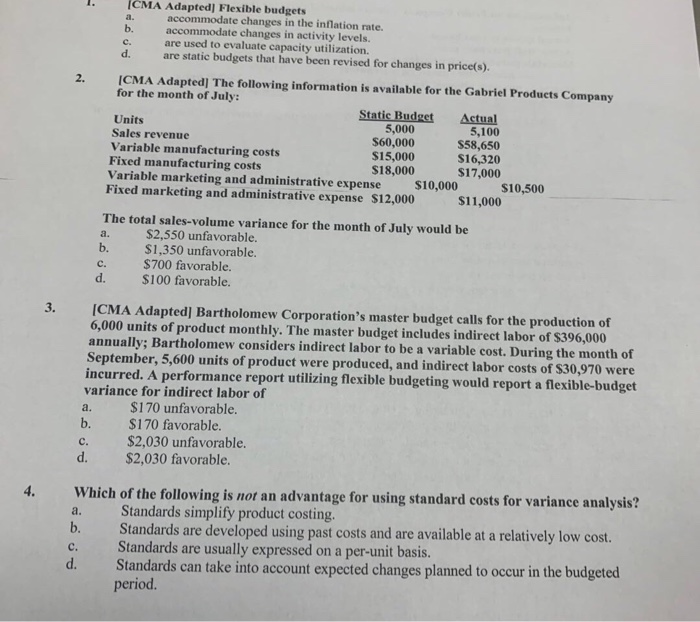

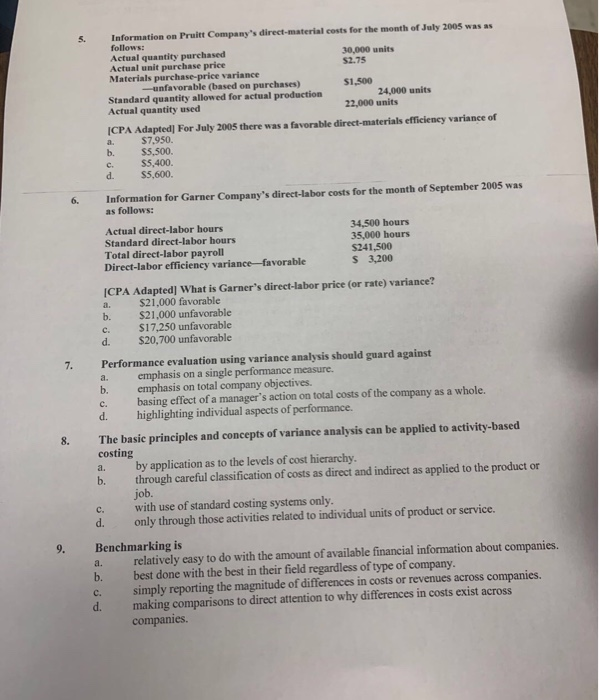

(CMA Adapted] Flexible budgets accommodate changes in the inflation rate. b. accommodate changes in activity levels. are used to evaluate capacity utilization. are static budgets that have been revised for changes in price(s). d. (CMA Adapted] The following information is available for the Gabriel Products Company for the month of July: Static Budget Actual Units 5,000 5,100 Sales revenue $60,000 $58,650 Variable manufacturing costs $15,000 S16,320 Fixed manufacturing costs $18,000 $17,000 Variable marketing and administrative expense $10,000 $10,500 Fixed marketing and administrative expense $12,000 $11,000 The total sales-volume variance for the month of July would be $2,550 unfavorable. b. $1,350 unfavorable. c. $700 favorable. d. $100 favorable. (CMA Adapted] Bartholomew Corporation's master budget calls for the production of 6,000 units of product monthly. The master budget includes indirect labor of $396,000 annually; Bartholomew considers indirect labor to be a variable cost. During the month of September, 5,600 units of product were produced, and indirect labor costs of $30.970 were incurred. A performance report utilizing flexible budgeting would report a flexible-budget variance for indirect labor of a. $170 unfavorable. b. $170 favorable. $2,030 unfavorable. $2,030 favorable. d. Which of the following is not an advantage for using standard costs for variance analysis? Standards simplify product costing. Standards are developed using past costs and are available at a relatively low cost. Standards are usually expressed on a per-unit basis. Standards can take into account expected changes planned to occur in the budgeted period. Information on Pruitt Company's direct-material costs for the month of July 2005 was as follows: Actual quantity purchased 30,000 units Actual unit purchase price $2.75 Materials purchase-price variance -unfavorable (based on purchases) $1,500 Standard quantity allowed for actual production 24,000 units Actual quantity used 22,000 units ICPA Adapted] For July 2005 there was a favorable direct-materials efficiency variance of $7.950. b. SS.500 c. $5,400. d. $5,600 Information for Garner Company's direct-labor costs for the month of September 2005 was as follows: Actual direct-labor hours 34,500 hours Standard direct-labor hours 35,000 hours Total direct-labor payroll $241,500 Direct-labor efficiency variance favorable $ 3,200 ICPA Adapted) What is Garner's direct labor price (or rate) variance? a. S21.000 favorable b. $21.000 unfavorable c. $17,250 unfavorable d. $20,700 unfavorable Performance evaluation using variance analysis should guard against emphasis on a single performance measure. b. emphasis on total company objectives. C. basing effect of a manager's action on total costs of the company as a whole. d. highlighting individual aspects of performance. The basic principles and concepts of variance analysis can be applied to activity-based costing by application as to the levels of cost hierarchy. b. through careful classification of costs as direct and indirect as applied to the product or job. c. with use of standard costing systems only. d. only through those activities related to individual units of product or service. Benchmarking is relatively easy to do with the amount of available financial information about companies. best done with the best in their field regardless of type of company. simply reporting the magnitude of differences in costs or revenues across companies. d. making comparisons to direct attention to why differences in costs exist across companies