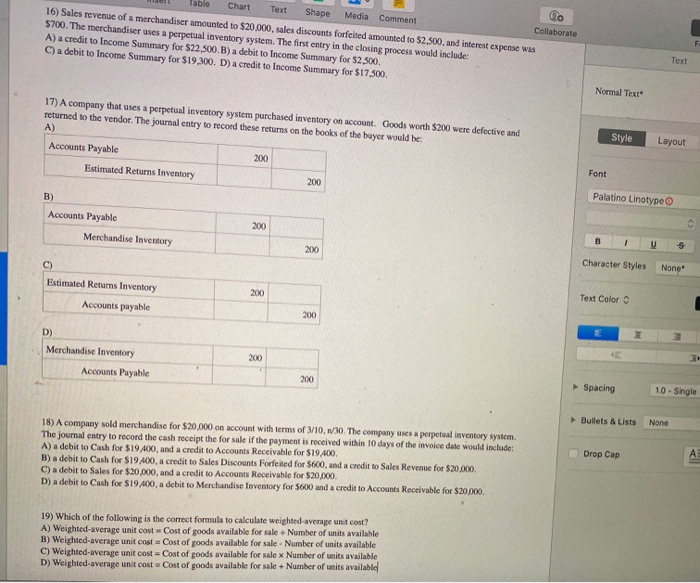

Co Table Chart Text Shape Media Comment Collaborate 16) Sales revenue of a merchandiser amounted to $20.000, sales discounts forfeited amounted to $2.500, and interest expense was $700. The merchandiser uses a perpetual inventory system. The first entry in the closing process would include: A) a credit to Income Summary for $22,500.B) a debit to Income Summary for $2,300. C) a debit to Income Summary for $19,300. D) a credit to Income Summary for $17.500. F Text Normal Text 17) A company that uses a perpetual inventory system purchased inventory on account. Goods worth $200 were defective and returned to the vendor. The journal entry to record these returns on the books of the buyer would be: A) Accounts Payable 200 Style Layout Estimated Returns Inventory Font 200 B) Palatino Linotype Accounts Payable Merchandise Inventory 200 U S 200 Character Styles Nong" C) Estimated Returns Inventory 200 Text Color Accounts payable 200 D) Merchandise Inventory Accounts Payable 200 200 Spacing 10 - Single Bullets & Lists None 18) A company sold merchandise for $20,000 on account with terms of 3/10, 130. The company is a perpetual inventory system, The journal entry to record the cash receipt the for sale if the payment is received within 10 days of the invoice date would include: A) a debit to Cash for $19,400, and a credit to Accounts Receivable for $19,400 B) a debit to Cash for $19,400, a credit to Sales Discounts Forfeited for $600, and a credit to Sales Revenue for $20,000 C) a debit to Sales for $20,000, and a credit to Accounts Receivable for $20,000 D) a debit to Cash for $19.400, a debit to Merchandise Inventory for $600 and a credit to Accounts Receivable for $20.000, Drop Cap A 19) Which of the following is the correct formula to calculate weighted average unit cost? A) Weighted average unit cost Cost of goods available for sale Number of units available B) Weighted average unit cost Cost of goods available for sale - Number of units available C) Weighted average unit cost = Cost of goods available for sale x Number of units available D) Weighted average unit cost Cost of goods available for sale + Number of units available