Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CMGT 5 3 3 0 Construction Cost Management HW 0 3 : Analysis of Finanolal Statement Instructor: Prof. Minkyyum Kim Total Credit: 1 0 0

CMGT Construction Cost Management

HW: Analysis of Finanolal Statement

Instructor: Prof. Minkyyum Kim

Total Credit: Points

Due: Refer to Blackboard

Course Level Objectives:

CLO: Demonstrate knowledge of construction accounting and financing managonent principles,

Weekly Learning Objectives:

WLOI: Calculate deprecation using the straightline, sumoftheyears, and decliningbalance methods.

WLO: Calculate the financial ratios for a construction company and compare them to industry averages.

Submission: Upload your homework on Blackboard as a word document. Handwritten documents are not accepted.

Rename your file as HWLasiNameFirstName.docx. Failing to follow these requirements will result in a

deduction of S points.

Assignment Descriptions:

Answer the following questions.

In your company purchased a frontend loader for $ a dump ruck for $ and a dumping

trailer pup for the dump truck for $ The frontend loader was placed in service in April and the dump

truck and dumping trailer were placed in service in July. In your company purchased three sidedump

trailers far $ each and three tractors to pull the sidedump trailers for $ each, which were placed in

service in May. In December of your company purchased a dump tnuck for $ Determine the

depreciation allowed for tax puposes for the tax year. The tux year runs fram January to December

Ignore all Section deductions. Hint: The tractors have a different recovery period than the rest of the

equipment.

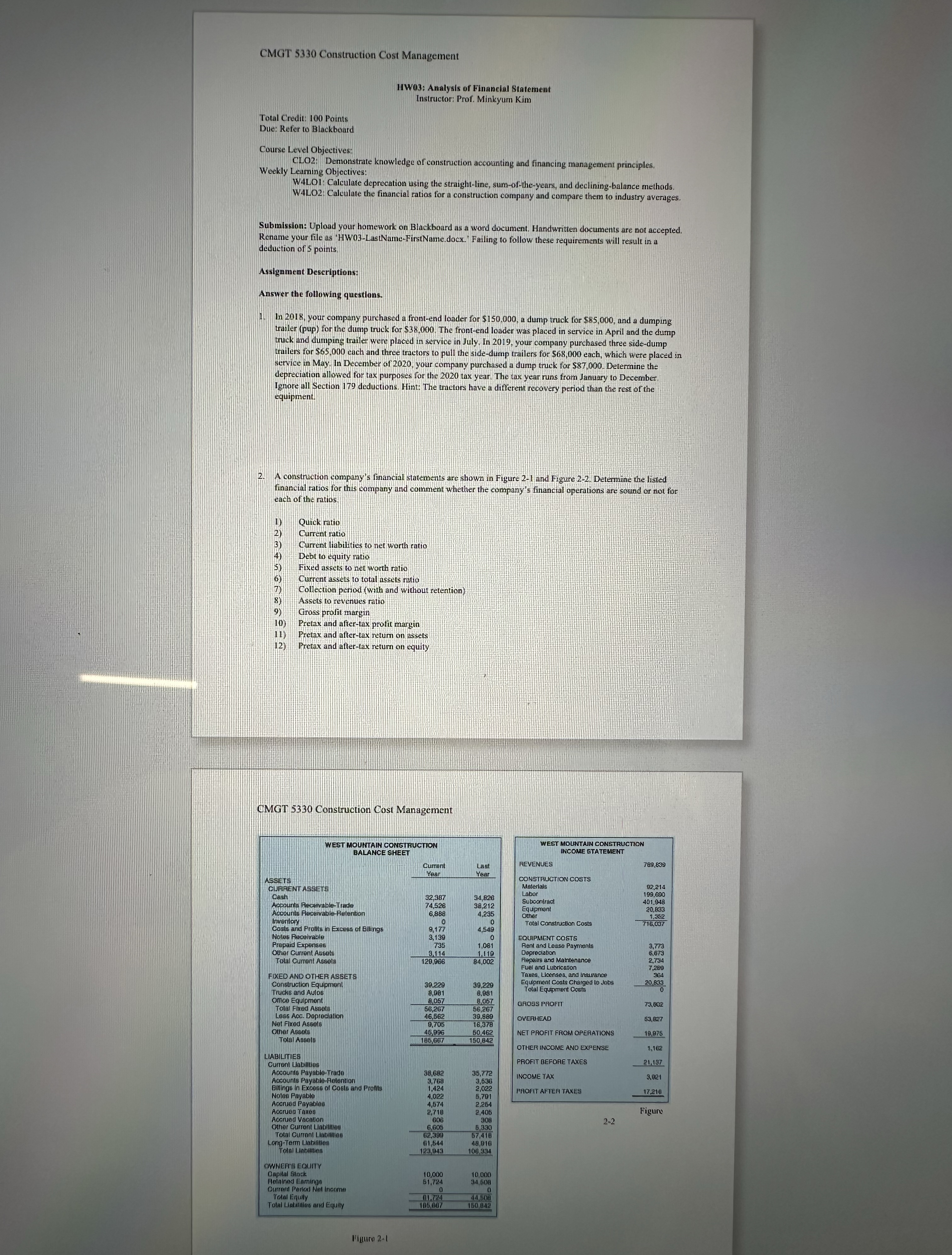

A construction company's financial statements are shown in Figure and Figure Detemume the listed

financial ratios for this company and comment whether the company's financtal operations are sound or not for

each of the ratios.

Quick ratio

Current ratio

Current liabilities to net worth ratio

Debt to equity ratio

Fixed assets to net worth ratio

Current assets to total assets ratio

Collectian period with and without retention

Assets to revenues ratio

Gross profit margin

Pretax and aftertax profic margin

Pretax and aftertax return on assets

Pretax and aftertax return on equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started