Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clyde Corp. is considering the purchase of a new place of equipment. The cost savings from the equipment would result in an annual Increase in

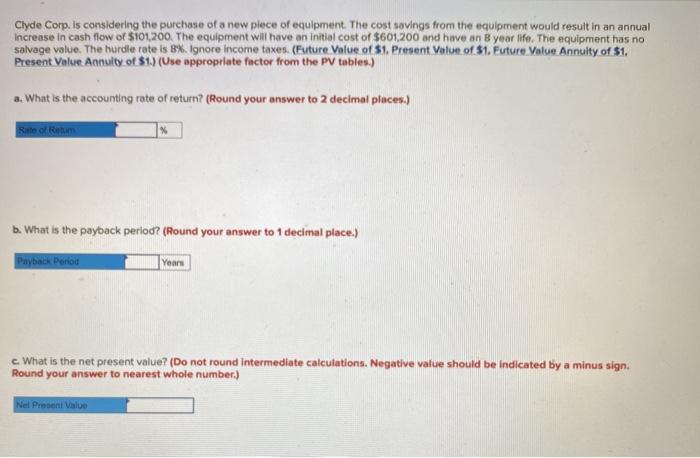

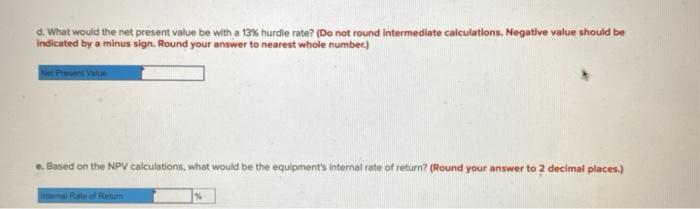

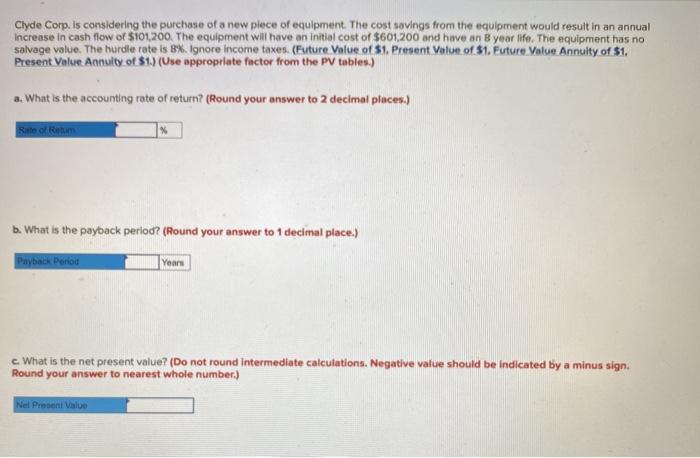

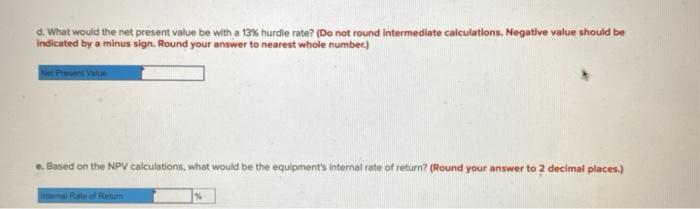

Clyde Corp. is considering the purchase of a new place of equipment. The cost savings from the equipment would result in an annual Increase in cash flow of $101,200. The equipment will have an initial cost of $601,200 and have an 8 year life. The equipment has no salvage value. The hurdle rate is 8%. Ignore income taxes. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor from the PV tables.) a. What is the accounting rate of return? (Round your answer to 2 decimal places.) Bite of Reum b. What is the payback period? (Round your answer to 1 decimal place.) Payback Period Years c. What is the net present value? (Do not round intermediate calculations. Negative value should be indicated by a minus sign. Round your answer to nearest whole number.) Nel Present Value d. What would the net present value be with a 13% hurdle rate? (Do not round Intermediate calculations. Negative value should be Indicated by a minus sign. Round your answer to nearest whole number.) Person e. Based on the NPV calculations, what would be the equipment's internal rate of return? (Round your answer to 2 decimal places.)

Clyde Corp. is considering the purchase of a new place of equipment. The cost savings from the equipment would result in an annual Increase in cash flow of $101,200. The equipment will have an initial cost of $601,200 and have an 8 year life. The equipment has no salvage value. The hurdle rate is 8%. Ignore income taxes. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor from the PV tables.) a. What is the accounting rate of return? (Round your answer to 2 decimal places.) Bite of Reum b. What is the payback period? (Round your answer to 1 decimal place.) Payback Period Years c. What is the net present value? (Do not round intermediate calculations. Negative value should be indicated by a minus sign. Round your answer to nearest whole number.) Nel Present Value d. What would the net present value be with a 13% hurdle rate? (Do not round Intermediate calculations. Negative value should be Indicated by a minus sign. Round your answer to nearest whole number.) Person e. Based on the NPV calculations, what would be the equipment's internal rate of return? (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started