Question

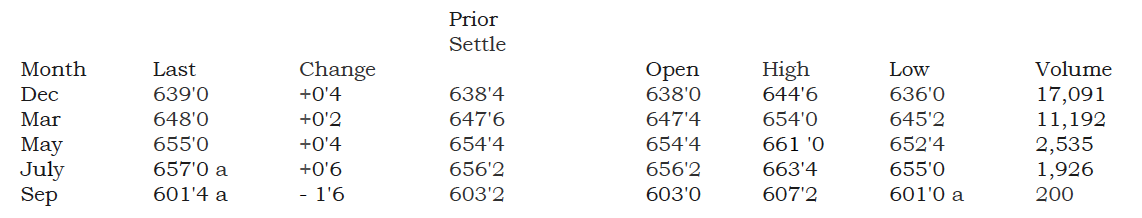

CME Corn Futures - Quotes The table above shows information on CME corn futures contracts.Prices are in cents per bushel with a minimum tick size

CME Corn Futures - Quotes

The table above shows information on CME corn futures contracts.Prices are in cents per bushel with a minimum tick size of 1/4cents per bushel. Thus, a price of quote of 601'4 is equivalent to$6.01 5 per bushel. There are 5,000 bushels per contract. Mr.Greenjeans grows corn on 2,000 acres near Sioux City Iowa. Mr.Greenjeans expects to harvest 165 bushels per acre or 330,000bushels in total. Mr. Greenjeans hopes to sell his corn for $6.015per bushel when he harvests it in September, so he uses CMESeptember corn futures contracts to lock in this price (at theprice indicated in the table).

Assume that the summer passes and September arrives. The spotprice of corn falls to $5.50/bu. Mr. Greenjeans sells his harvestlocally at the spot price. Simultaneously he executes an offsettrade in the futures market. Assume that, due to convergence, thefutures price is equal to the spot price. What are his totalproceeds from selling his com? The total proceeds include theprofit (loss) from the futures transactions.

A) *$1,984,950

B) $ 1 69,950

C) $2,1 54,900

D) $1,815,000

Looking for the process work to understand why the solutionis A) $1,984,950.

Month Dec Mar May July Sep Last 639'0 648'0 655'0 657'0 a 601'4 a Change +0'4 +0'2 +0'4 +0'6 - 1'6 Prior Settle 638'4 647'6 654'4 656'2 603'2 Open 638'0 647'4 654'4 656'2 603'0 High 644'6 654'0 661 '0 663'4 607'2 Low 636'0 645'2 652'4 655'0 601'0 a Volume 17,091 11,192 2,535 1,926 200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A futures contract is a legal agreement to buy or sell a particular commodity at a predetermined pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started