Co. A had beginning inventory of $50,000. Purchases for the year were $500,000. On July 10 ,2022 its warehouse caught fire and destroyed much

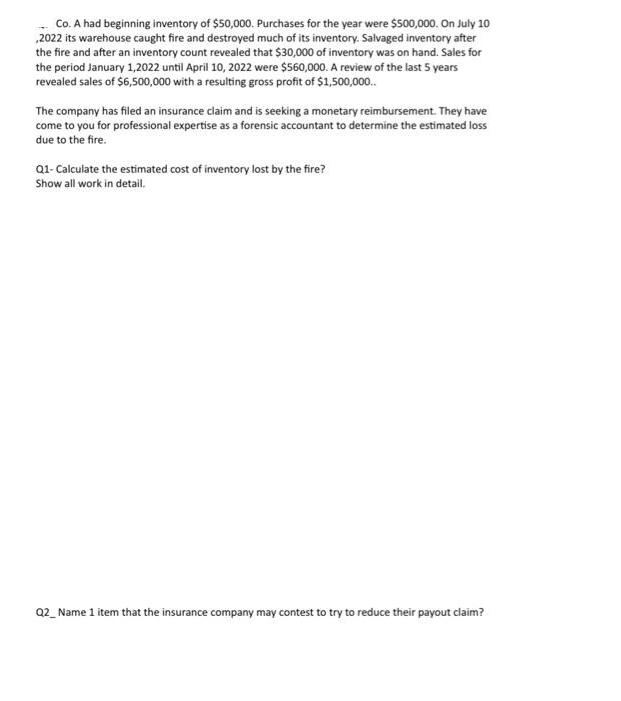

Co. A had beginning inventory of $50,000. Purchases for the year were $500,000. On July 10 ,2022 its warehouse caught fire and destroyed much of its inventory. Salvaged inventory after the fire and after an inventory count revealed that $30,000 of inventory was on hand. Sales for the period January 1,2022 until April 10, 2022 were $560,000. A review of the last 5 years revealed sales of $6,500,000 with a resulting gross profit of $1,500,000.. The company has filed an insurance claim and is seeking a monetary reimbursement. They have come to you for professional expertise as a forensic accountant to determine the estimated loss due to the fire. Q1- Calculate the estimated cost of inventory lost by the fire? Show all work in detail. Q2_Name 1 item that the insurance company may contest to try to reduce their payout claim?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started