Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CNH Capital (NLD) (a subsidiary of CNH Global) and Ivanhoe Mines Ltd. (CAN) sign a lease agreement dated January 1, 2015, that calls for

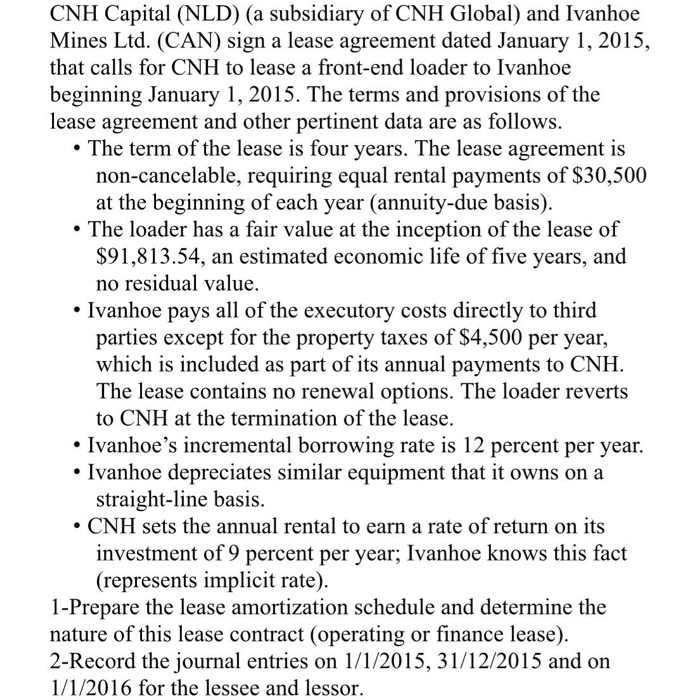

CNH Capital (NLD) (a subsidiary of CNH Global) and Ivanhoe Mines Ltd. (CAN) sign a lease agreement dated January 1, 2015, that calls for CNH to lease a front-end loader to Ivanhoe beginning January 1, 2015. The terms and provisions of the lease agreement and other pertinent data are as follows. The term of the lease is four years. The lease agreement is non-cancelable, requiring equal rental payments of $30,500 at the beginning of each year (annuity-due basis). The loader has a fair value at the inception of the lease of $91,813.54, an estimated economic life of five years, and no residual value. Ivanhoe pays all of the executory costs directly to third parties except for the property taxes of $4,500 per year, which is included as part of its annual payments to CNH. The lease contains no renewal options. The loader reverts to CNH at the termination of the lease. Ivanhoe's incremental borrowing rate is 12 percent per year. Ivanhoe depreciates similar equipment that it owns on a straight-line basis. CNH sets the annual rental to earn a rate of return on its investment of 9 percent per year; Ivanhoe knows this fact (represents implicit rate). 1-Prepare the lease amortization schedule and determine the nature of this lease contract (operating or finance lease). 2-Record the journal entries on 1/1/2015, 31/12/2015 and on 1/1/2016 for the lessee and lessor.

Step by Step Solution

★★★★★

3.27 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

In the given case It is Finance Lease as the Present value of annual lease payment and unguaranteed residual value is 10770449 which is greater than t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started