Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C-Ment Industries, Inc. is in the business of designing, manufacturing and selling concrete equipment vehicles. In 20X9, C-Ment designed and manufactured a line of

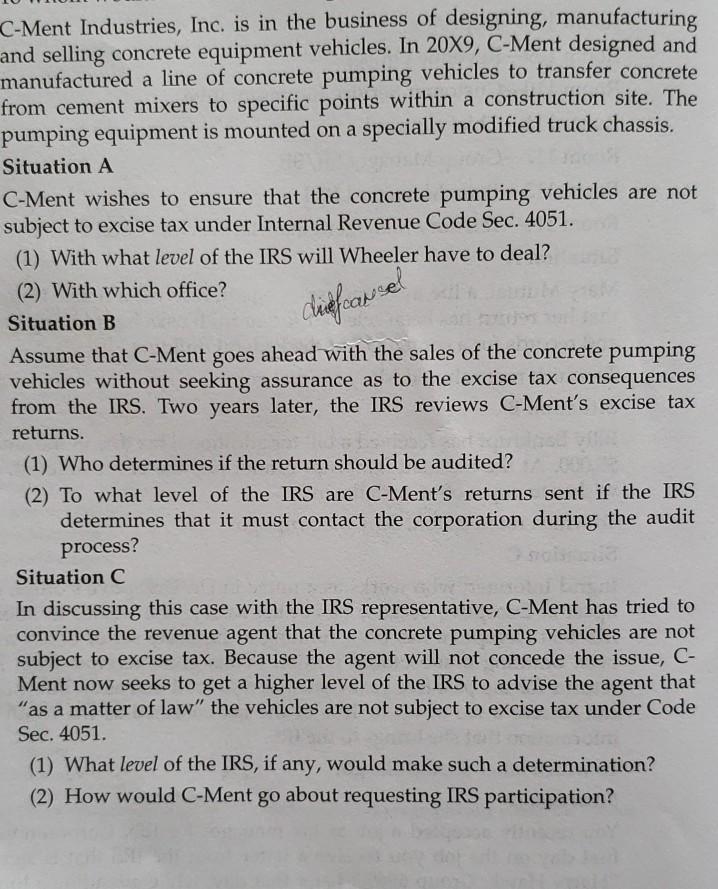

C-Ment Industries, Inc. is in the business of designing, manufacturing and selling concrete equipment vehicles. In 20X9, C-Ment designed and manufactured a line of concrete pumping vehicles to transfer concrete from cement mixers to specific points within a construction site. The pumping equipment is mounted on a specially modified truck chassis. Situation A C-Ment wishes to ensure that the concrete pumping vehicles are not subject to excise tax under Internal Revenue Code Sec. 4051. (1) With what level of the IRS will Wheeler have to deal? (2) With which office? diefcansel Situation B Assume that C-Ment goes ahead with the sales of the concrete pumping vehicles without seeking assurance as to the excise tax consequences from the IRS. Two years later, the IRS reviews C-Ment's excise tax returns. (1) Who determines if the return should be audited? (2) To what level of the IRS are C-Ment's returns sent if the IRS determines that it must contact the corporation during the audit process? Situation C In discussing this case with the IRS representative, C-Ment has tried to convince the revenue agent that the concrete pumping vehicles are not subject to excise tax. Because the agent will not concede the issue, C- Ment now seeks to get a higher level of the IRS to advise the agent that "as a matter of law" the vehicles are not subject to excise tax under Code Sec. 4051. (1) What level of the IRS, if any, would make such a determination? (2) How would C-Ment go about requesting IRS participation?

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

SITUATION A 1 The IRS will most likely deal with the concrete pumping vehicles at the manufacturing level CMent will have to ensure that the concrete pumping vehicles are not subject to excise tax und...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started