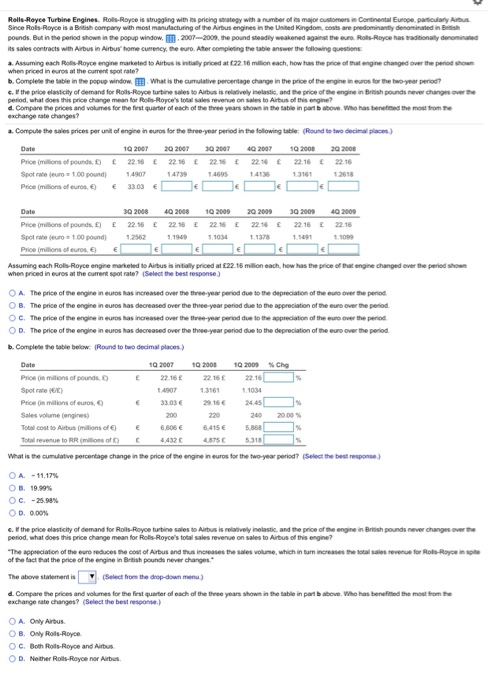

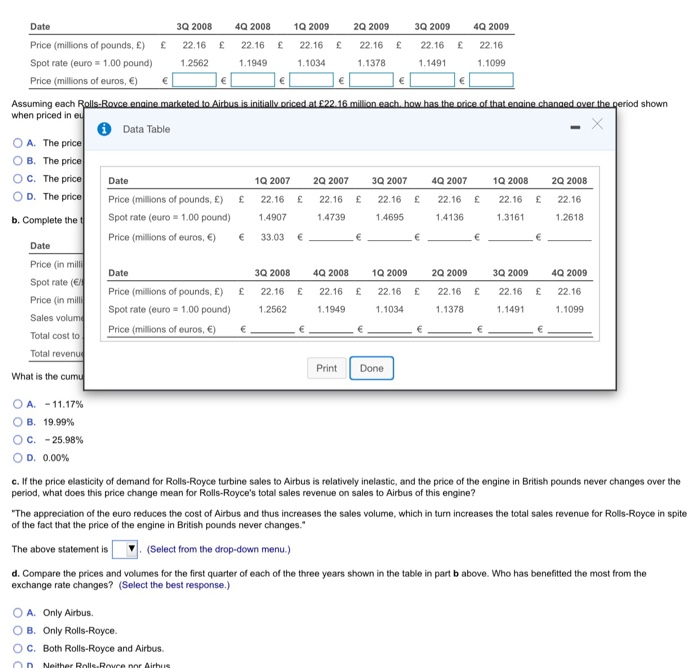

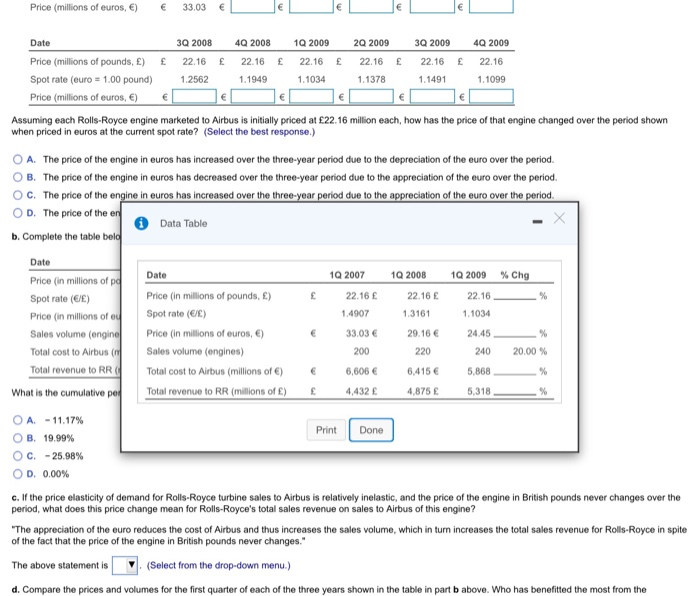

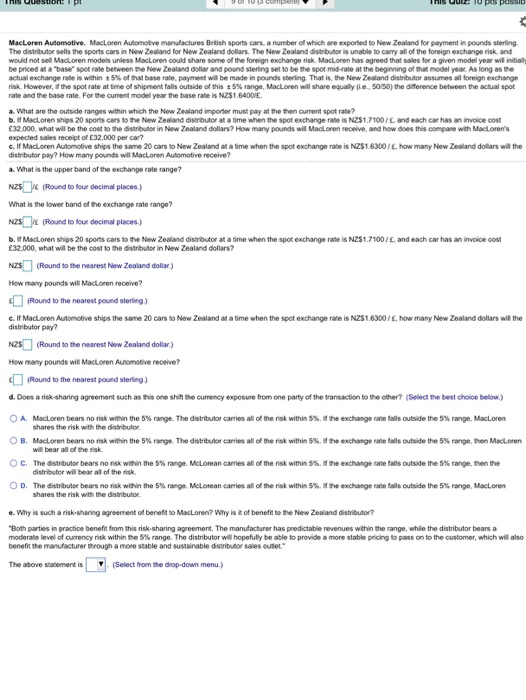

Co Rolls-Royce Turbine Engines RoRoyce is ring with pricing with a number of Since Royce is a company with cung others angesied e pounds. But in the period showie popup window . 2001-2008 he pound e d the correct with Albus in Aubus home currency there. Atter completing the answer the following u s when priced in the current state? d. Compare prices and womes for the future of how t h e motore Compute the price per unit of engine i s for the period in the following Round image 19 2007 22 20 2007 22 30 2007 22 2007 2210 10 2008 2211 20 2008 2216 Price s of pound Date 2009 2216 Price Spor 30 2008 40 2008 220 221 1.250 1 of pounds) 100 pound 10 2009 20 2009 10 2009 220 221 2215 1101137 11 E Assuming each Rolls-Royce engine marketed to Airbus is initially priced at 22.15 million each how has the price of that engine changed over the period show when priced in eros at the current state? Select the best response) O A The price of the engine in euros has increased over the year period due to the depreciation of the over the period OB. The price of the engine in euros has decreased over the three year period due to the appreciation of the eve over the period OC. The price of the engine in euros has increased over the three-year period due to the appreciation of the cover the period OD. The price of the engine in euros has decreased over the three-year period due to the depreciation of the euro over the period b. Complete the table below Round to two decimal places) 10:00 10:00 10 000 % Cho Price s of pounds) 226 22 15 16 Sport () 14907 1.3161 1.1034 Price on wins of euros 3303 2.15 24.45 Sales volume engines) 200 220 2200 2000 Total cost to Airbus milions of 6.806 6.415 5.858 Tove RR 42 What is the cumulative percentage change in the price of the engine in euros for the two year period? Select the best response) OA-11.17 OB. 19.0% C-28 DO the price isticity of demand for Rolls-Royce turbine sales to Abus is relatively inelastic and the price of the engine in Brish pounds never change period, what does this price change man for Rolls Royce's total sales revenue on sales to Artus of this engine? "The precion of the reduces the cost of Arts and thus in the volume, which in turn the w o rs e of the the price of the engine h unds ever changes The above mentis Select from the drop-down ) DA Oy Ab OB Owy Rose OC Boots Royce and bus OD NA Date 4Q 2008 22.16 1.1949 10 2009 22.16 1.1034 Price (millions of pounds, ) Spot rate (euro = 1.00 pound) Price (millions of euros, ) 3Q 2008 22.16 1.2562 ECC 20 2009 22.16 1.1378 3Q 2009 2216 1.1491 4Q 2009 22.16 1.1099 Assuming each Rolls-Royce engine marketed to Airbus is initially priced at 22. 16 million each how has the price of that engine changed over the period shown when priced in ey Data Table O A. The price OB. The price OC. The price Date 1Q 2007 20 2007 30 2007 4Q 2007 10 2008 20 2008 OD. The price Price (millions of pounds, ) 22.16 22.16 22.16 22.16 22.16 22.16 b. Complete the Spot rate (euro = 1.00 pound) 1.4907 1.4739 1.4695 1.4136 1.3161 1.2618 Price (millions of euros, ) 33.03 Date Date 3Q 2008 22.16 1.2562 4Q 2008 22.16 .1949 Price (in milli Spot rate ( Price (in milli Sales volume Total cost to Price (millions of pounds, ) Spot rate (euro = 1.00 pound) Price (millions of euros, ) 20 2009 22.16 1.1378 10 2009 22.16 1.1034 3Q 2009 22.16 1.1491 4Q 2009 22.16 1.1099 1 Total revenu Print Done What is the cumu O A. - 11.17% OB. 19.99% O C. - 25.98% OD. 0.00% c. If the price elasticity of demand for Rolls-Royce turbine sales to Airbus is relatively inelastic, and the price of the engine in British pounds never changes over the period, what does this price change mean for Rolls-Royce's total sales revenue on sales to Airbus of this engine? "The appreciation of the euro reduces the cost of Airbus and thus increases the sales volume, which in turn increases the total sales revenue for Rolls-Royce in spite of the fact that the price of the engine in British pounds never changes." The above statement is V. (Select from the drop-down menu.) d. Compare the prices and volumes for the first quarter of each of the three years shown in the table in part b above. Who has benefitted the most from the exchange rate changes? (Select the best response.) O A. Only Airbus. OB. Only Rolls-Royce O C. Both Rolls-Royce and Airbus Neither Rolls Roure nor Airbus Price (millions of euros, ) 33.03 Date 3Q 2008 22.16 1.2562 4Q 2008 22.16 1.1949 10 2009 22.16 1.1034 Price (millions of pounds, ) Spot rate (euro = 1.00 pound) Price (millions of euros, ) 20 2009 22.16 1.1378 3Q 2009 22.16 1.1491 4Q 2009 22.16 1.1099 Assuming each Rolls-Royce engine marketed to Airbus is initially priced at 22.16 million each, how has the price of that engine changed over the period shown when priced in euros at the current spot rate? (Select the best response.) O A. The price of the engine in euros has increased over the three-year period due to the depreciation of the euro over the period. OB. The price of the engine in euros has decreased over the three-year period due to the appreciation of the euro over the period. O C. The price of the engine in euros has increased over the three-year period due to the appreciation of the euro over the period. OD. The price of the en i Data Table b. Complete the table beld Date 1Q 2007 10 2008 1Q 2009 % Chg Date Price (in millions of pa Spot rate (EE) Price (in millions of ey Sales volume (engine Total cost to Airbus Total revenue to RR Price (in millions of pounds, ) Spot rate (/E) Price (in millions of ouros, E) Sales volume (engines) Total cost to Airbus (millions of ) Total revenue to RR (millions of ) 22.16 1.4907 33.03 200 6,606 4,432 22.16 1.3161 29.16 220 6,415 4,875 22.16 1.1034 24.45 240 5,868 5,318 20.00 % What is the cumulative per Print Done OA. - 11.17% OB. 19.99% OC.-25.98% OD. 0.00% c. If the price elasticity of demand for Rolls-Royce turbine sales to Airbus is relatively inelastic, and the price of the engine in British pounds never changes over the period, what does this price change mean for Rolls-Royce's total sales revenue on sales to Airbus of this engine? "The appreciation of the euro reduces the cost of Airbus and thus increases the sales volume, which in turn increases the total sales revenue for Rolls-Royce in spite of the fact that the price of the engine in British pounds never changes. The above statement is (Select from the drop-down menu.) d. Compare the prices and volumes for the first quarter of each of the three years shown in the table in part b above. Who has benefitted the most from the THIS ULEIUS POSSID MacLoren Automotive MacLaren Automotive ma tures Bris sports car anber of which we exported to New Zealand for payment pour stig The distributores the sports cars in New Zealand for New Zealand dollars. The New Zealand distr i t o carry of the foreign exchange risk and would not sell MacLoren models MacLaren could share some of the foreign exchange Macron has agreed that for a given model year will De priced at a base state between the New Zealand and pound sterling to be so m e begge d As long as the actual changes in 5% of that have payment will be made pounding that the New Zealand Do m es for change However, the spot rate at time of shientas outside of this stage. MacLaren will share equally e. 5050, the ference between the actual spot rate and the base . For the current model year the baseratis N$1.5400 a What are the o n es win which the New Zealand importer must pay at the the current sport? D. Macon 20 sports cars to the New Zealand G ame when the spot exchanges NS1.71001Candach chan ces 32.000 what will be the o the r in New Zealand ? How many pounds will Maconceive and how does the compone with Maclor's expected sales receipt of 32.000 per car? c. MacLaren Automotive this the same 20 cars to New Zealand at a time when the spot exchange rates N251 63001 how many New Zealand dollars will the distributor pay? How many pounds Maclaren Automotive receive? a. What is the upper band of the exchange rate range? NZS (Round to four decimal places) What is the lower band of the exchange rate range? NS R ound to four decimal places) and each car has an invoices D. MacLorenships 20 sports cars to the New Zealand distributor at a time when the spot exchange rates N251 7100 32.000, what will be the cost to the distributor in New Zealand dollars? NZS (Round to the nearest New Zealand dollar) How many pounds will Maclaren receive? Round to the nearest pound sterling) c. If MacLaren Automotive ships the same 20 cars to New Zealand at a time when the spot exchange rate is NZ$1,6300/6. how many New Zealand dollars will the distributor pay? NZS (Round to the nearest New Zealand dollar) How many pounds will MacLoren Automotive receive? Pound to the nearest pound sterling) d. Does aris sharing agreement such as this one shit the currency exposure from one party of the transaction to the other? Select the best choice below) range, Mactoren range, then MacLoren O A MacLaren bears no risk within the 5% range. The distributor carries all of the risk within 5% of the exchange rate falls outside the shares the risk with the distributor OB. MacLaren bears no risk within the 5% range. The distributor carries all of the risk within the exchange rate alls outside the will bear all of the risk OC. The distributor bears no risk within the range. MeLorean carries all of the risk within 5%. If the exchange rate fails outside the distributor will be all of the risk OD. The distributor bears nois within the range, McLorean carries all of the within the exchange rates outside the shares the risk with the distributor range, then the range, Maclaren .. Why is such a risching agreement of benefit to MacLoren? Why is of benefit to the New Zealand distributor? "Both parties in practice benefit from this is sharing agreement. The manufacturer has predictable revenues within the range, while the distributor bearsa moderate level of currency is within the range. The distributor will hopefully be able to provide a more stable pricing to pass onto the customer which will benefit the manufacturer rough a more able and t able distributor sales outlet The above mentis 7 (Select from the drop-down menu.)