes two types of hiking boots-the Xtreme and the Pathfinder. Data concerning these two product lines appear below Book Selling price per unit Direct materiale per unit Direct labor per unit Direct labor-hours per unit Estimated annual production and sales Xtreme $140.00 $ 72.00 $ 24.00 2.0 DE 20,000 units Pathfinder $99.00 $ 53.00 $ 12.00 1.0 D 80,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor hours Data concerning manufacturing overhead and direct labor hours for the upcoming year appear below Estimated total manufacturing overhead Estimated total direct labor-hours $ 1,980,000 120,000 DLHS Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system 2. The company is considering replacing its traditional costing system with an activity based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs) Estimated Activities and activity Measures Overhead Coat Xtreme Pathfinder Expected Activity Total Supporting direct labor (direct labor-hours) $ 783, 600 40,000 80,000 120,000 Batch setups (setup) 495.000 200 100 300 Product sustaining number of products) 602,400 1 1 2 othes 99.000 NA NA NA Total manufacturing overhead cost $1,900,000 Compute the product margins for the Xtreme and the Pathfinder products under the activity based costing system. 3. Prepare a quantitative comparison of the traditional and activity based cost assignments Complete this question by entering your answers in the tabs below. Required Required 2 Required 3 Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) Xtreme Pathfinder Total Product margin 3 Mercer Asbestos Removal Company removes potentially toxic asbestos insulation and related products from buildings. There has been a long-simmering dispute between the company's estimator and the work supervisors. The on-site supervisors claim that the estimators do not adequately distinguish between routine work, such as removal of asbestos insulation around heating pipes in older homes, and nonroutine work, such as removing asbestos contaminated ceiling plaster in industrial buildings. The on-site supervisors believe that nonroutine work is far more expensive than routine work and should bear higher customer charges. The estimator sums up his position in this way "My job is to measure the area to be cleared of asbestos. As directed by top management, I simply multiply the square footage by $250 to determine the bid price. Since our average cost is only $2175 per square foot, that leaves enough cushion to take care of the additional costs of nonroutine work that shows up. Besides, it is difficult to know what is routine or not routine until you actually start tearing things apart." eBook To shed light on this controversy, the company initiated an activity-based costing study of all of its costs. Data from the activity based costing system follow: Activity Cont Pool Activity Measure Total Activity Removing asbestos Thousands of square feet 800 thousand square feet Estimating and job setup Number of jobs 500 jobs Working on nonroutine jobs Number of nonroutine jobs 100 no routine jobs other organization-wuitaining conta and idle capacity costa) None Note: The 100 no routine Jobs are included in the total of 500 jobs. Both no routine jobs and routine jobs require estimating and setup. Cost for the Year Wages and salaries Disposal fees Equipment depreciation On-site supplies office expenses Licensing and insurance Total cost 300,000 700,000 90,000 50.000 200,000 400,000 $ 1,740,000 100 Distribution of Resource consumption heross Activities Estimating Working on Removing and Job Non routine Asbestos Setup Jobs Wages and salarios 300 Disposal fees 605 os 403 Equipment depreciation 405 56 208 On-site supplies 605 301 103 office expenses 105 350 256 Licensing and insurance 305 os 505 other 101 08 356 08 305 205 Total 1001 1001 1001 1005 1000 1001 Required: 1 Perform the first stage allocation of costs to the activity cost pools 2. Compute the activity rates for the activity cost pools 3. Using the activity rates you have computed, determine the total cost and the average cost per thousand square feet of each of the following jobs according to the activity-based costing system a A routine 1000 square foot asbestos removal job b. A routine 2,000 square-foot asbestos removal job c. A nonroutine 2,000-square-foot asbestos removal job Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started