Question

Closets & More is an all-equity company without any debt at the moment. The cost of equity of Closets & More is currently 11.2

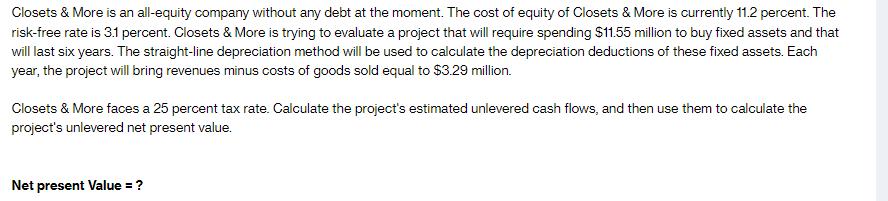

Closets & More is an all-equity company without any debt at the moment. The cost of equity of Closets & More is currently 11.2 percent. The risk-free rate is 3.1 percent. Closets & More is trying to evaluate a project that will require spending $11.55 million to buy fixed assets and that will last six years. The straight-line depreciation method will be used to calculate the depreciation deductions of these fixed assets. Each year, the project will bring revenues minus costs of goods sold equal to $3.29 million. Closets & More faces a 25 percent tax rate. Calculate the project's estimated unlevered cash flows, and then use them to calculate the project's unlevered net present value. Net present Value = ?

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the present value of each years cash flow Given Unlevered Cash Flows UCF per year 2948750 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App