Question

CLOUD 9 Assignment 2 You are a graduate working for W&S Partners, a Canadian accounting firm with offices located in each of Canadas major cities.

CLOUD 9 Assignment 2 You are a graduate working for W&S Partners, a Canadian accounting firm with offices located in each of Canadas major cities. W&S Partners has just been awarded the December 31, 2023, audit for Cloud 9 Ltd. (Cloud 9). The audit team assigned to this client is:

Jo Wadley, partner

Sharon Gallagher, audit manager

Josh Thomas and Suzie Pickering, audit seniors

Mark Batten, IT audit manager

Ian Harper and you, graduates

PART 1 Materiality, Analytical Procedures, Sampling W&S Partners commenced the risk assessment phase of the Cloud 9 audit with procedures to gain an understanding of the clients structure and its business environment. You have completed your research on the key market forces as they relate to Cloud 9s operations. The topics you researched included the general and industry-specific economic trends and conditions; the competitive environment; product, customer, and supplier information; technological advances and the effect of the Internet; and laws and regulatory requirements. The purpose of this research is to identify the inherent risks. The auditor needs to identify which financial statement assertions may be affected by these inherent risks. Identifying the risks will help determine the nature of the audit procedures to be performed. Through your analysis you have determined that the Inherent Risk is High.

Management implicitly or explicitly makes assertions regarding the recognition, measurement, presentation, and disclosure of the various elements of the financial statements. Auditors use assertions for account balances to form a basis for the assessment of risks of material misstatement. That is, assertions are used to identify the types of errors that could occur in transactions that result in the account balance. Consequently, further breaking down the account into these assertions will direct the audit effort to those areas of higher risk. The auditors broadly classify assertions as existence or occurrence; completeness; valuation or allocation; rights and obligations; and presentation and disclosure.

An additional task during the risk assessment phase is to consider the concept of materiality as it applies to the client. The auditor will design procedures in order to identify and correct errors or irregularities that would have a material effect on the financial statements and affect the decision-making of the users of the financial statements. Materiality is used in determining audit procedures and sample selections, and in evaluating differences between client records and audit results. It is the maximum amount of misstatement, individually or in aggregate, that can be accepted in the financial statements. In selecting the base figure to be used to calculate materiality, an auditor should consider the key drivers of the business and ask, What are the end users (that is, shareholders, banks, and so on) of the accounts going to be looking at? For example, will shareholders be interested in profit figures that can be used to pay dividends and increase share price?

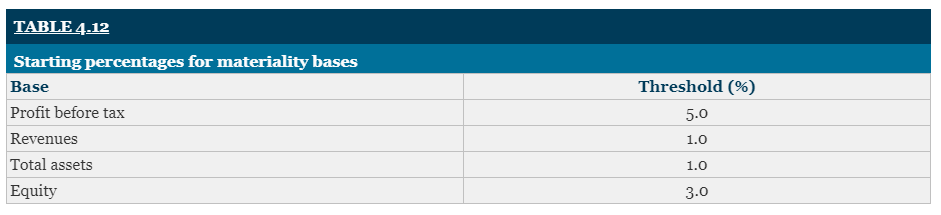

W&S Partners audit methodology dictates that one planning materiality (PM) amount is to be used for the financial statements as a whole. Further, only one basis should be selecteda blended approach or average should not be used. The basis selected is the one determined to be the key driver of the business. W&S Partners uses the percentages in table 4.12 as starting points for the various bases. These starting points can be increased or decreased by taking into account qualitative client factors, such as:

the nature of the clients business and industry (for example, rapidly changing through growth or downsizing, or because of an unstable environment)

whether the client is a public company (or subsidiary of one) that is subject to regulations

the knowledge of or high risk of fraud.

Typically, profit before tax is used; however, it cannot be used if reporting a loss for the year or if profitability is not consistent.

When calculating PM based on interim figures, it may be necessary to annualize the results. This allows the auditor to plan the audit properly based on an approximate projected year-end balance. Then, at year end, the figure is adjusted, if necessary, to reflect the actual results.

Required :

Answer the following questions based on the information presented for Cloud 9 in Appendix A to this book and in the current and earlier chapters. You should also consider your answers to the case study questions in earlier chapters.

Using the December 31, 2023, trial balance (in Appendix A), calculate planning materiality and include the justification for the basis that you have used for your calculation.

Using analytical procedures and the information provided in the appendix, perform preliminary analytics of Cloud 9s financial position and its business risks. Discuss the ratios indicating a significant or an unexpected fluctuation.

Which specific areas do you believe should receive special emphasis during your audit? Consider your discussion of the results of analytical procedures as well as your preliminary estimate of materiality. Prepare a memorandum to Suzie Pickering outlining potential problem areas (that is, where possible material misstatements in the financial report exist) and any other special concerns (for example, going concern). Specify the relevant accounts and the related risks that would require particular attention.

Consider and explain the effects that the opening of Cloud 9s first retail store would have on its accounting.

Describe how this business change would affect the components of audit risk.

What changes would you expect to see in inventory transactions and balances as Cloud 9 changes from a wholesale-only business to a retail and wholesale business? Be specific in your answer.

Which inventory balance and transaction assertions would be most affected? Explain.

Describe the population(s) and suggest a sampling approach for controls and substantive testing for inventory.

PART 2 Control Testing & Data Analytics Sharon Gallagher and Josh Thomas have assessed the internal controls at Cloud 9 as being effective at an entity level. This means that, at a high level, the company demonstrates an environment where potential material misstatements are prevented or detected.

Required:

You have been assigned the task of documenting the understanding of the process for recording sales, trade receivables, and cash receipt transactions for wholesale customers. In your absence, Josh met with the Cloud 9 financial controller, Carla Johnson, and received permission to tape the interview, which is provided as a transcript (see Appendix A). Using this interview transcript and other information presented in the case, you are asked to:

1. Prepare a flowchart or narrative documenting your understanding of the sales to cash receipts process for wholesale sales.

2. Identify any follow-up questions you would like to ask the client if aspects of the process are not adequately explained. You could address such questions to Carla Johnson or any other employee you deem appropriate.

3. Draw up a worksheet using the following format.

Use the column Potential Material Misstatement and identify the potential material misstatements that could occur in the sales to cash receipts process. Use as many rows as you need. Identify the potential material misstatements that could occur in the sales to cash receipts process for wholesale sales. Using the material misstatements identified, complete the third column Assertions to identify the financial statement assertion that is affected for each potential material misstatement. Lastly, in column four, include the transaction-level internal controls Cloud 9 has implemented to prevent and/or detect potential errors.

4. During discussions with management, Josh asked how often the product prices are changed. Carla Johnson, the Financial Controller, responded that they didnt change that often. Describe a data analytics technique that could be used to corroborate Carlas statement using the five-step approach. Be specific in identifying a logical source that Josh might be able to obtain data from in order to better understand pricing fluctuations.

TABLE 4.12 Starting percentages for materiality bases Base Profit before tax Revenues Total assets Equity Threshold (%) 5.0 1.0 1.0 3.0 Significant Process Potential Material Misstatement Assertions Transaction-Level Controls TABLE 4.12 Starting percentages for materiality bases Base Profit before tax Revenues Total assets Equity Threshold (%) 5.0 1.0 1.0 3.0 Significant Process Potential Material Misstatement Assertions Transaction-Level ControlsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started